Bengaluru, NFAPost: Bandhan Mutual Fund announces the launch of Bandhan Innovation Fund, an open-ended thematic fund dedicated to investing in companies at the forefront of innovative breakthroughs.

The fund targets companies with substantial R&D investment, high skilled-employee costs, potentially higher margins or growth, unique products or services, non-linear business models, and a notable brand presence.

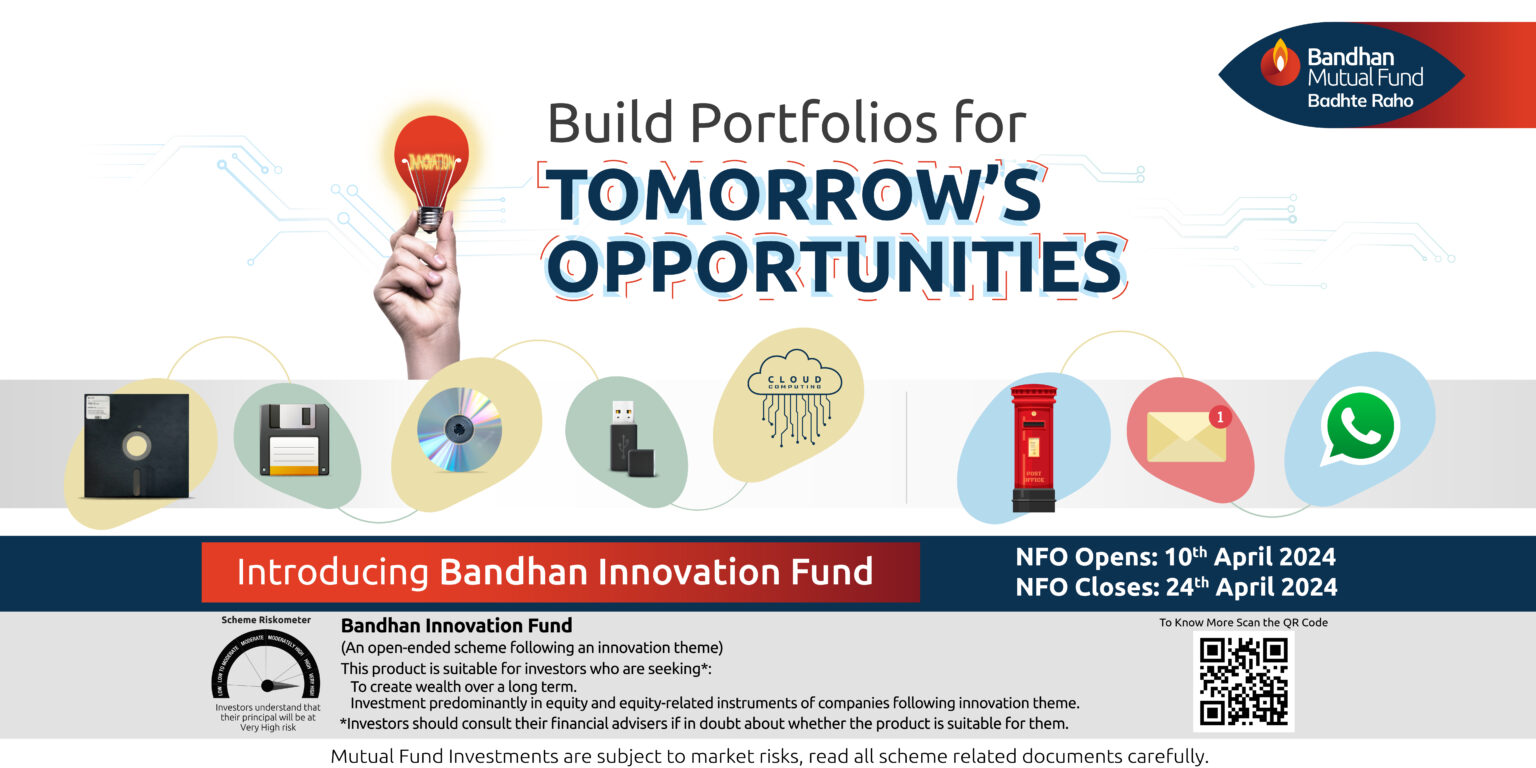

The New Fund Offer (NFO) begins on Wednesday, April 10, 2024, and will conclude on Wednesday, April 24, 2024. Investments in the Bandhan Innovation Fund can be made through licensed mutual fund distributors, investment advisors, online platforms, and directly at https://bandhanmutual.com/nfo/bandhan-innovation-fund/.

While discussing the new offering, Bandhan AMC Chief Executive Officer Vishal Kapoor said innovation has consistently driven companies forward, and today, India’s flourishing innovation landscape presents an exciting investment opportunity.

“We are observing ground-breaking transformations not only in technology but also in sectors like finance, auto, technology, healthcare, entertainment, retail, etc. With India’s climb in the global innovation rankings and swift advancements in fields like digital media, ecommerce, and electric vehicles, we stand at a crucial juncture,” said Bandhan AMC Chief Executive Officer Vishal Kapoor.

Bandhan AMC Chief Executive Officer Vishal Kapoor also added that the Bandhan Innovation Fund is crafted to capitalise on these pivotal shifts, inviting investors to join in this wave of innovation-driven growth.

The Bandhan Innovation Fund will allocate its investments across a spectrum of innovators: 35-45% to Leading Innovators with substantial industry R&D investments; 35-45% to Rising Innovators utilising innovation for a competitive edge; and 10-15% to Emerging Innovators, those filling market gaps with disruptive products or services and showing a strong growth trajectory.

The fund is ideal for investors with a long-term investment horizon and higher risk appetite, looking for diversification in their satellite portfolio and generating potential alpha.