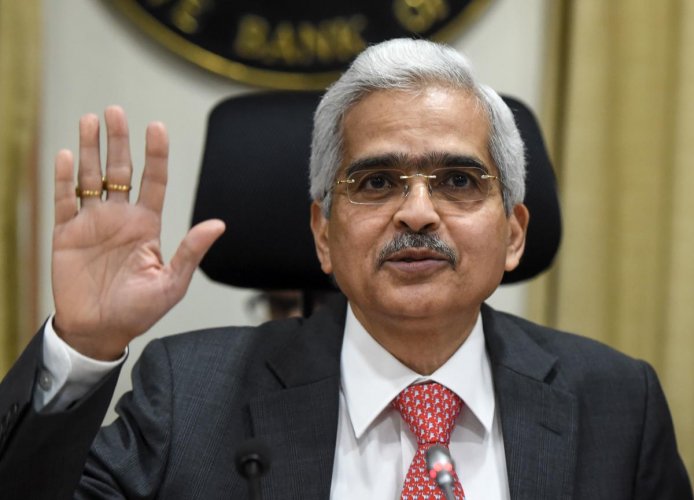

Mumbai, NFAPost: Keeping at bay on speculation, Reserve Bank of India (RBI) Governor Shaktikanta Das made it very clear that India’s banking system continued to be resilient and stable, and the central bank had been engaging with domestic lenders on all fronts for the last few years to prepare them for any future risks. His remarks came against the backdrop of the collapse of three banks in the US.

The statement assumes significant in the context of recent developments in the US banking, especially SVB conundrum and its impact on investors.

“These are areas which have a significant impact on preserving the financial stability of every country,” he said while delivering the K P Hormis Comm–emorative Lecture in Kochi. “I am happy to report that the way the Indian banking system has evolved and the way it is positioned today, it continues to be resilient and stable,” said RBI Governor Shaktikanta Das.

He said the US banking crisis drives home the importance of prudent asset-liability management, robust risk management and sustainable growth in liabilities and assets, undertaking periodic stress tests and building up periodic buffers for any unanticipated future stress. He also pointed out that this crisis also underlined that cryptocurrencies or assets could be a real danger to banks, whether directly or indirectly.

The RBI Governor also emphasised that the RBI had been taking necessary steps in these areas. “When we see excessive growth in deposits without corresponding increase in credit, then there is a cause for worry. What do you do with the excess deposits that banks are mobilising? That is a call which banks have to take…Here the question of risk management comes in. Every investment, credit when it is given out, should be backed by appropriate risk assessment,” said Shaktikanta Das.

He went on to say that risks and likely stress arising out of the interest risk needed to be properly assessed and appropriate stress tests done. “In our engagement with banks over the last few years, we have been driving home this point to do internal stress tests, have robust internal risk management, and be very careful with asset-liability management,” said Shaktikanta Das.

Shaktikanta Das also said the RBI’s supervisory systems have been strengthened significantly in recent years through measures which include a unified and harmonised supervisory approach for commercial banks, NBFCs and UCBs.

“The frequency and intensity of on-site supervisory engagement is now based on the size as well as riskiness of institutions. Off-site supervision has also become more intense and frequent. The focus is now more on identifying the root cause of vulnerabilities rather than dealing with the symptoms alone,” said Shaktikanta Das.

At a time when India has assumed the presidency of G20, Das said globalisation must produce better outcomes for all, and not just a few. “Actually, the backlash against globalisation had started even before the pandemic struck, as globalisation created both winners and losers. The international order could not provide cooperative solutions to make the process win-win for all. This indeed is the biggest challenge for G20 as a multilateral group. Globalisation must produce better and more equitable outcomes for all, including the global south,” said Shaktikanta Das.