The neobank startup, Jupiter, publicly launching next month, has announced that it has secured $45 million Series B co-led by Nubank, Global Founders Capital, Sequoia Capital and Matrix Partners India, as per news source.

According to the company, the fund will be used to help on-board about 100,000 users who have signed up for the platform’s launch, which will occur in about a month.

The deal shows promise for the up-and-coming Indian neobank, considering the involvement by Nubank, which has quickly becoming the Latin American digital banking market leader.

In 2015, Nubank also raised a similar-sized Series B. In funding rounds of 2018, 2019 and 2021, the company raised more than $2 billion. Every one of those rounds has been over $100 million, and their most recent Series G raising a whopping $750 million, co-led by Berkshire Hathaway and Sands Capital Ventures.

Nubank founder and CEO David Vélez said Nubank and Jupiter share the mission of making banking the best experience possible for our customers, putting an end to all the bureaucracy and the pain in the current system.

“The Indian and Brazilian markets have many similarities and through this investment, we aim to support Jupiter in their growth path. We see a lot of potential and are excited about joining them so early on their journey,” David Vélez.

Along with existing investors like Addition Ventures, Tanglin VC, 3one4 Capital, Greyhound and Beenext, Mirae Assets Ventures also participated in the round. The funding follows the company’s $24 million seed round in late 2019 and $2 million venture round led by Hummingbird Ventures in 2020 and brings Jupiter’s total funding raised to $71 million.

Jupiter is now valued at $300 million.

Jupiter was founded in 2019 by Jitendra Gupta, former Founder of Indian payment solution provider Citrus Pay and managing director following its sale to Prosus’ PayU.

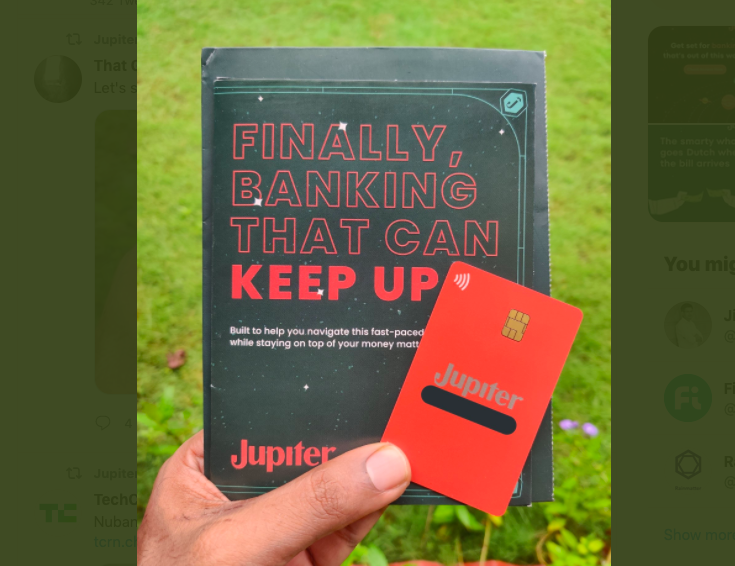

The company has created a number of products which will be available upon its upcoming platform launch and are intended to help improve the banking experience in India. These services include savings accounts, personalized tips and guides for financial wellness, simplified money management and BNPL-integration.