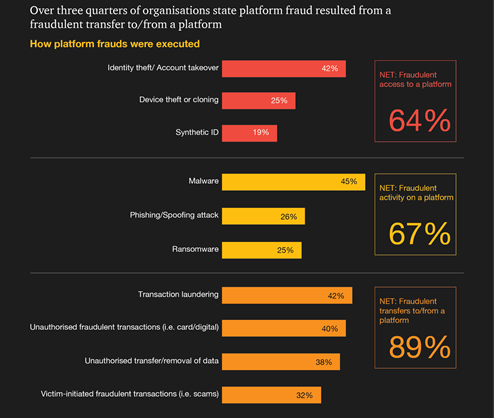

Bengaluru, NFAPost: The prevalence of platform fraud has witnessed a sharp increase in recent years, fueled by the pandemic and the surge in remote work, e-commerce, and contactless payments. According to PwC’s Global Economic Crime and Fraud Survey 2022: India Insights, titled “Platforms: The new frontier of fraud in India,” platforms such as financial, social media, goods, enterprises, media sharing, knowledge sharing, and services have become the primary targets, with 99% of fraud incidents in the past 24 months occurring on these platforms. The impact has been significant, with 26% of Indian organizations experiencing losses exceeding USD 1 million due to platform fraud.

Key Statistics:

- 99% of fraud incidents in the past 24 months have occurred on platforms such as financial, social media, goods, enterprises, media sharing, knowledge sharing, and services.

- 44% of fraud perpetrators engage in fraudulent activities for financial gain.

- 26% of Indian organizations have incurred losses exceeding USD 1 million as a result of platform fraud.

Impact of the Pandemic: The onset of the pandemic has further accelerated the rise of platform fraud due to increased reliance on remote work, e-commerce, delivery applications, and contactless payments. In India, 57% of all fraud incidents are attributed to platform fraud, posing a significant challenge to companies. This emerging form of economic crime has exposed organizations to various risks, including financial loss and brand damage.

Motives Behind Platform Fraud: Financial gain is the primary motive driving platform fraud, with 44% of perpetrators in India engaging in fraudulent activities for monetary reasons. Brand damage and competitive advantage are also cited as common motives, with 32% and 21% of surveyed organizations identifying them, respectively.

Evolution and Spread of Platform Fraud: Platform fraud continues to evolve and spread rapidly, posing an ongoing threat to Indian companies. Puneet Garkhel, Partner and Leader, Forensics Services, PwC India, emphasizes the need for organizations to be aware of these evolving threats and invest in robust fraud prevention and detection strategies.

Combatting Platform Fraud: To mitigate platform fraud, organizations should prioritize strengthening internal controls, as four out of every ten platform fraud incidents in India involve internal perpetrators. Collaboration between internal actors and external perpetrators is also a significant concern, accounting for 26% of platform fraud cases. By implementing strong internal controls, over two-thirds of platform fraud incidents can be prevented.

Recommendations for Mitigating Platform Fraud:

- Involve executives and adopt a cohesive approach that spans the entire enterprise, prioritizing the ability to recover from adverse events.

- Design a strategy for identifying, assessing, and responding to fraud, including the implementation of monitoring programs to detect anomalies.

- Stay vigilant by monitoring online activity, negative media coverage, consumer opinions, and social media for potential fraudulent activity.

- Leverage purpose-built transaction monitoring systems and gain knowledge of partners’ controls, such as third-party audit reports, to mitigate significant exposure.

Building Resilience: Platform fraud poses a significant threat to Indian organizations, necessitating the integration of resilience into comprehensive risk strategies. While technological solutions like document verification and anomaly detection offer potential remedies, organizations must remain proactive in addressing this growing wave of fraud.

Conclusion: The rise of platform fraud on various digital platforms is a cause for concern among Indian organizations. As these incidents continue to increase in sophistication and impact, organizations must prioritize the implementation of robust fraud prevention and detection measures. By strengthening internal controls, adopting a cohesive approach, and leveraging monitoring programs, organizations can better safeguard themselves against platform fraud and mitigate its adverse effects.