New Delhi, NFAPost: Worldwide revenues for the artificial intelligence (AI) market, including software, hardware, and services, is estimated to grow 15.2% year over year in 2021 to $341.8 billion, according to the latest release of the International Data Corporation (IDC) Worldwide Semiannual Artificial Intelligence Tracker.

The market is forecast to accelerate further in 2022 with 18.8% growth and remain on track to break the $500 billion mark by 2024. Among the three technology categories, AI Software occupied 88% of the overall AI market. However, in terms of growth, AI Hardware is estimated to grow the fastest in the next several years. From 2023 onwards, AI Services is forecast to become the fastest-growing category.

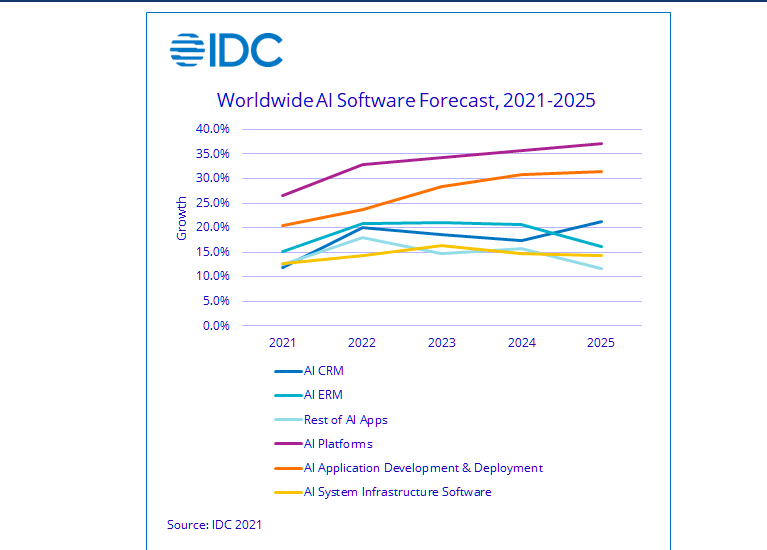

Within the AI Software category, AI Applications has the lion’s share at nearly 50% of revenues. In terms of growth, AI Platforms is the strongest with a five-year compound annual growth rate (CAGR) of 33.2%.

The slowest will be AI System Infrastructure Software with a five-year CAGR of 14.4% while accounting for roughly 35% of all AI Software revenues. Within the AI Applications market, AI ERM is expected to grow slightly stronger than AI CRM over the next five years. Meanwhile, AI Lifecycle Software is forecast to grow the fastest among the markets within AI Platforms.

IDC group vice president for AI and Automation Research Ritu Jyoti said disruption is unsettling, but it can also serve as a catalyst for innovation and transformation.

“2020 was the year that accelerated digital transformation and strengthened the value of enterprise AI. We have now entered the domain of AI-augmented work and decision across all the functional areas of a business. Responsible creation and use of AI solutions that can sense, predict, respond, and adapt at speed is an important business imperative,” said Ritu Jyoti.

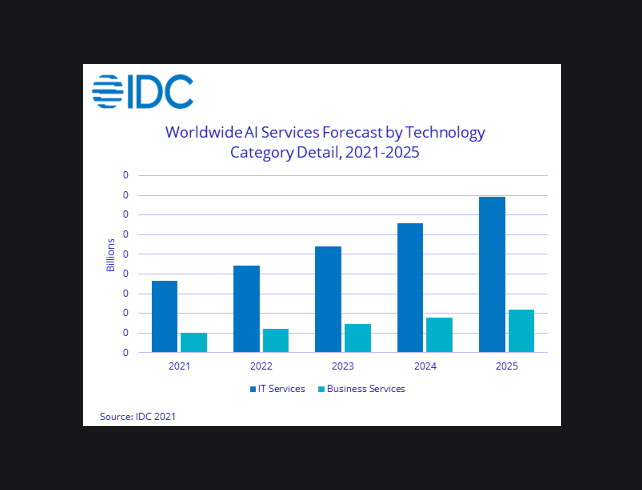

The AI Services market was estimated at $19.4 billion in 2020, representing the fastest growth relative to hardware and software. For 2021, it is forecast to grow at 19.3%. Over the next five years, it is expected to enjoy the best CAGR at 21%.

This technology category breaks down into two segments: IT Services and Business Services. IT Services is the larger of the two, accounting for nearly 80% of all AI Services revenues. From a growth perspective, the two markets are similar with five-year CAGRs of 21%. Overall, AI Services is expected to be a $50 billion market by 2025.

“AI has emerged as an essential component of the future enterprise, fueling demand for services partners to help organizations clear the many hurdles standing between pilot projects and enterprise AI,” said Jennifer Hamel, research manager, Analytics and Intelligent Automation Services. “Client demand for expertise in developing production-grade AI solutions and establishing the right organization, platform, governance, business process, and talent strategies to ensure sustainable AI adoption at scale drives expansion across both IT services and business services segments.”

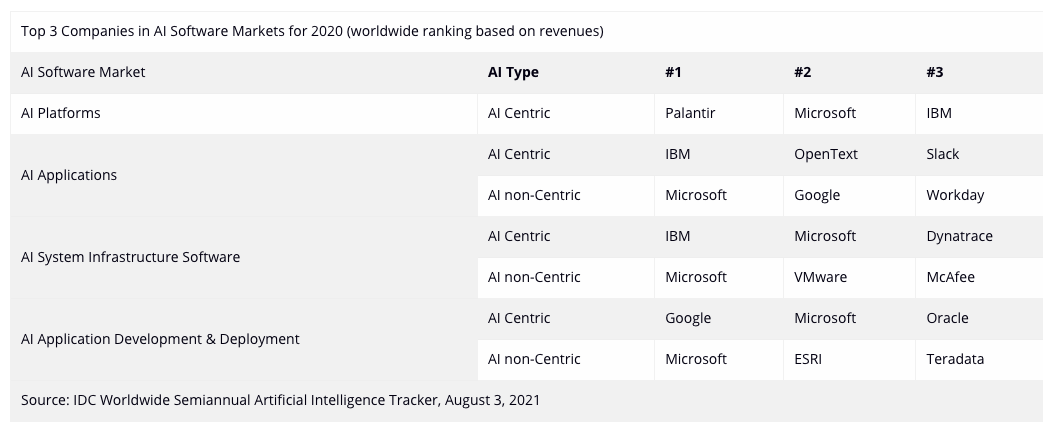

Almost 190 companies were included in the AI Services market in this release of the AI Tracker. Under IT Services for AI, the Top 3 companies in 2020 were IBM, Accenture, and Tata Consultancy Services. Each of the three companies achieved over $1 billion in revenues and combined for a total of 26% market share. Beyond them, another eight companies generated more than $500 million each. The Top 3 companies in Business Services for AI in 2020 were Ernst & Young, Accenture, and Deloitte, accounting for a combined share of 46%. Outside of these top 3, there were another nine companies that broke the $100 million mark during 2020. Overall, the competitive landscape in both services markets for AI remains highly fragmented where many players from across the services value chain continue to invest in technology assets, innovation resources, and expertise in applying AI to solve industry- and domain-specific problems for clients.

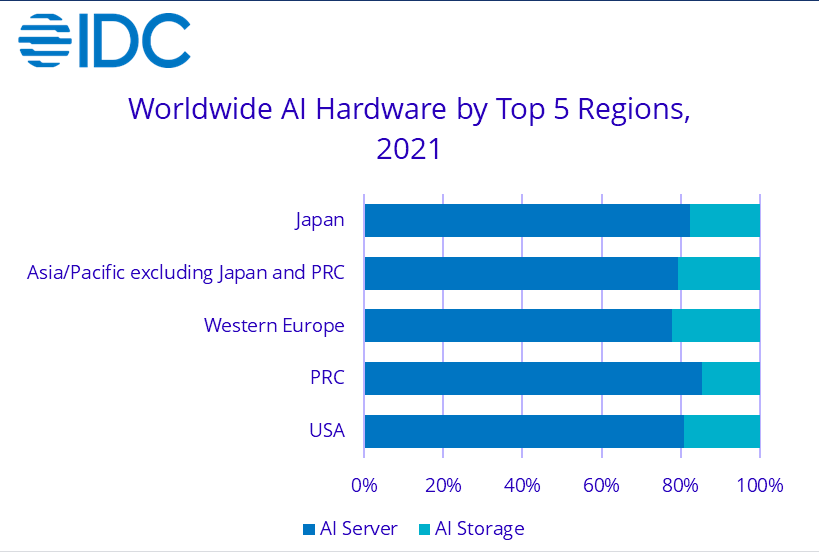

AI Hardware is the smallest category with 5% share of the overall AI market. Nonetheless, it is forecast to grow the fastest in 2021 at 29.6% year over year. It is also expected to hold the best growth spot in 2022. Over the next five years, its CAGR is estimated at 19.4%. This technology category breaks down into two markets: Server and Storage. Server has the larger share at approximately 82% while Storage is forecast to have better growth with a five-year CAGR of 22.1%.

“The market for AI servers and storage was less impacted than anticipated by the COVID-19 pandemic and is now rapidly picking up steam again, especially at the edge,” said Peter Rutten, research director, Infrastructure Systems, Platforms and Technologies at IDC. “The infrastructure of choice is coalescing around massively parallel compute using co-processors and server clusters with fast interconnects and networks.”

In AI Server market, there were a total of six companies that generated over $500 million each in 2020; they are (in alphabetical order) Dell, HPE, Huawei, IBM, Inspur, and Lenovo. Together, they held 62% of overall market share. Meanwhile, in the AI Storage market, there were also six companies that achieved over $100 million each in 2020; they are (in alphabetical order) Dell, HPE, Hitachi, Huawei, IBM, and NetApp. These six companies had a combined market share of 68%.

The IDC Worldwide Semiannual Artificial Intelligence Tracker publishes AI vendor share and market forecast data on a semi-annual basis. It provides data and insights into all the key technology areas – server, storage, software, and services – built on IDC’s comprehensive methodology involving vendor product, market, and workload modeling. Over 700 companies are currently published in the Tracker, ensuring that the competitive landscape is well represented across all the three technology categories. Data is available on a total of 27 countries and five rest-of regions. In this July 2021 release, we are adding deployment type segmentation on the software data for the first time. Through its broad and in-depth coverage, the Tracker can be relied on by users to assess which areas within the AI market are expected to grow during these unusually challenging times and optimize their business plans accordingly. In the next release, scheduled for January 2022, IDC will expand the Tracker with more market details, especially in the software space.