The restructuring exercise will be undertaken by Arjun Mohan, who was recently elevated as chief executive officer (CEO) of its India business, replacing Mrinal Mohit, according to the sources

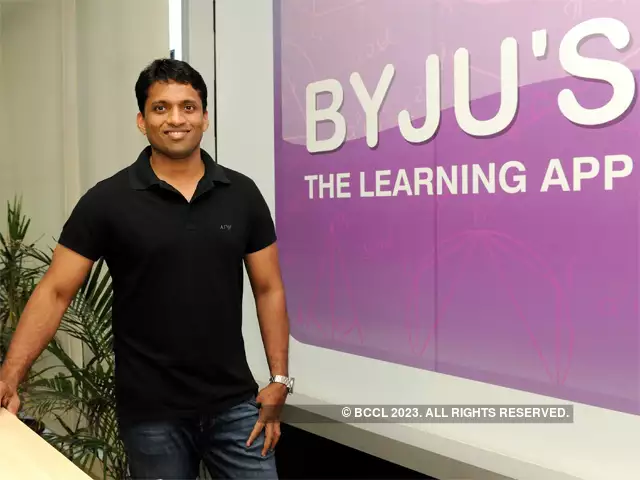

Bengaluru, NFAPost: Byju’s has decided to lay off around 4,000 employees or over 11 per cent of its total workforce over the next few weeks as part of a restructuring exercise as the struggling edtech giant faces a severe funding crunch, battles lenders and has faced a markdown in its valuation, according to the sources. The Bengaluru-based firm has a total of about 35,000 employees.

The restructuring exercise will be undertaken by Arjun Mohan, who was recently elevated as chief executive officer (CEO) of its India business, replacing Mrinal Mohit, according to the sources.

A Byju’s spokesperson declined to reveal the total number of employees who would be impacted but said the firm is in the final stages of a business restructuring exercise.

“We are in the final stages of a business restructuring exercise to simplify operating structures, reduce the cost base and better cash flow management,” said a Byju’s spokesperson. “Byju’s new India CEO, Arjun Mohan, will be completing this process in the next few weeks and will steer a revamped and sustainable operation ahead.”

Mohan, who was once the company’s chief business officer, returned to spend the last three months working with founder and group CEO Byju Raveendran. While away from Byju’s, Mohan worked at Ronnie Screwvala-led edtech firm UpGrad.

Raveendran recently said that Arjun Mohan’s return is a testament to his belief in the company’s mission and the unparalleled opportunities that lie ahead. “His expertise will undoubtedly help our turnaround efforts and strengthen our position in the global EdTech landscape,” said Raveendran.

Mohit, the outgoing CEO of India business at Byju’s, left to pursue personal aspirations. Three senior Byju’s executives resigned earlier, it was reported in August. They were Prathyusha Agarwal, chief business officer of Byju’s; Himanshu Bajaj, business head of tuition centres, and Mukut Deepak, business head for Class 4 to 10.

Cherian Thomas, Byju’s senior vice president for international business, also quit recently to join US-based Impending Inc as CEO. Thomas played an integral part in setting up the US operations at Byju’s and was also responsible for spearheading the business of Byju’s owned educational gaming firm Osmo as its CEO

Byju’s recently said it will clear the full and final settlement dues of laid-off employees soon amid “difficult business restructuring”.

Early this year, Byju’s laid off about 1,000 employees. Sources in the company said the move was part of the “optimisation” strategy that the edtech firm had announced last year, which included sacking 2,500 workers.

In August this year, the firm handed the pink slip to 100 employees in a fresh round of layoffs, post a performance review. However, according to a media report, the edtech company has sacked about 400 people.

Last year, Byju’s laid off about 600 at its group companies — WhiteHat Jr and Toppr. It said this was a move to drive cost efficiency.

Byju’s has decided to put two of its key assets — Epic and Great Learning — on the block to generate $800 million to $1 billion in cash, with an aim to meet the edtech firm’s various commitments, including repaying the entire $1.2 billion term loan B (TLB) within six months, according to sources.

The cash-strapped company has proposed repaying $300 million of the $1.2 billion loan in the next three months, depending on whether the lenders accept Byju’s amendment proposal, said people familiar with the development.

In August, Byju’s appointed veteran Infosys HR leader Richard Lobo as exclusive advisor to help transform its HR function. This strategic move underscores Byju’s commitment to fortify its employee-centric culture. Lobo joined Byju’s after a 23-year stint at Infosys, where he held various leadership roles. Most recently, he served as its executive vice-president and head of human resource.

On July 22, Byju’s auditor Deloitte Haskins & Sells resigned from its role as the company was delaying filing financial results. Following the auditor’s resignation, the firm’s top three investors — Prosus, Peak XV Partners, and Chang Zuckerberg Initiative — representatives also resigned. After these resignations, Byju’s chief executive officer Byju Raveendran addressed shareholders and employees on the issue.

The firm recently announced the appointment of accounting firm BDO as the company’s statutory auditor for the next five years. It also announced the formation of an Advisory Council, on July 13. Former State Bank of India chief and current chairman of BharatPe Rajnish Kumar and former chief financial officer (CFO) of Infosys Mohandas Pai have joined Byju’s BAC (Board Advisory Committee).

Byju’s has raised total funding of $5.8 billion from investors like Qatar Investment Authority (QIA), Sumeru Ventures, Vitruvian Partners, BlackRock, Chan Zuckerberg Initiative, Sequoia, Silver Lake, Bond Capital, Tencent, General Atlantic and Tiger Global.