Bengaluru, NFAPost: India would have tied over many global economic turbulance. But IMF warns that the current Covid-19 pandemic the Indian economy will have to face deeper downturn as it will witness sharp contraction of 4.5% during the fiscal 2021. But iMF also forecast a bounce back in 2022 fiscal.

In its latest World Economic Outlook titled A Crisis like No Other, An Uncertain Outlook, IMF finds that there is a marginal fall compared with its April forecast of a 1.9 expansion stating it a historic low in India’s economic growth journey. According to the IMF’s record, this is the lowest ever for India since 1961.

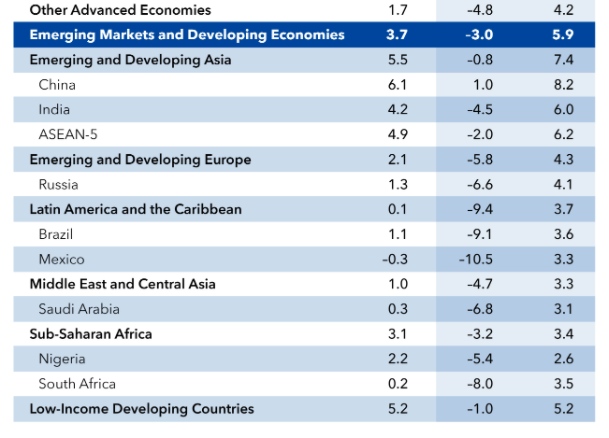

In fact, India faced the sharpest cut in the outlook — a 6.4-percentage point revision due to a more severe fallout of the pandemic than anticipated. In comparison, emerging markets (EMs) and developing countries saw a 2-percentage point reduction in outlook, while the global outlook was cut by 1.9 percentage points.

But the study states that the Indian economy is expected to bounce back in FY22 with a 6% growth rate and it is lower than even the ASEAN-5 average of 6.2% estimated for 2021 by the agency.

After releasing the report, IMF Chief Economist Gita Gopinath said international Monetary Fund is projecting a sharp contraction of 4.5%

“Given the unprecedented nature of this crisis, as is the case for almost all countries, this projected contraction is a historic low. “The Covid-19 pandemic pushed economies into a Great Lockdown, which helped contain the virus and save lives, but also triggered the worst recession since the Great Depression,” IMF Chief Economist Gita Gopinath said after releasing the WEO update.

IMF makes it clear that the Covid-19 pandemic has had a more negative impact on activity in the first half of 2020 than anticipated, and the recovery is projected to be more gradual than previously forecast.

In 2021 global growth is projected at 5.4%. Overall, this would leave 2021 GDP some 6.5 percentage points lower than in the pre-Covid-19 projections of January 2020. The adverse impact on low-income households is particularly acute, imperiling the significant progress made in reducing extreme poverty in the world since the 1990s.

As with the April 2020 WEO projections, there is a higher-than-usual degree of uncertainty around this forecast.Moreover, the forecast assumes that financial conditions—which have eased following the release of theApril 2020 WEO—will remain broadly at current levels. Alternative outcomes to those in the baseline are clearly possible, and not just because of how the pandemic is evolving.

With the updated forecast, the IMF joins other international agencies in projecting negative growth for India in the current fiscal. Last week, the Asian Development Bank also scaled down India’s growth forecast to -4 per cent from a 4 per cent expansion.

“India has unveiled liquidity support (4.5 per cent of GDP) through loans and guarantees for businesses and farmers, and equity injections into financial institutions and electricity sector,” the report mentioned.

It said that where the fiscal space was limited, countries needed to reorient revenue and spending to increase and incentivise productive investment.

“Making some provisions (for example, relaxing eligibility) of social protection programmes to be more long-lasting, could enhance automatic stabilisers and help tackle rising poverty and inequality. All measures should be embedded in a medium-term fiscal framework and transparently managed and recorded to mitigate fiscal risks, including loans and guarantees that do not have an immediate effect on government debt and deficits,” it said.

IMF states that strong multilateral cooperation remains essential on multiple fronts. Liquidity assistance is urgently needed for countries confronting health crises and external funding shortfalls, including through debt relief and financing through the global financial safety net. Beyond the pandemic, policymakers must cooperate to resolve trade and technology tensions that endanger an eventual recovery from the COVID-19 crisis.