India’s first real-time risk management solution for payment gateways that aims at reducing fraudulent activities upto 40%

Bengaluru, NFAPost: Cashfree Payments, India’s leading payments and API banking company, announced the launch of ‘RiskShield’, India’s first real-time risk management solution for payment gateways.

The company aims at reducing fraudulent activities up to 40%. Built in-house, this solution will also help Indian businesses reduce chargebacks and disputes, thereby empowering them with tools strategically designed to combat fraudulent transactions with precision and securing financial stability.

Cashfree Payments CEO and Cofounder Akash Sinha said as one of the largest payment service providers, it’s the company’s responsibility to make the ecosystem safer and more secure for Indian businesses.

“We built ‘RiskShield’ to empower merchants to fortify their defense against fraudulent transactions. This product is a result of years of Cashfree Payments’ research and analysis of high risk transactions into a set of tools that merchants can now use as a complete risk management solution through which they can curb cybercrime,” said Cashfree Payments CEO and Cofounder Akash Sinha.

Cashfree Payments CEO and Cofounder Akash Sinha said the company believes RiskShield will redefine the security landscape of online transactions in India, offering merchants unparalleled protection and peace of mind.

As per reports, in FY 2023, the Reserve Bank of India (RBI) documented bank frauds close to Rs 30,000 crore. This surge in fraudulent activities due to digital transactions poses a significant threat to security, causing critical issues for businesses such as direct revenue loss, bank account debit freeze, working capital blockages, operational complexities, legal expenses, and the looming threat of account termination due to high chargebacks.

Cashfree Payments’ RiskShield provides a secure business environment by mitigating fraud, minimizing litigation risks, improving transaction experiences, and fostering positive customer relationships. Additionally, merchants using Cashfree Payments’ orchestration platform FlowWise can seamlessly integrate RiskShield to block fraud transactions on multiple Payment aggregators.

RiskShield uses advanced artificial intelligence and machine learning algorithms across their merchant network to identify fraudulent transaction patterns and safeguard the merchants from huge potential losses and litigation risks. Additionally, this solution also empowers the merchant with a wide plethora of controls to define very specific rules that are applicable only to their business scenario. Remarkably, all this integration can be done seamlessly with their existing system with no engineering effort.

Cashfree Payments Chief Technology Officer Ramkumar Venkatesan said the launch of the solution demonstrates the company’s commitment to prioritising safety and security led by tech-first innovations.

“Businesses either completely neglect investment in risk and fraud detection tools or even if they have the tools, they lack real-time payment-blocking features and suggested rules for implementation. Additionally, to build risk solutions, businesses would require specific certifications like PCI DSS certificate etc,” said Cashfree Payments Chief Technology Officer Ramkumar Venkatesan.

Cashfree Payments Chief Technology Officer Ramkumar Venkatesan said RiskShield provides such businesses with a comprehensive solution built on AI & ML algorithms and a rule engine to address these operational gaps. He also said RiskShield will be invaluable for businesses facing high chargebacks/frauds, including financial services, ecommerce, travel and more.

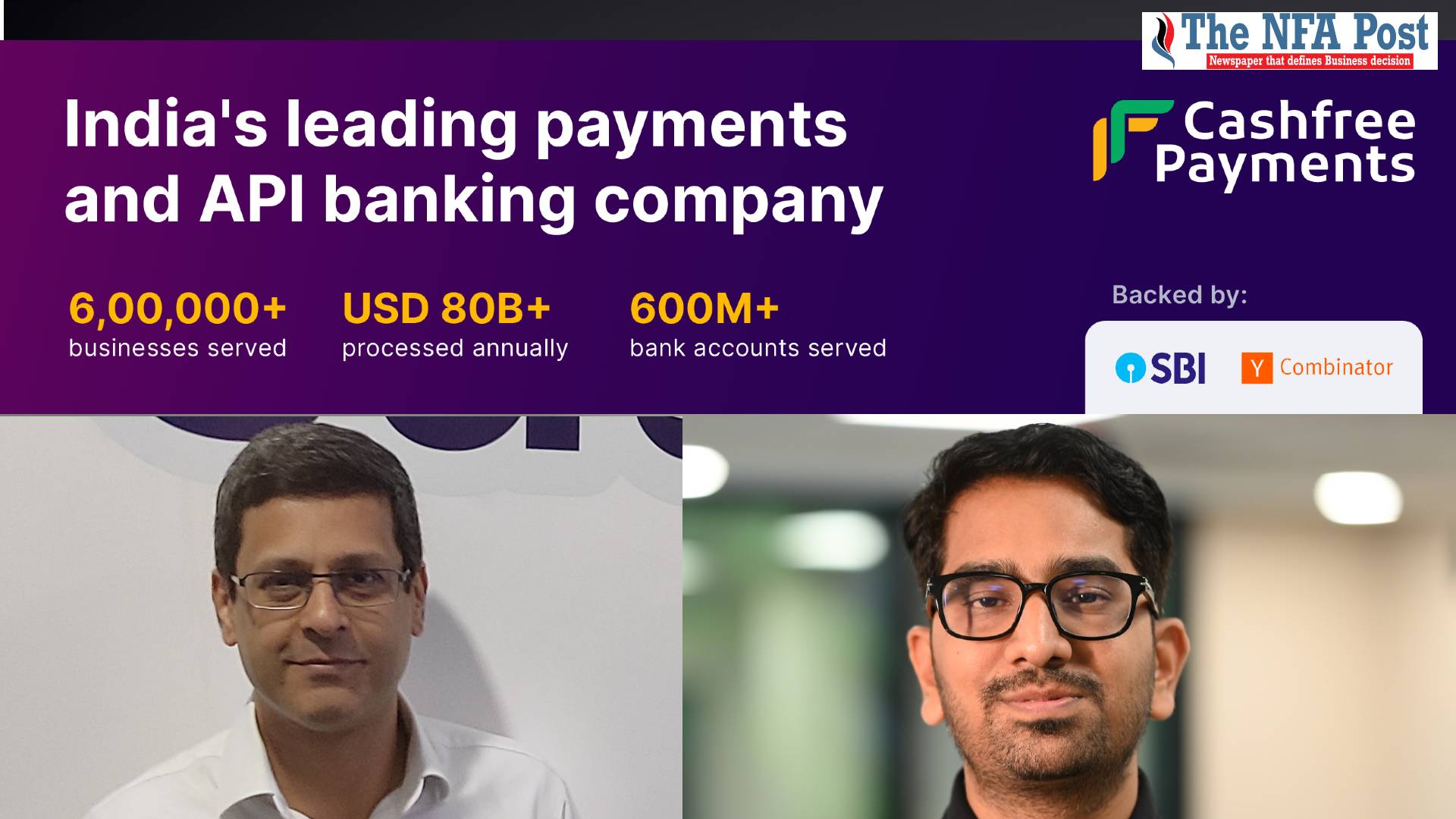

Cashfree Payments (www.cashfree.com) is a payments and banking technology company that enables businesses in India to collect payments online and make payouts. Cashfree Payments enables more than 6,00,000 businesses with payment collections, vendor payouts, wage payouts, instant loan disbursements, ecommerce refunds, insurance claims processing, expense reimbursements, loyalty, and rewards payments. Cashfree customers include leading internet companies such as Cred, BigBasket, Zomato, HDFC Ergo, Ixigo, Acko, Zoomcar, and Delhivery among others.