Samsung Electronics pips Intel to become the largest semiconductor producer in the world as its revenue increased 28% in 2021

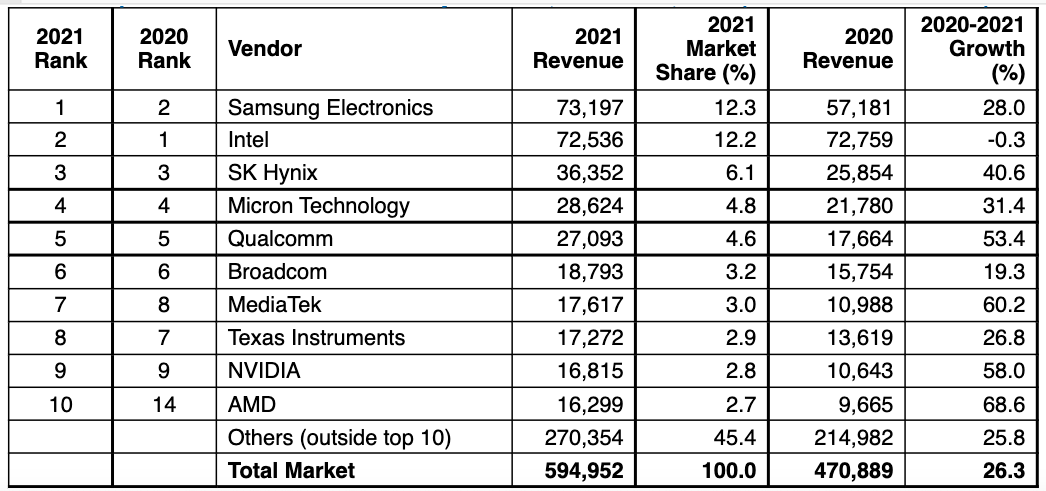

San Francisco, NFAPost: Worldwide semiconductor revenue totaled $595 billion in 2021, an increase of 26.3% from 2020, according to final results by Gartner, Inc.

Commenting on the development, Gartner Research Vice President Andrew Norwood said the events behind the current chip shortage continue to impact original equipment manufacturers (OEMs) around the world.

“But the 5G smartphone ramp up and a combination of strong demand and logistics/raw material price increases drove semiconductor average selling prices (ASPs) higher, contributing to significant revenue growth in 2021,” said Gartner Research Vice President Andrew Norwood.

Samsung Electronics regained the top spot from Intel for the first time since 2018, though by less than a percentage point, with revenue increasing 28% in 2021 (see Table 1).

Intel’s revenue declined 0.3%, garnering 12.2% market share compared to 12.3% market share for Samsung. Within the top 10, AMD and Mediatek experienced the strongest growth in 2021 at 68.6% and 60.2% growth, respectively.

The most significant shift among the semiconductor vendor ranking in 2021 was HiSilicon dropping out of the top 25.

Gartner Research Vice President Andrew Norwood said HiSilicon’s revenue declined 81%, from $8.2 billion in 2020 to $1.5 billion in 2021.

“This was a direct result of the U.S. sanctions against the company and its parent company Huawei,” said Gartner Research Vice President Andrew Norwood.

He also pointed out that this also impacted China’s share of the semiconductor market as it declined from 6.7% market share in 2020 to 6.5% in 2021.

“South Korea had the largest increase in market share in 2021 as strong growth in the memory market propelled South Korea to garner 19.3% of the global semiconductor market,” said Gartner Research Vice President Andrew Norwood.

Automotive and Wireless Communications Segments spur demand

2021 saw stronger demand return to the automotive and industrial markets compared to the weak, COVID-disrupted market in 2020. The automotive semiconductor market outperformed all other end markets, growing 34.9% in 2021.

Wireless communications, which is dominated by smartphones, saw growth of 24.6%. The number of 5G handsets produced reached 556 million in 2021, up from 251 million units in 2020, and enterprises upgraded their Wi-Fi infrastructure for employees heading back to the office.

Driven by DRAM, memory accounted for 27.9% of semiconductor sales in 2021 and experienced 33.2% revenue growth, increasing $41.3 billion over the previous year. Memory continued to benefit from the key demand trend in the last couple of years — the shift to home/hybrid working and learning.

This trend fueled increased server deployments by hyperscale cloud service providers to satisfy online working and entertainment, as well as a surge in end-market demand for PCs and ultramobiles.