· Offers unlimited complimentary access to international and domestic airport lounges

· Cardholder gets unlimited complimentary rounds of golf games/lessons every month across select golf courses in India

·Offers a complimentary membership to the cardholder and his/her spouse to the Club ITC Culinaire, a premium loyalty programme of the ITC Group

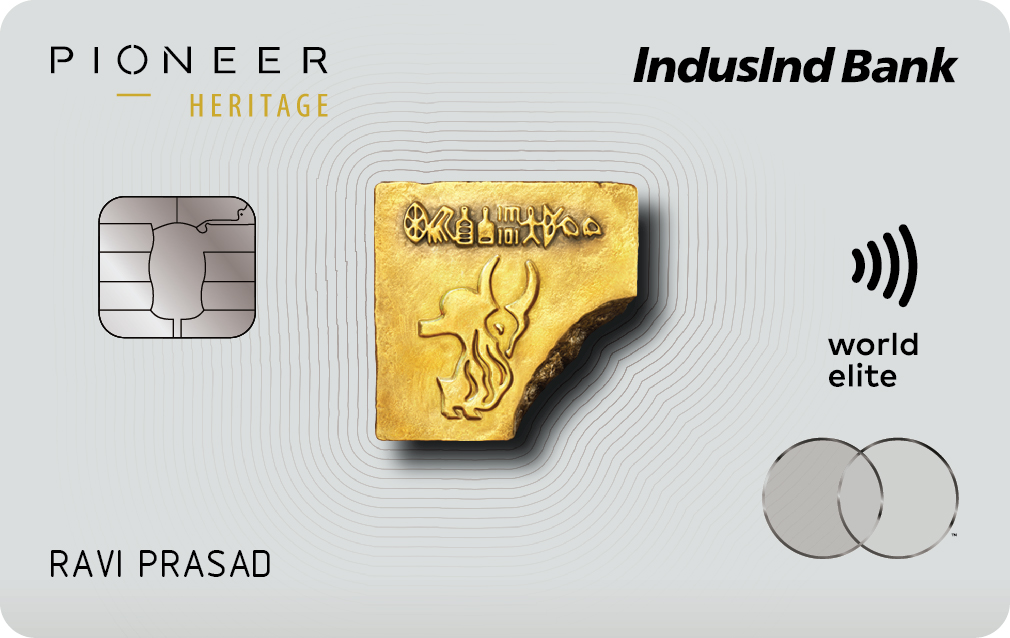

Mumbai, NFAPost: IndusInd Bank in partnership with Mastercard announced the launch of its first metal credit card – ‘PIONEER Heritage’ for the Bank’s ultra-high net worth segment of customers.

Equipped with best-in-class features & privileges across an array of categories like travel, wellness, lifestyle among others, the all-new credit card has been specially curated to match the requirements of affluent Indian professionals and entrepreneurs.

It is also part of the ‘World Elite’ platform by Mastercard comprising privileges that complement the lifestyle of the discerning few. The ‘World Elite’ platform is Mastercard’s signature global program that offers the choicest benefits to HNI cardholders across their passion points.

With the launch of the ‘Pioneer Heritage Credit Card’, IndusInd Bank has joined the ranks with few other banks globally, that offer a credit card which has been exquisitely crafted with metal.

Speaking on the launch of the new card, IndusInd Bank Head – Affluent Banking Samir Dewan said IndusInd Bank believes that it is important to anticipate customers’ needs, and curate the most rewarding experiences for them.

“With the launch of the PIONEER Heritage Credit Card, we are strengthening as well as broadening our card proposition for the PIONEER banking customers, providing them access to world class services by leveraging on our wide network and relationships. We believe, the new credit card is a compelling proposition that offers best-in-class privileges and indulgences across travel, wellness, lifestyle and luxury categories, thereby offering our wealth customers with an unmatched banking experience,” said Samir Dewan.

Commenting on the launch, Mastercard South Asia Vice President, Product and Innovation Aman Ahuja said Mastercard is pleased to partner with IndusInd Bank for the launch of our very first metal credit card ‘PIONEER Heritage’.

“India has over a million millionaires, and the number is growing by 12-13% every year. These High-Net-Worth-Individuals (HNWIs) exhibit an increasing demand for services, experiences, and differentiated products. Mastercard is committed to bringing customized experiences to this elite, affluent segment. This metal credit card is specially designed to offer Priceless moments to the ultra-high net worth segment of customers to meet their diverse preferences with meticulously customized offerings. This card offers a combination of niche banking solutions and carefully curated lifestyle privileges,” said Aman Ahuja.

Key benefits of the ‘IndusInd Bank Pioneer Heritage Credit Card’ include:

Travel:

·Unlimited complimentary access to participating international and domestic airport lounges

Financial:

·Waiver on card annual fee if the cardholder meets the minimum spends criteria of INR 10,00,000 or more (combined spends of Primary and all Add-on Cards, if any) during the period

·Lifetime waiver of late payment charges, cash advance fee as well as over limit fee

Lifestyle:

·Unlimited complimentary golf games and lessons at select golf courses in India

·4 complimentary movie tickets per quarter as well as 20% discount on events on bookmyshow.com

· Complimentary membership for the card holder and his/her spouse to the Club ITC Culinaire

Insurance:

·Complimentary personal air accident cover of Rs. 2.5 crores

· Insurance cover for a sum up to the credit limit on the card

· Lost baggage insurance of Rs.1,00,000

· Loss of travel document insurance of Rs. 75,000

To apply for the ‘IndusInd Bank Pioneer Heritage Credit Card’, one can visit any of the existing IndusInd Bank PIONEER lounges or can also contact their PIONEER relationship manger. More information on this credit card is available on < https://bank.indusind.com/pioneer/personal-banking/cards/pioneer-heritgae-credit-card.html >

IndusInd Bank launched ‘PIONEER Banking, its wealth management platform in January 2020, which caters to the high net worth segment of customers. Based on state-of-the-art research based capabilities of the Bank, the service merges bespoke wealth management solutions with a wide array of personal & commercial banking products, curated to suit the requirements of the discerning few.

IndusInd Bank, which commenced operations in 1994, caters to the needs of both consumer and corporate customers. Its technology platform supports multi-channel delivery capabilities. As on September 30, 2020, IndusInd Bank has 1910 Branches/ Banking Outlet and 2785 ATMs spread across 751 geographical locations of the country.

The Bank also has representative offices in London, Dubai and Abu Dhabi. The Bank believes in driving its business through technology. It enjoys clearing bank status for both major stock exchanges – BSE and NSE – and major commodity exchanges in the country, including MCX, NCDEX and NMCE. IndusInd Bank was included in the NIFTY 50 benchmark index on April 1, 2013.

Domestic Ratings

● CRISIL AA + for Infra Bonds program

● CRISIL AA for Additional Tier I Bonds program

● CRISIL A1+ for certificate of deposit/short term fixed deposits program

● IND AA+ for Senior bonds program by India Ratings and Research

● IND AA for Additional Tier I Bonds program by India Ratings and Research

● IND A1+ for Short Term Debt Instruments by India Ratings and Research