New Delhi, NFAPost: Amid growing questions on its IPO performance, One 97 Communications Limited owned Paytm CEP Vijay Shekhar Sharma said the company should be operating EBITDA breakeven in next 6 quarters (i.e. EBITDA before ESOP cost, and by the quarter ending September 2023).

In a statement to the SEBI, Paytm CEO Vijay Shekhar Sharma said against the backdrop of volatile market conditions for high-growth stocks globally, the company’s shares are down significantly from the IPO price.

“I believe we should be operating EBITDA breakeven in next 6 quarters (i.e. EBITDA before ESOP cost, and by the quarter ending September 2023), well ahead of estimates by most analysts. Importantly, we are going to achieve this without compromising any of our growth plans,” said Paytm CEO Vijay Shekhar Sharma.

He also highlighted that the entire Paytm team is committed to build a large, profitable company and to create long-term shareholder value.

“Aligned with this, my stock grants will be vested to me only when our market cap has crossed the IPO level on a sustained basis. I am proud of the talent that we have in our company, and our culture of being ambitious and entrepreneurial. We continue to expand our team with great talent from both the technology and finance industries. We remain grateful for the support of our shareholders,” said Paytm CEO Vijay Shekhar Sharma.

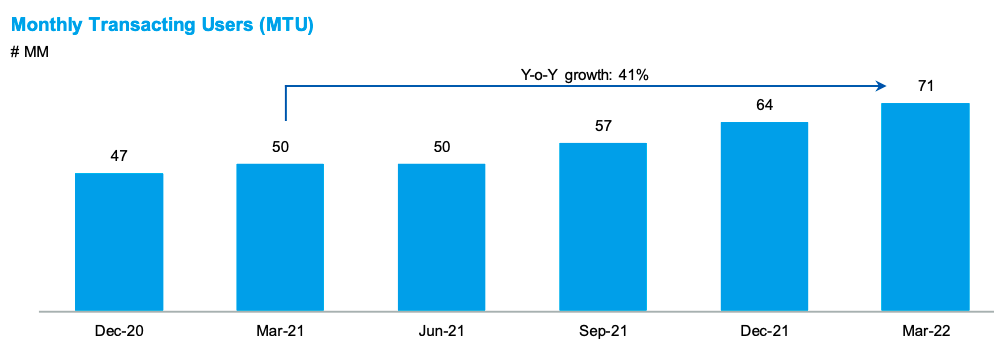

In another development, the during the fourth quarter ending March 2022 the company achieved highest monthly transacting ssers on Paytm superapp.

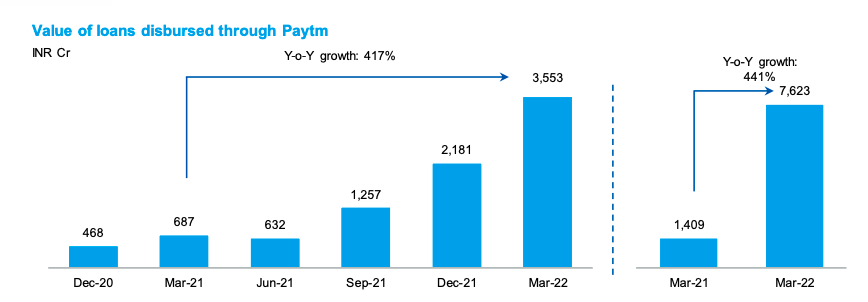

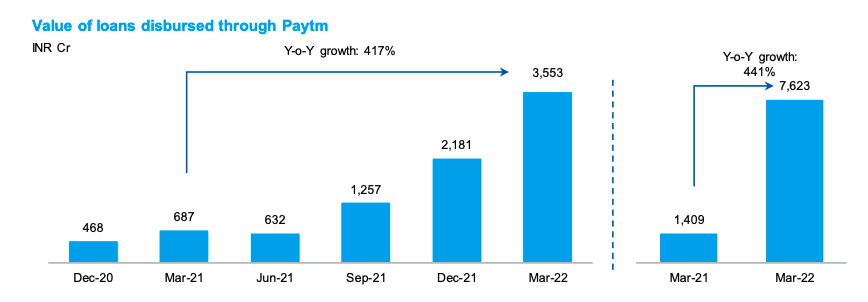

Lending business scales to 6.5 million loan disbursals during the quarter, aggregating to a total loan value of Rs 3,553 crore ($474 million) during the quarter, registering YoY growth of 417%.

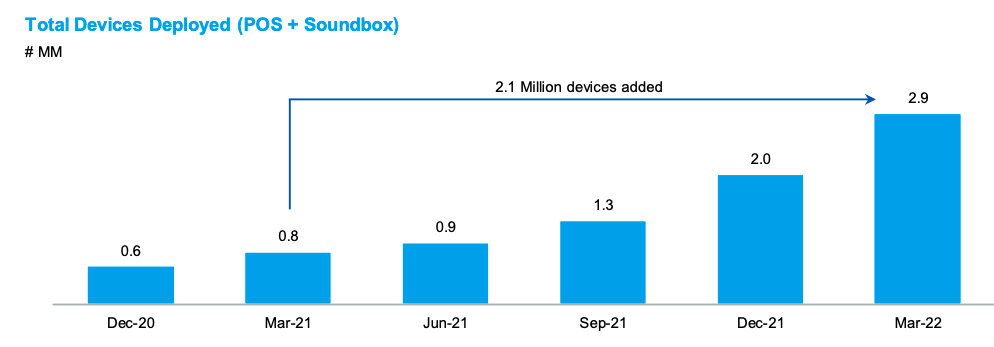

The company’s offline payments business accelerates with 0.9 million devices deployed in this quarter. Total number of devices deployed grew to 2.9 million. Paytm Super App average monthly transacting users (MTU) for the quarter grows 41% YoY to 70.9 million

At the same time, the company registered over 104% YoY increase in GMV for the quarter at Rs 2.59 lakh crore ($34.5 billion).

Paytm also registered hgihest surge in its lending business. “Working in partnership with marquee lenders, we have scaled our loan disbursement and servicing business to great scale. RBI’s clear

regulations have make this a mainstream business. The number of loans disbursed through our platform grew 374% YoY to 6.5 million loans in Q4 FY 2022, while the value of loans disbursed was Rs 3,553 crore restering YoY growth of 417%.

Paytm offers omnichannel payment solutions to online and offline merchants and registered robust growth in merchant payments volume. Total merchant payment volume (GMV) processed through the platform during the fourth quarter of FY 2022 aggregated to approximately Rs 2.59 lakh crore ($34.5 billion), marking a y-o-y growth of 104%.

“We saw strong quarter-on-quarter trends, despite the previous quarter having an impact of the festive season,” states the company.

Paytm Super App offerings drive highest user engagement as it gives the most comprehensive payment choices to customers. “We have seen record growth in user engagement on the Paytm platform, with average monthly transacting users (MTU) in the fourth quarter of FY 2022 at 70.9 million, growth of 41% Y-o-Y.

Over 900,000 devices deployed this quarter:

With our device-led strategy, Paytm is taking offline payment to the next stage of technology adoption and monetisation from subscription and lending.

“In just 3 years, we have deployed 2.9 million devices in stores and are currently deploying about 1,000 devices per day. Due to the higher engagement that we see with our device merchants, we expect a rise in the number of merchants eligible for loans,” states the company