Bengaluru, NFAPost: Amid lukewarm response for startup funding, Arkam Ventures is courting its second fund, aiming for $180 million.

The new fund is expected to nearly double the size of its maiden fund, as the Indian venture capital firm gears up to double down on the expanding ‘middle India’ opportunity.

Besides high-profile international institutional investors, Arkam Ventures’s partners said that they are hopeful to retain support from family offices for the new fund. Key investors in Arkam’s first fund included British International Investment, SIDBI and Evolvence.

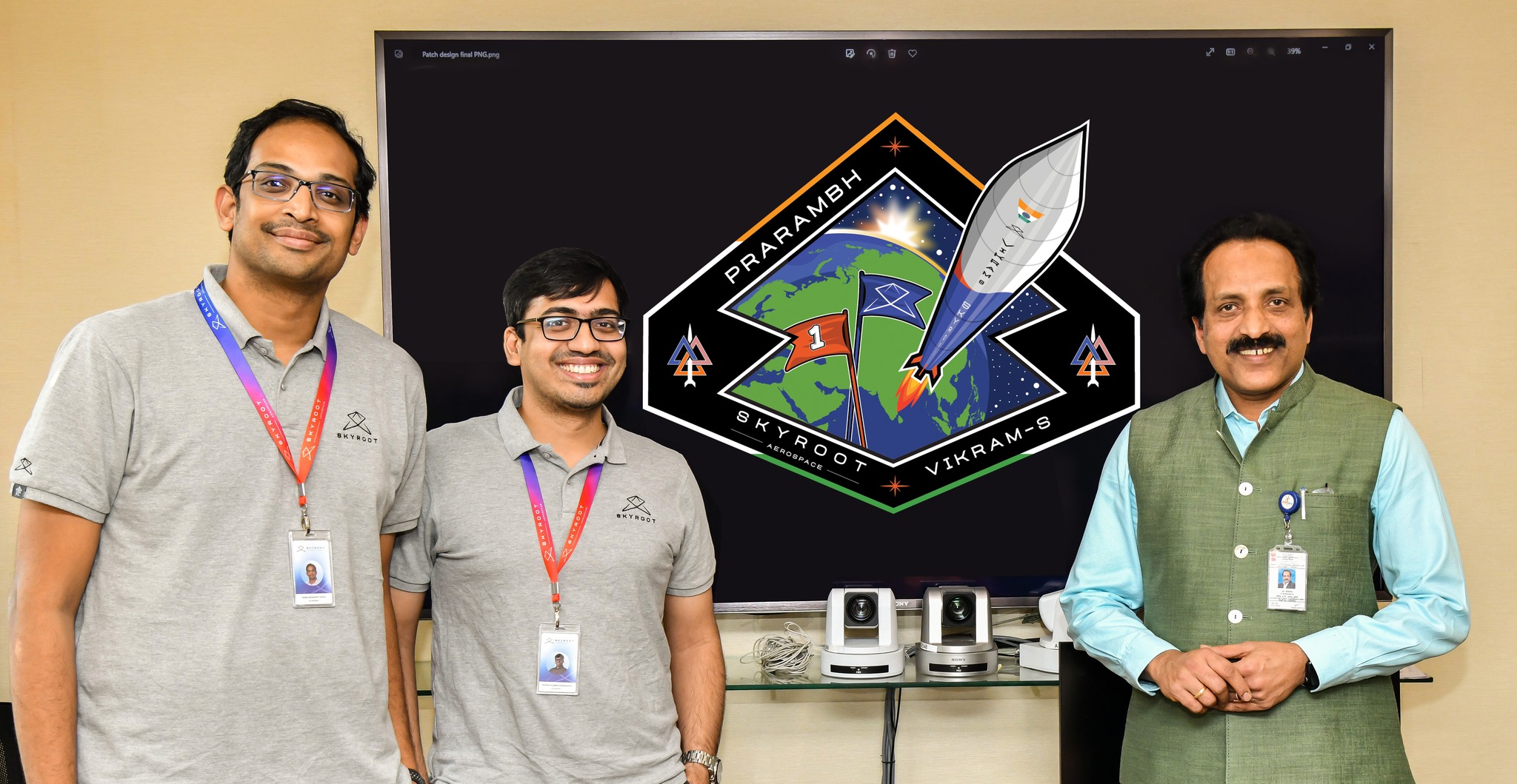

Arkam, whose startup portfolio includes Jar, Smallcase, Kreditbee, and Jai Kisan, seeks to write larger early-stage checks with the new fund to secure bigger stake in emerging companies, said Bala Srinivasa (left in the lead picture), co-founder and managing director of the fund, in a conversation with TechCrunch.

The deliberation on the new fund coincides with a period when VC firms are grappling with closing new funds, and in many instances, reducing the target size due to a slackened economy that has quelled the public markets in the preceding eighteen months.

This scenario contrasts the historical highs during the zenith of 2021 and early 2022 that saw scores of VC firms in India raise record size funds. Rahul Chandra, Arkam’s other co-founder and managing director, indicated that although Arkam could have set a higher target, the firm has remained judicious considering the market conditions and its obligations to its limited partners.

Many firms that accumulated capital at the market’s apex would likely slash their target size by 50% if they were closing funds under the current conditions, he said.

Srinivasa additionally questioned the viability of returning a fund. “If you raise $1 billion, then you have to wonder if you can return 4x of that. It’s an open question,” he said, responding to the availability of potential investment opportunities in India given the current surplus of uninvested capital.

Both Srinivasa and Chandra bring a wealth of experience to the table. Prior to Arkam, Srinivasa held a position at Kalaari Capital and worked at startups, while Chandra has had a varied career including roles at regulatory body SEBI and venture firm Helion.

Arkam’s strategy is centred around the belief that startups are now capable of addressing the needs of India’s wider populace, including families with incomes as low as $3,650 per annum. They hope to achieve this while keeping costs of service and acquisition economical.

Such a bet was deemed untenable in India just a few years ago. However, the emergence and adoption of payments rail UPI, identity platform Aadhaar, and online authentication platform e-KYC have resulted in a more promising landscape.

(The story is based on inputs from TechCrunch)