Prime Minister Narendra Modi today said banks should create technological solutions for fintech and startups to help the poor.

He lauded the excellent work of the Indian Fintech Startups in creating new and better financial products for new startups and their exploration of every possibility in this sector.

He added that the Indian Fintechs have very high participation in the Start-Up Deals that have taken place in the Corona era as well.

He cited experts that this year also there would be great momentum for the financial sector in India.

Modi said, over the years, better use of technology and the creation of new systems has played a very big role in financial inclusion in the country.

To strengthen the Indian financial system, Modi said that the government is committed to strengthening its banking sector and therefore Banking reforms have been carried out and they will still continue.

Modi also spoke about a new Development Finance Institution for the development of infrastructure and industrial projects to cater to the long-term financial needs of such projects.

He also emphasized encouraging sovereign wealth funds, pension funds, and insurance companies to invest in infrastructure.

Modi said a clear roadmap has been laid out in the Union Budget on how to expand the participation of the private sector and strengthen the Public sector institutions.

“The government’s vision of the country’s financial sector is very clear. Our top priority is to ensure that the Depositor as well as Investor experience Trust and Transparency. The old ways and old systems of banking and non-banking sectors are being changed,” he said.

The Prime Minister said steps have been taken to free the country from non-transparent credit culture. Instead of brushing the NPAs under the carpet, it is mandatory to report even one day NPA, he added.

Modi said mechanisms like Insolvency and bankruptcy code, are assuring the lenders and borrowers, he said.

The Prime Minister said that the country is rapidly moving towards financial empowerment after financial inclusion.

A World-Class Financial Hub is being built in IFSC GIFT City, as the Fintech market is estimated to be over 6 trillion in India in the next 5 years.

He said the construction of modern infrastructure in India is not only India’s aspiration but also the need for Aatmanirbhar Bharat. “So in this budget, bold targets are kept for the infrastructure,” he added.

He stressed the need for Investment to meet these goals and said that every effort is made to bring this investment.

He said these goals will be achieved only with the active support of the entire financial sector.

He sought effective participation of the public sector in banking and insurance sectors to come out with innovative products for startups and fintech to support the poor.

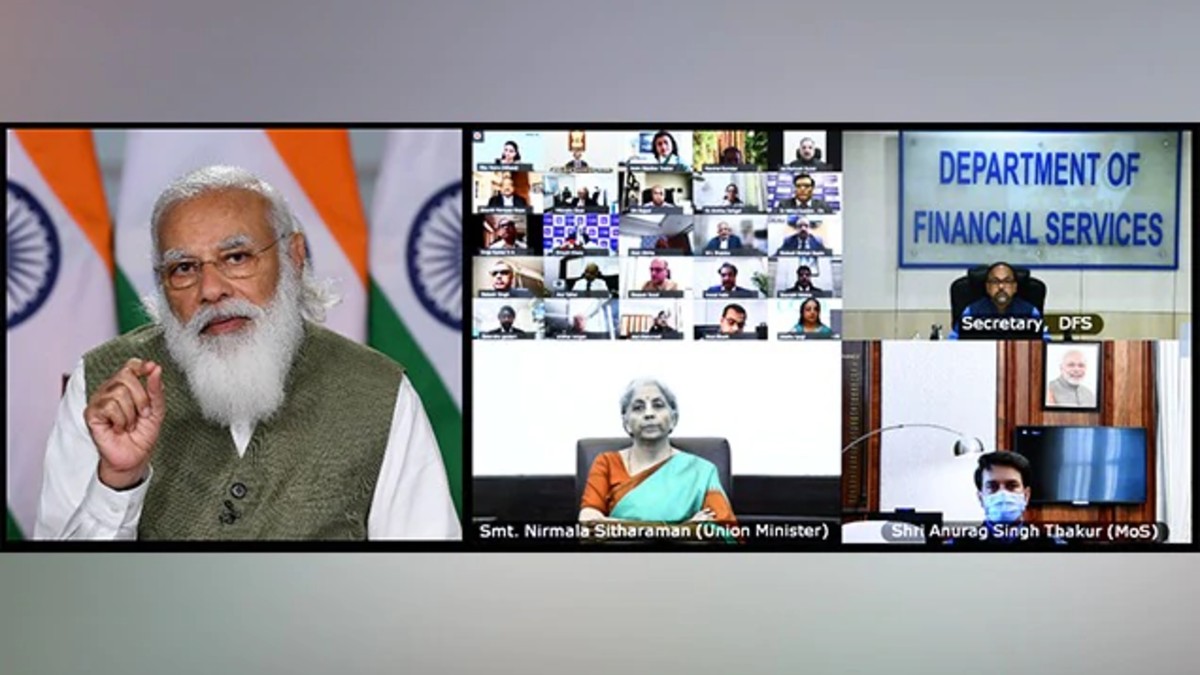

“The private enterprises are being promoted wherever possible, still, along with this, an effective participation of the public sector in banking and insurance is still needed by the country,” he said at the webinar on effective implementation of budget provisions regarding financial services.

“To strengthen the public sector, equity capital infusion is being emphasized. Simultaneously, New ARC structure is being created which will keep track of NPAs of banks and will address loans in a focused way. This will strengthen Public Sector Banks,” he added.

Modi said in view of the immense potential for banking and insurance in the economy, several initiatives were announced in this budget including privatization of two public sector banks, permitting up to 74 percent FDI in insurance, listing Initial Public Offering for LIC, etc.

He noted that today, in the country, 130 crore people have Aadhar Card and more than 41 crore countrymen have Jan Dhan accounts.

About 55 percent of these Jan Dhan accounts are of women and about one and a half lakh crore rupees are deposited in them.

He further said with the Mudra scheme itself, loans worth about Rs. 15 lakh crore have reached the small entrepreneurs. In this also about 70 percents are women and more than 50 percent are Dalit, deprived, tribal, and backward class entrepreneurs.

The Prime Minister insisted that Aatmnirbhar Bharat will not be made only by big industry and big cities, but also by MSMEs and startups.

Modi said special plans were made for MSMEs during the Corona period, about 90 lakh enterprises took advantage of these measures and received a credit of Rs 2.4 trillion.

He said the government has done several reforms and opened many sectors like agriculture, coal, and space for MSMEs.

The Prime Minister said as the Indian economy gets bigger it is equally important for credit flow to start growing rapidly.