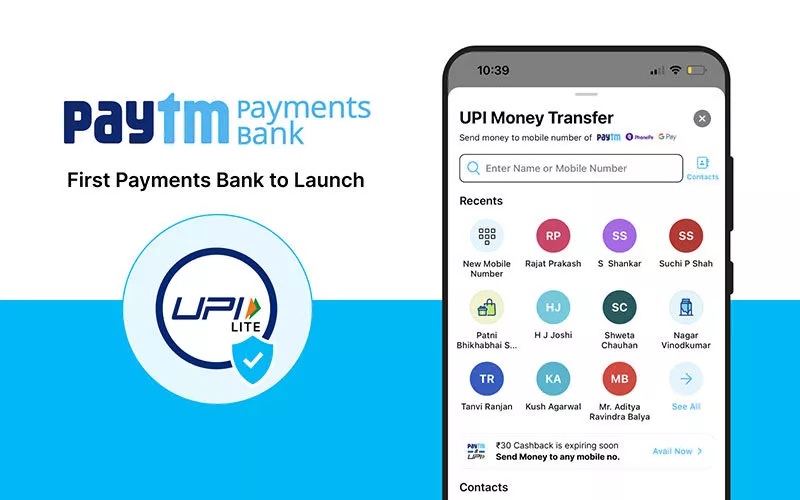

Paytm Payments Banks Limited (PPBL) has launched Unified Payments Interface (UPI) LITE, enabled by the National Payments Corporation of India (NPCI) for multiple small-value UPI transactions. This feature will help with faster real-time transactions with a single click through Paytm as the bank aims to drive the adoption of digital payments across the country. As a part of its efforts to drive innovation, the Bank said it is the first payments bank to launch such a UPI LITE feature.

It also de-clutters the bank passbook of small value transactions, as these payments would now only show in the Paytm balance and history section, and not in the bank passbook. The small-value transactions would now only show in the Paytm balance and history section, and not in the bank passbook. With UPI LITE, users can carry out a large number of small-value UPI payments in a superfast manner without worrying about the cap on the number of bank transactions.

What is UPI Lite?

- UPI LITE is a new payment solution that leverages the trusted NPCI Common Library (CL) application to process low-value transactions that have been set at below ₹ 200. The solution runs off existing UPI ecosystem protocols for mobile phones to ensure commonality, compliance and system acceptance.

- Designed by the National Payments Corporation of India (NPCI), UPI LITE was launched by the Reserve Bank of India in September 2022. Unified Payments Interface (UPI) is an instant real-time payment system developed by the National Payments Corporation of India (NPCI).

- The interface facilitates inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) transactions. It is used on mobile devices to instantly transfer funds between two bank accounts.