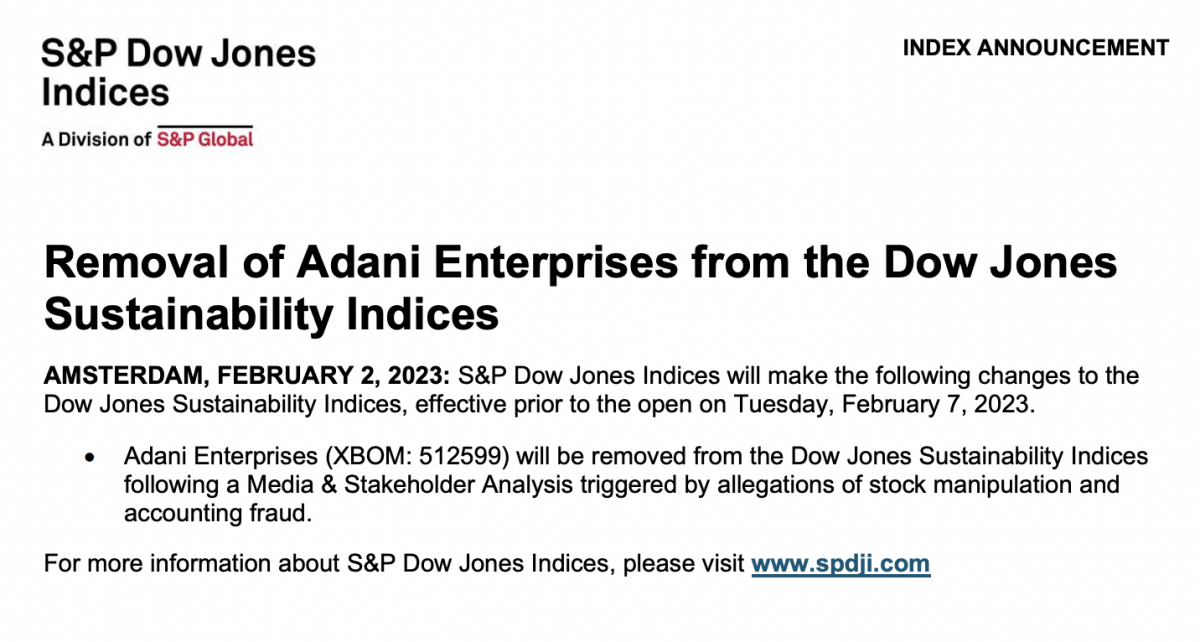

Under fire following allegations of fraud and stock manipulation, the Adani group has received another jolt from the US markets. The group’s flagship company Adani Enterprises has been removed from the Dow Jones Sustainability Indices effective February 7. According to a note issued by S&P Dow Jones Indices, home to iconic financial market indicators, the decision to remove Adani Enterprises was taken “following a media & stakeholder analysis”.

More About This Development

The New York-based short-seller Hindenburg Research on January 24 accused the Adani group of using offshore shells for money laundering and fraud. Adani group denied the allegations, saying they were timed to hit its Rs 20,000 crore FPO. In fact, Gautam Adani, the group’s chairman, released a video statement on February 2 that he was rolling back the fully-subscribed follow-on public offering and returning investors’ money.

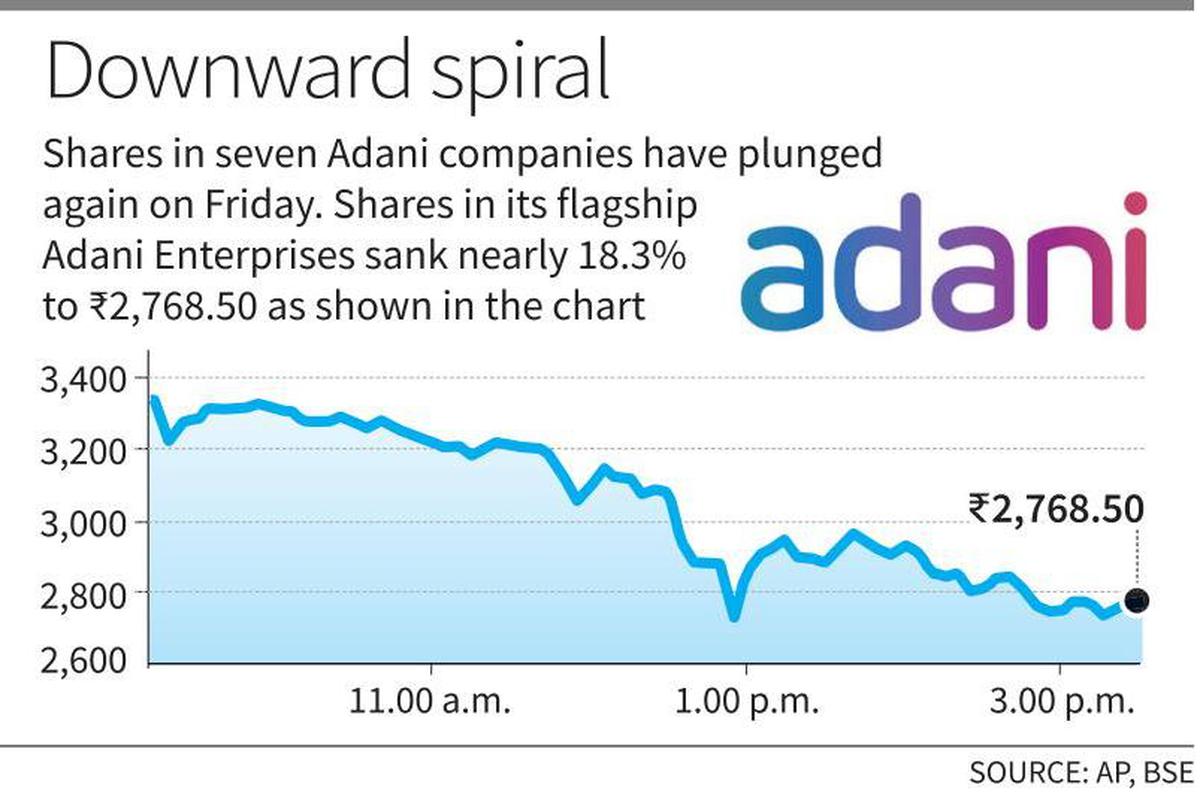

Adani’s Huge Loss

However, the Hindenburg report triggered panic among investors, and the Adani group has lost $108 billion in market value since the report first came out. To tame the fallout from the downfall of the Adani group, the National Stock Exchange (NSE) announced that it was putting three Adani group stocks — Adani Enterprises, Adani Ports and Special Economic Zone and Ambuja Cements — in ASM (Additional Surveillance Measure) list.

However, the Hindenburg report triggered panic among investors, and the Adani group has lost $108 billion in market value since the report first came out. To tame the fallout from the downfall of the Adani group, the National Stock Exchange (NSE) announced that it was putting three Adani group stocks — Adani Enterprises, Adani Ports and Special Economic Zone and Ambuja Cements — in ASM (Additional Surveillance Measure) list.

About The S&P Dow Jones Indices

S&P Dow Jones Indices describes itself as the largest global resource for essential index-based concepts, data, and research, and home to iconic financial markets indicators, such as the S&P 500 and the Dow Jones Industrial Average. It is a division of S&P Global.