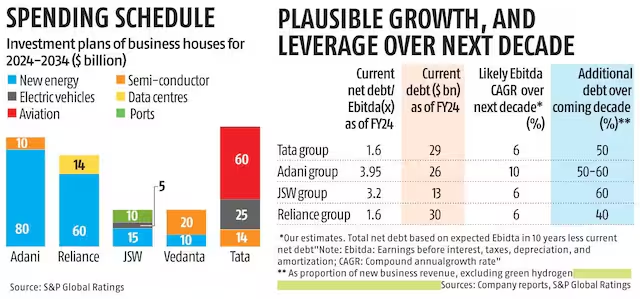

New Delhi, NFAPost: Indian conglomerates — including prominent names such as Reliance Industries, and the Adani, Tata, and JSW groups — are gearing up for an investment of $800 billion over the next decade, nearly trebling their spending compared to the previous 10 years, according to a report from S&P Global Ratings. Roughly 40% of this projected outlay is expected to go towards emerging industries, including green hydrogen, clean energy, semiconductors, and electric vehicles (EVs).

While the potential for transformation is substantial, these investments come with significant risks, cautions the ratings agency, noting that these companies face both execution risks and the possibility of accumulating debt on technologies yet to prove their commercial viability. Green hydrogen, a key focus area, exemplifies the challenge, as it requires considerable upfront capital with uncertain returns.

According to S&P Global’s Credit Analyst Neel Gopalakrishnan, as debt levels rise, conglomerates will need to reinforce their core business operations to maintain stable credit profiles.

“Any failure to meet performance expectations during this critical investment phase could jeopardise credit metrics. Notably, the Vedanta, Tata, Adani, Reliance, and JSW groups alone are set to channel around $350 billion into these forward-looking sectors over the coming decade,” said S&P Global’s Credit Analyst Neel Gopalakrishnan.

On the other hand, conglomerates like the Birla, Mahindra, Hinduja, Hero, ITC, Bajaj, and Murugappa groups are expected to focus more on consolidating their established businesses, with an emphasis on expanding scale and boosting profitability. These groups have a record of conservative growth, the report underlines.

If the investment patterns seen over the past two years hold, Indian conglomerates could collectively direct $400–$500 billion into existing businesses over the next decade.

The report identifies the Tata group as a standout due to its substantial positive cash flows and significant cash reserves, enabling it to fund new ventures more independently. By contrast, other conglomerates are already stretching their operating cash flows to cover capital expenditures and dividends, meaning they will likely depend on external capital for expansion into new areas.

A substantial portion of this future investment — up to 50 per cent — could be funded without increasing leverage, assuming steady earnings before interest, taxes, depreciation, and amortisation (Ebitda) growth, says S&P Global, adding the remaining capital would likely come from a blend of debt and equity financing.

Some firms, the report says, have the means to reduce incremental debt. For example, the Tata group, as part of its substantial investment in expanding Air India’s fleet, could explore sale-and-lease-back arrangements with aircraft lessors. This approach would not only cut down on debt but also provide funds for planes retained on their balance sheet.

Although Indian conglomerates are making bold bets on newer technologies, they remain cautious. Should a particular technology fail to meet expectations, these firms are prepared to recalibrate their investment. Adani, for instance, is taking a measured approach with its green hydrogen initiative, planning an initial $10 billion investment to reach a production target of 1 million tonnes annually by 2027, the report adds.