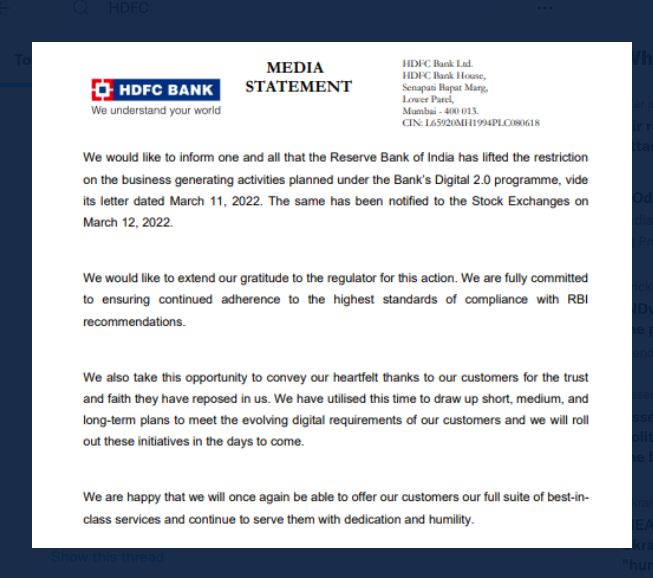

Mumbai, NFAPost: HDFC Bank on Saturday came up with a statement that Reserve Bank of India has lifted the restriction on the business generating activities planned under the Bank’s Digital 2.0 programme.

The apex bank issued a letter dated March 11, 2022, in this regard. The same has been notified to the Stock Exchanges on March 12, 2022.

“We would like to extend our gratitude to the regulator for this action. We are fully committed to ensuring continued adherence to the highest standards of compliance with RBI recommendations,” states HDFC Bank in a statement.

RBI had order issued an order in December 2020 and advised the bank to temporarily stop all launches of the digital business-generating activities planned under its program Digital 2.0 and other proposed business generating IT applications and sourcing of new credit card customers.

The Bank also conveyed its heartfelt thanks to its esteemed customers for the trust and faith they have reposed in HDFC Bank.

“We have utilised this time to draw up short, medium, and long-term plans to meet the evolving digital requirements of our customers and we will roll out these initiatives in the days to come,” states the Bank.

The leading bank also expressed its happiness that it will once again be able to offer customers full suite of best-in-class services and continue to serve them with dedication and humility.

Besides asking to temporarily stop all launches of its upcoming digital business-generating activities and sourcing of new credit card customers after outage at its data centre which impacted operations last month, the RBI issued directives to the bank board to examine the lapses and fixes accountability.

During that time HDFC Bank had said over the last two years, it has taken several measures to fortify its IT systems and will continue to work swiftly to close out the balance and would continue to engage with the regulator in this regard.

“The bank has been taking conscious, concrete steps to remedy the recent outages on its digital banking channels and assures its customers that it expects the current supervisory actions will have no impact on its existing credit cards, digital banking channels and existing operations. The bank believes that these measures will not materially impact its overall business,” it added.