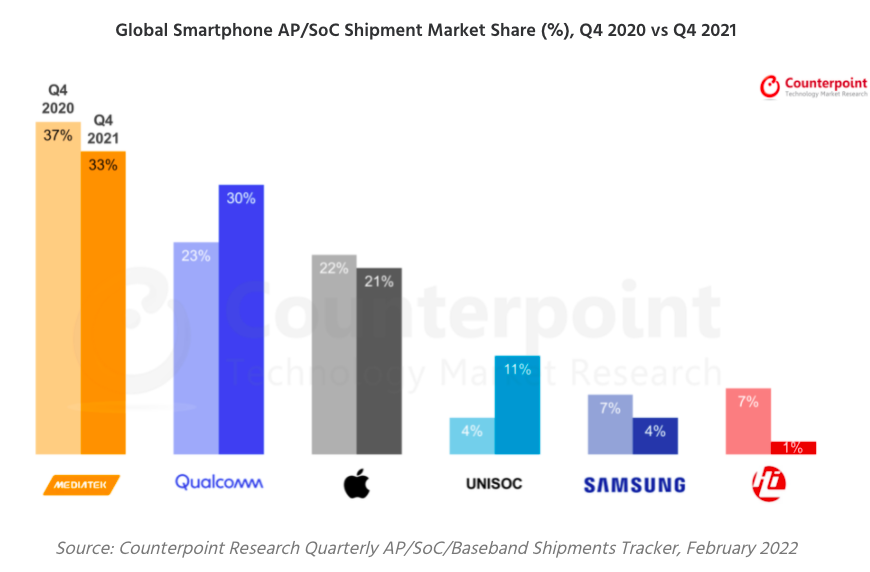

Qualcomm’s share reached 30% driven by the premium tier; MediaTek Continues to Lead

UNISOC had a strong Q4 with its share reaching 11%.

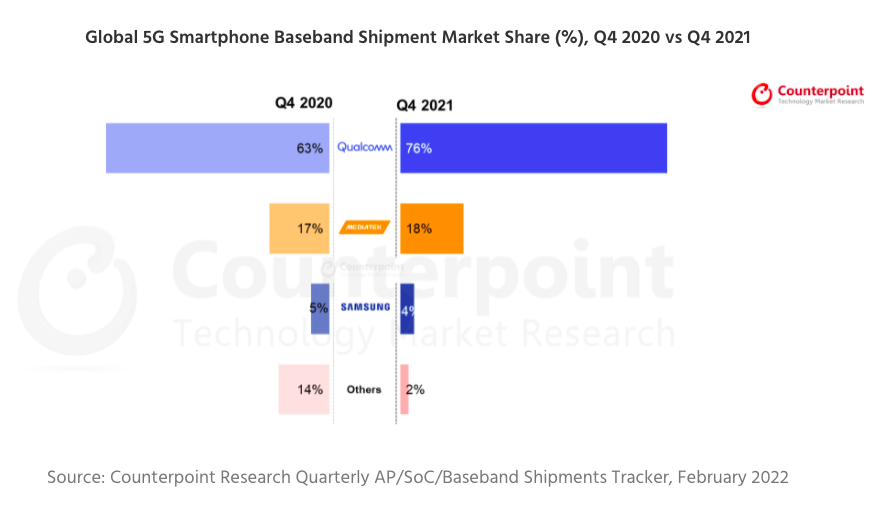

Qualcomm led the 5G baseband market with a 76% share.

Tokyo, NFAPost: The global smartphone AP (Application Processor)/SoC (System on Chip) chipset shipments grew 5% YoY in Q4 2021, according to the latest research from Counterpoint’s Foundry and AP/SoC service. 5G smartphone SoC shipments were almost half of the total SoC shipments.

Commenting on the development, Research Director Dale Gai said MediaTek led the smartphone SoC market with a share of 33%.

“Its smartphone SoC volumes declined this quarter due to the high shipments in the first half and inventory corrections from Chinese smartphone OEMs. Many customers had built chipset inventories to manage uncertainties in the supply situation,” said Research Director Dale Gai

On the growth outlook, Research Director Dale Gai added Qualcom expects revenues to grow in Q1 2022 driven by the flagship chipset (Dimensity 9000) for smartphones.

“Higher 5G penetration will offset the lower seasonal demand. The increase in chipset prices after TSMC’s wafer price hike is reflected from Q4 2021 onwards. 5G migration in regions like APAC, MEA and LATAM and continued LTE demand will help MediaTek have a strong 2022,” said Research Director Dale Gai.

Commenting on Qualcomm’s performance, Research Analyst Parv Sharma said Qualcomm recorded a very strong quarter, growing 18% QoQ and 33% YoY despite component shortages and foundry capacity not being able to keep up with demand.

“Qualcomm was able to prioritize high-end Snapdragon sales, which come with higher profitability and less impact from shortages than mid-end and low-end mobile handsets. The company was also able to increase supplies from its major foundry partners by dual-sourcing key products. It captured a 76% share in the 5G baseband shipments driven by Apple’s iPhone 13 and 12 series and premium Android portfolio,” said Research Analyst Parv Sharma.

Commenting on the growth opportunities, Research Analyst Parv Sharma added Qualcomm’s Snapdragon 8 Gen 1 flagship mobile platform will start shipping from Q1 2022. The performance in Q1 2022 will be driven by design wins in the Samsung Galaxy S22 series and launches in the Chinese New Year.

“Overall, the next inflexion in growth will be in H2 2022 with the launch of 5G handsets by major OEMs. The share of revenues from Android is also growing as more OEMs are adopting Qualcomm’s modem-to-antenna RFFE solution across tiers,” said Research Analyst Parv Sharma.

Global 5G Smartphone Baseband Shipment Market Share (%), Q4 2020 vs Q4 2021

MediaTek led the smartphone SoC market in Q4 2021 with a 33% share. Shipments declined due to inventory correction as many customers had built inventories due to supply chain constraints.

Qualcomm grew 18% sequentially due to the premium segment and dual-sourcing from foundries. It dominated the 5G baseband modem shipments with a 76% share, driven by basebands for Apple and premium Android.

Apple maintained its third position in the smartphone SoC market in Q4 2021 with a 21% share. The iPhone 13 launch and festive season drove the shipments.

UNISOC continued with shipment growth this year and reached an 11% share in Q4 2021. On an annual basis, its SoC shipments more than doubled in 2021. It has expanded its customer base, securing design wins with HONOR, realme, Motorola, ZTE, Transsion and Samsung.

Samsung Exynos slipped to the fifth position with a 4% share as Samsung is in the middle of rejigging its smartphone portfolio strategy of in-sourcing as well as outsourcing to Chinese ODMs. As a result, the share of MediaTek and Qualcomm has been growing across Samsung’s smartphone portfolio, from the mid-range 4G and 5G models manufactured by ODMs to the flagship ones.

HiSilicon was unable to manufacture Kirin chipsets due to the US trade ban against Huawei. The accumulated inventory of Kirin SoCs is on the verge of being exhausted. As a result, Huawei is launching its latest series with Qualcomm SoCs but is limited to 4G capabilities.

For our comprehensive research on foundries to chipsets to devices, feel free to get in touch with us at the contacts given below.