The VC will invest upto Rs 1 crore per startup

Bangalore, NFAPost: PointOne Capital, a pre-seed focussed VC fund, recently announced the first closing of its maiden fund. The SEBI registered CAT-1 AIF which targets early seed stage startups, plans a total corpus of Rs 50 crore with a ticket size of up to Rs 1 crore per startup.

The fund counts successful entrepreneurs, PE & VC firm partners, CXOs & seasoned senior corporate leaders as its LPs. PointOne aims to solve the funding gap for start ups at the pre-product and revenue or the beta launch phase with very early traction.

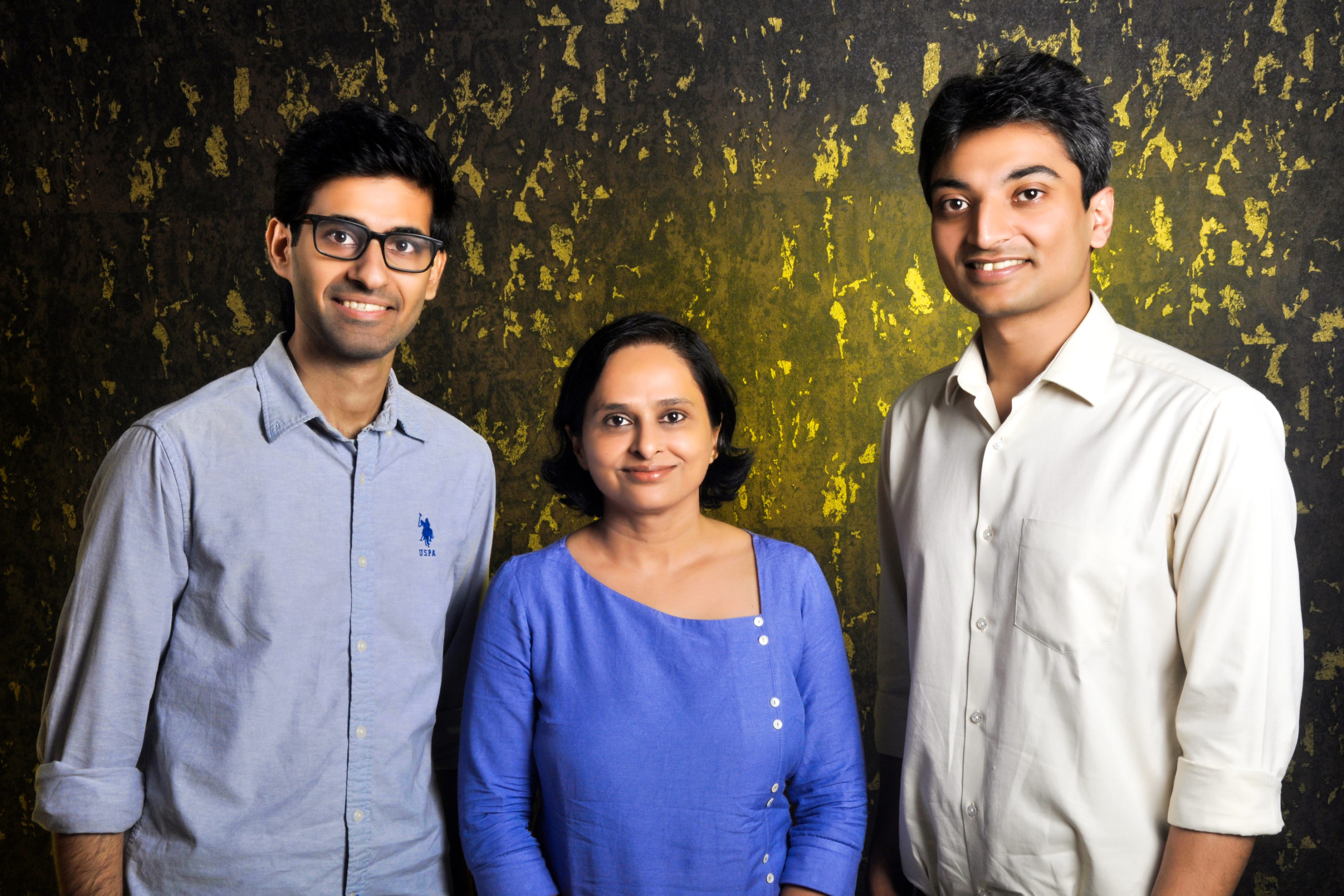

The team comes with an in-depth experience and success in early stage investing and includes Archana Priyadarshini, Mihir Jha and Ravish Ratnam. All the three have collectively worked with over 1000 startups. Closing over 60 investments in their tenure apart from collaborating with 100+ VC funds and 1000+ angel investors, provides them an edge in identifying success patterns and enabling future rounds of their portfolio companies.

Adding further, PointOne Capital Managing Partner Mihir Jha (Ex- Letsventure, Urban Company) said raising funding at a beta stage or pre-PMF stage is challenging for founders – it becomes too risky vis-a-vis the traction for larger VCs unless the founders come with a proven entrepreneurial track record.

“We are willing to take those risks in favour of the opportunity and the new insights the team brings to the table. Another problem is feedback in cases where an investor is not interested in investing. PointOne believes in changing that paradigm. Our conviction is that pointed feedback at early stages of venture building will contribute manifold to increasing the overall efficiency of the Indian startup ecosystem. We aim to provide this to every entrepreneur whom we engage with,” said Mihir Jha.

PointOne Capital Managing Partner Ravish Ratnam (Ex- Letsventure) added that India is is producing entrepreneurs at an unprecedented rate – needless to say, capital needs to catch up.

“PointOne has been set up to partner with the founders at the most fundamental stage, one which has the most number of variables(and hidden variables). We are glad to have the backing of industry experts from India and abroad in our first close as it opens up a powerful network which our portfolio founders can leverage as they navigate through their zero-to -one journey,” said Ravish Ratnam.

Speaking about this, PointOne Capital Managing Partner Archana Priyadarshini (Ex-Unicorn India Ventures) said having met over 500 startups in the last 5 years, the company has seen that initial days are the most difficult in a founder’s journey.

“At such a stage, guidance along with capital becomes very important as founders need support in clearly articulating their vision, preparing a focused output-oriented pilot and defining the initial GTM. Through PointOne, we strive to be that pillar of support for the founders and also learn from them during that process,” said Archana Priyadarshini.

PointOne calls itself the “earliest early stage VC” and vouches for its speed of decision making. Their focus is on providing a clear investment feedback to founders whom they engage with. Their major USP includes the fact that the fund offers a dedicated Venture Partner to its portfolio companies post investment. These are entrepreneurs in the specific sector with a successful track record of scaling tech businesses.

Prior to this, PointOne has been investing in similar ventures through their angel syndicate. Some of these ventures have already raised their next round of funding within 6 months of PointOne’s syndicate investment. Although largely sector agnostic they are primarily targeting large untapped opportunities in Fintech, Consumer Internet, Gaming, SMB SaaS, Enterprise SaaS, Healthcare and Ed-tech. They plan least 1 investment per month going forward.