Manufacturing sector contracts in March quarter due to supply disruptions

Mumbai, NFAPost: India’s economy grew 4.1% year-on-year in the January-March period of 2021-22 (Q4 FY22), even as the rate of growth slowed sequentially for a third straight quarter with the Omicron wave-induced restrictions and high commodity prices weighing on economic activities.

The National Statistics Office on Tuesday pared down the overall growth estimate for FY22 to 8.7% from the 8.8% projected in February. In FY22, all sectors except trade, hotels and communication services were above the pre-pandemic levels of FY20.

Growth in private final consumption expenditure, or private spending, decelerated sequentially in Q4 to 1.8%, proving to be the weakest link. Government spending, however, picked up to grow at 4.8%, supporting overall growth. Gross fixed capital formation, which represents investment demand in the economy, slowed to 5.1%.

On the supply side, the manufacturing sector contracted 0.2% in the March quarter due to supply chain disruptions, while agriculture growth (4.1%) remained robust despite the third advance estimates projecting a decline in wheat output due to the ongoing heat wave.

The labour-intensive construction sector returned to positive growth in the March quarter (2%) due to the government’s capex push and a pick-up in the real estate sector before the policy rate hike by the central bank. Growth in services output slowed to 5.5% as a result of a sluggish performance of trade, hotel transport, communications services (5.3%), signalling the pent-up demand did not quite translate to higher growth.

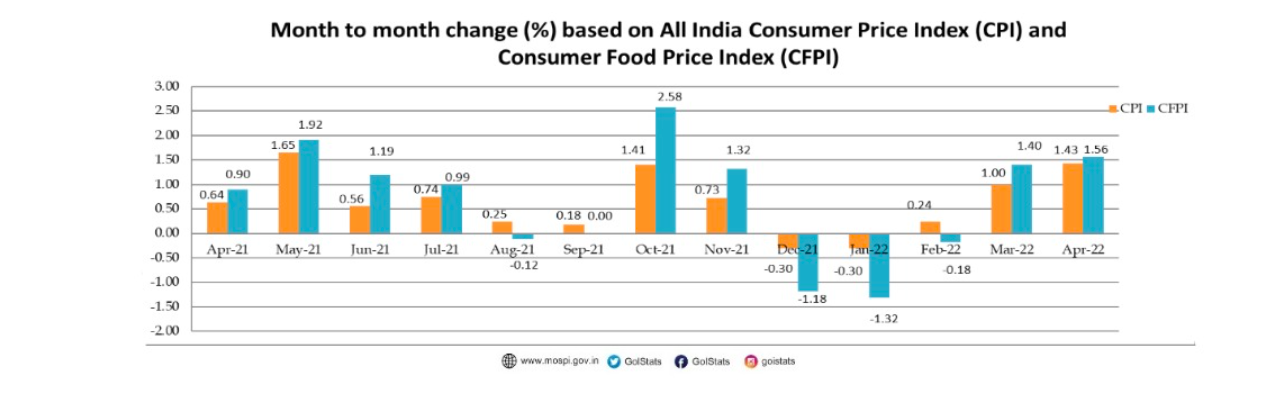

graph

Gross value added (GVA) at basic prices grew at 3.9% in the fourth quarter and 8.1% in FY22.

According to State Bank of India Group Chief Economic Adviser Soumya Kanti Ghosh said those looking for impeccable imprints of degrowth in GDP numbers released today, courtesy the persistent inflationary pressure and recalcitrant Omicron variant shadowing activities of last quarter for a sizeable part would do well to remember the state of economy as reflected through latest numbers are a just fraction of the possibilities that could have been had the adversity not gripped us with barely a shorter interval just when things looked emerging from the brutal second wave.

“During Q4, apart from manufacturing, all other sectors showed positive growth. Manufacturing declined by 0.2% indicating the slight impact of Omicron variant induced lockdowns. Construction also showed tepid growth of 2.0%. The sequential seasonally adjusted GDP growth is lower than the non-seasonally adjusted GDP growth for Q4 over the past. In FY22 Q4, real GDP growth is 6.7% qoq, however the seasonally adjusted real GDP growth is only 0.71%, showing only a modest improvement over the past quarter and loss of growth momentum,” said State Bank of India Group Chief Economic Adviser Soumya Kanti Ghosh.

Aditi Nayar, chief economist at ICRA Ratings, said the contraction in the manufacturing sector, which struggled with supply bottlenecks and high input prices in the last quarter of FY22, was a cause for concern. “The other concerning aspect is the reduction in the consumption-to-GDP ratio in the fourth quarter of FY22, even as the investment-to-GDP ratio has bounced back,” she added.

Reacting to the latest GDP data, Chief Economic Adviser V Anantha Nageswaran said recent high-frequency indicators showed strengthening domestic demand conditions and greater capacity utilisation in the manufacturing sector, signalling a pick-up in economic activity. “The projection of a normal monsoon and prospects of earning (higher) income will likely increase area under Kharif 2022-23 crops.

Rural demand (is) expected to revive in the coming months on the back of higher agricultural output, better pricing, expectations of a better monsoon and the government’s supportive policy for rural India,” he added.

State Bank of India Group Chief Economic Adviser Soumya Kanti Ghosh said on expenditure side, while private final consumption expenditure grew by 7.9% in FY22 as compared to contraction in FY21, the Government final consumption expenditure decelerated to 2.6% inFY22 as against 3.6% growth in FY21.

“However, if we look at the Q4 growth in PFCE, it has revealed a much lower growth rate at 1.8%, and it shows a continuous decline on[1]wards from Q1FY22. Gross fixed capital formation grew by whopping 15.8% in FY22. Both valuables and exports exhibited double-digit growth,” said State Bank of India Group Chief Economic Adviser Soumya Kanti Ghosh.

Nominal GDP is estimated to grow 19.5 per cent in FY22 to Rs 236.4 trillion. The growth embedded in nominal GDP assumed by the Union Budget for FY23 now turns out to be only 9 per cent instead of 11 per cent assumed earlier.

Many professional forecasters have recently pared down their growth projections for India. Barclays on Tuesday revised down its FY23 growth forecast to 7 per cent, acknowledging the downside risks to growth. S&P Global Ratings in May slashed India’s growth forecast to 7.3 per cent from 7.8 per cent for FY23 on rising inflationary pressures and the longer-than-expected Russia-Ukraine war.

The sector-wise data for April Indicate that credit off-take has happened in almost all sectors. Personal loans segment continued to perform well, registering acceleration in growth to 14.7% in April 2022 and contributes around 90% of the incremental credit during the month, primarily driven by ‘housing’, ‘vehicle loans’ and ‘Other personal loans’ segments. Customers, especially in retail verticals could be having a feel of future run expected in interest rates, and might be front loading their purchases in days to come giving a fillip to consumer demands in select niche areas.

The World Economic Outlook (WEO) has cut its global growth forecast for 2022 relative to its January 2022 projection by 0.8 percentage points to 3.6%. China’s economy remained deep in a slump in May as lockdowns continued to weigh on activity. The downward revision is sharper for emerging market and developing economies than for advanced economies.

(Inputs from Business Standard)