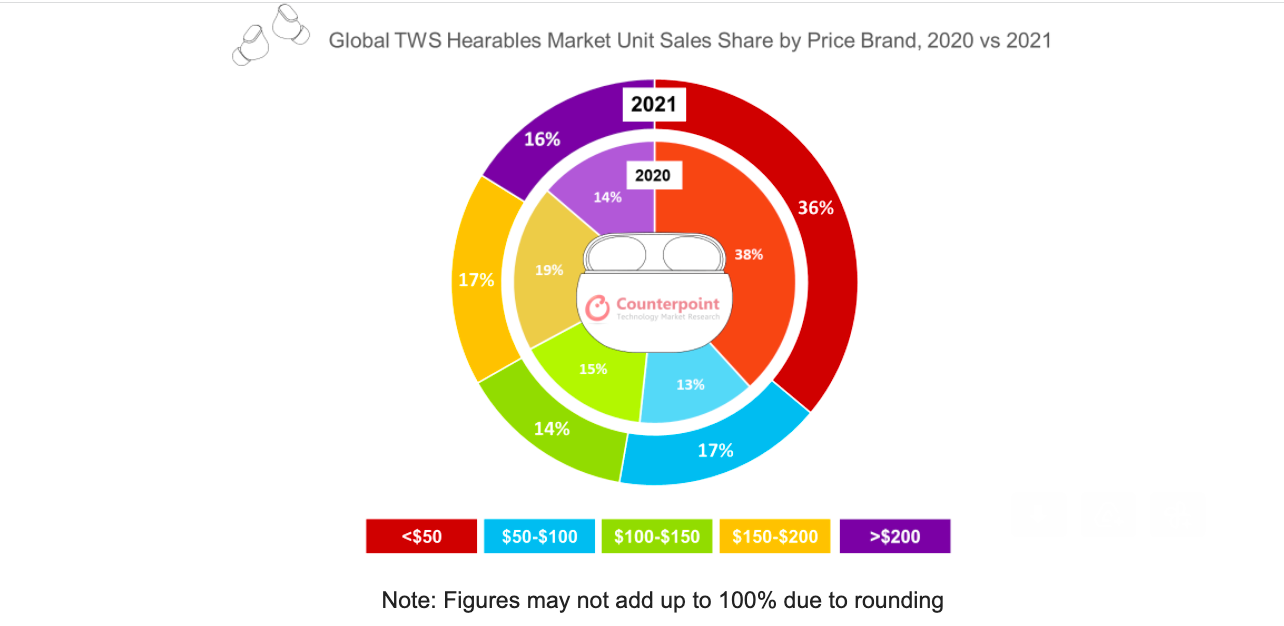

The $50-$100 and $200+ price bands led the market growth in 2021.

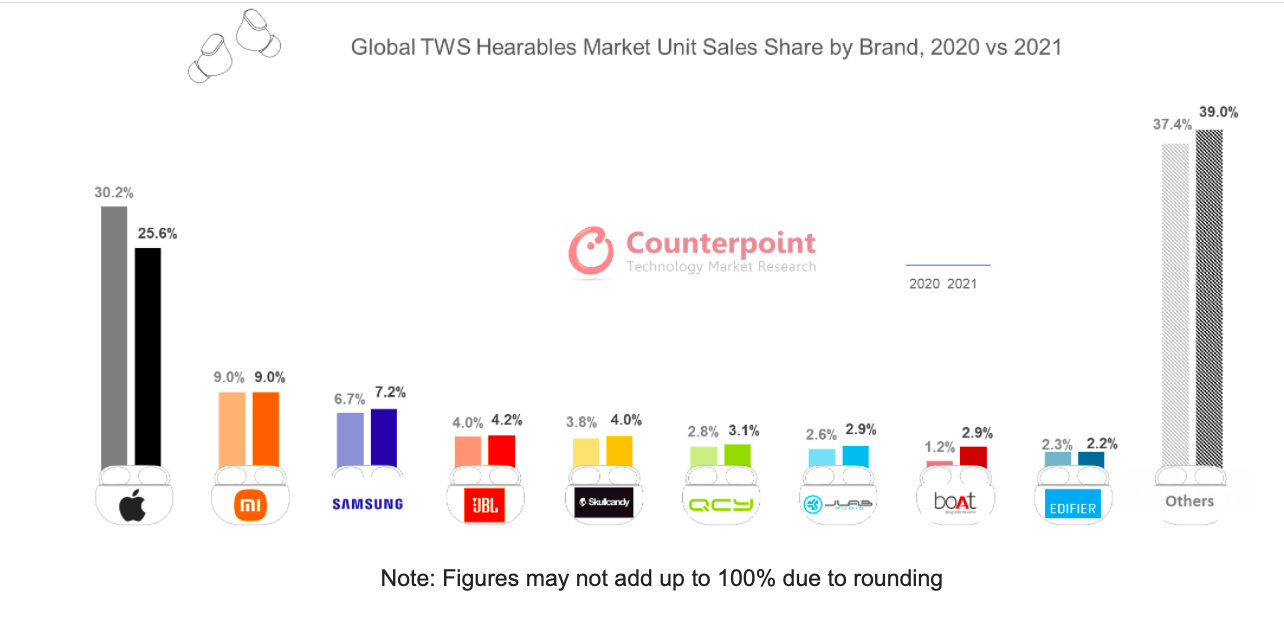

Apple maintained its first position in 2021 but with a shrinking share.

Boston, Toronto, London, New Delhi, Beijing, Taipei, Seoul – March 10, 2022

Bengaluru, NFAPost: The global True Wireless Stereo (TWS) hearables market shipments in 2021 grew 24% YoY in unit sales and 25% in terms of value, according to the latest research from Counterpoint’s TWS Hearables Market Tracker.

The unit sales growth rate was slightly lower than the original forecast due to the Covid-19 pandemic impact throughout the year. However, unit sales increased to around 300 million as new products entered the market.

The new products came up with more features, like ANC (Active Noise Cancellation) and expanded play time and that too at affordable prices. It is intersting to note that martphone OEMs continued to focus on TWS products to expand their smart ecosystem, resulting in increased competition and sales in the market.

TWS market leader Apple saw a slight increase of 5% YoY in its unit sales but its market share fell to 25.6%. Although the AirPods 3 was released later than expected, the AirPods 2 and AirPods Pro maintained high sales based on promotions throughout the year. With the growing influence of Apple in the Chinese market, sales of old models have also increased significantly.

The AirPods 3, primarily doing well in North America and Europe, led the entire TWS market in Q4 2021. Samsung saw a robust growth of 33% YoY with its new models Galaxy Buds Pro and Galaxy Buds 2, released in the first half and second half of the year respectively. Among other brands, Skullcandy and boAt showed noticeable growth, as they became key players in major regions like North America, Europe and India.

The growth in the $50-$100 and $200+ segments was notable. JBL and Xiaomi led the growth in the $50-$100 segment with their flagship models, while Skullcandy performed well with its models finding their way to the top 10 list of best-selling models.

Apple drove the growth in the $200+ segment with a 75% share. Just like in 2020, the sub-$50 segment accounted for the largest share in 2021 with strong demand from emerging markets like India. Xiaomi recorded the highest sales in the sub-$50 segment, while boAt recorded the highest growth compared to the previous year.

Counterpoint Senior Analyst (TWS hearables research) Liz Lee said the $50-$100 segment grew significantly YoY, as Xiaomi, which had focused on the sub-$50 segment, tried to expand its lineup to the $50-100 range.

“Further, the competition in the $50-$100 segment intensified, with smartphone OEMs like OPPO, OnePlus and realme pitted against emerging brands like Skullcandy, JLab and Nothing. All this competition resulted in new products offering good quality and more features at reasonable prices and pushing the market growth in 2021,” said Counterpoint Senior Analyst (TWS hearables research) Liz Lee.

Counterpoint Technology Market Research is a global research firm specialising in products in the TMT (technology, media and telecom) industry.

It services major technology and financial firms with a mix of monthly reports, customised projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.