As per International Data Corporation’s (IDC) latest Worldwide Quarterly Enterprise Storage Systems Tracker Q2 2021 release, India’s external storage market witnessed a growth of 14.8% year-over-year (YoY) by vendor revenue and stood at USD 73.7 million in Q2 2021 (April – June).

The quarter witnessed YoY growth in storage spending from the government, and manufacturing verticals, while observing a sharp decline in contribution from BFSI, professional services, and telecommunications verticals during the same period.

Commenting on the report, IDC India Senior Research Manager, Enterprise Infrastructure, Dileep Nadimpalli said enterprises are forced to change their existing IT architectures to be adaptive and efficient while securing the workloads.

“Additionally, workloads are getting distributed to the edge, which is even more complicating things for organizations. Enterprises are looking for an infrastructure platform which offers complete end-to-end data services along with built-in security features,” says Dileep Nadimpalli.

The adoption of All-Flash Arrays (AFA) is evident, contributing 34.4% to the overall external storage systems market in Q2 2021. The emergence of NVMe flash media would further drive the AFA market due to better cost vs performance ratio across verticals. HDD arrays saw a strong growth in Q2 2021 due to uptake of backup appliance for data protection needs.

Entry-Level storage systems grew by 65.4% YoY due to increased investments from banking, government, professional services, and manufacturing organizations in Q2 2021. The high-end storage segment witnessed a YoY decline; however, IDC expects uptake of this storage segment in the next couple of quarters.

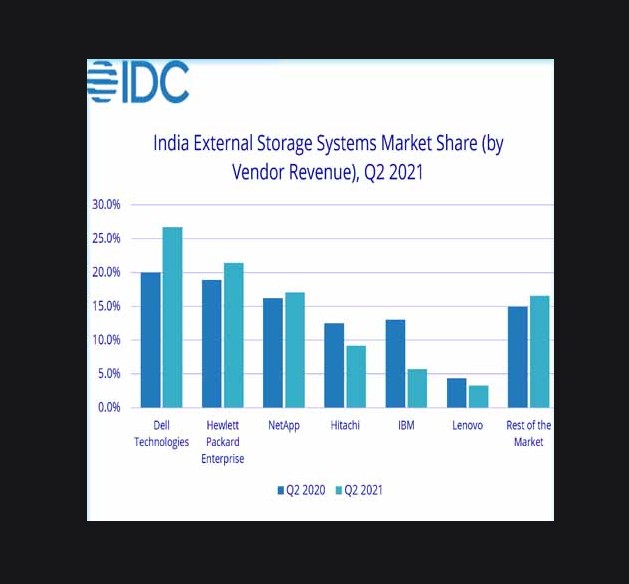

Dell Technologies continued to be the market leader in the external storage systems market with a 26.7% market share by vendor revenue, followed by HPE and NetApp in Q2 2021. Hitachi and IBM saw a YoY decline in Q2 2021.

IDC India Forecast

The external storage systems market is expected to grow at a single-digit compounded annual growth rate (CAGR) for the 2020 – 2025 period. Furthermore, the external storage systems spending is expected to grow YoY significantly in 2H 2021 due to large data localization projects in BFSI segment and large government deals.