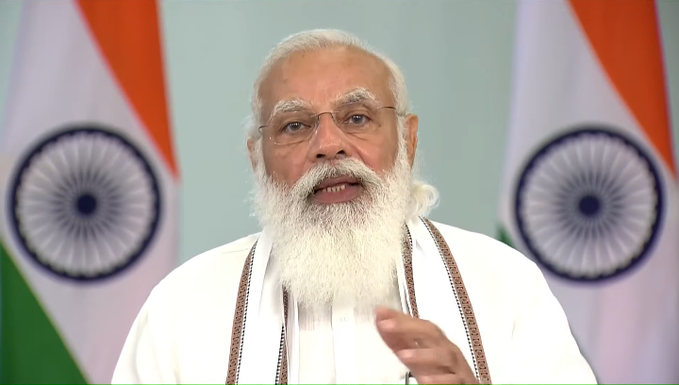

New Delhi, NFAPost: Prime Minister Narendra Modi launched a person and purpose-specific digital payment solution e-RUPI. Apart from being a cashless and contactless instrument for digital payment, e-RUPI is a QR code or SMS string-based e-Voucher, which is delivered to the mobile of the beneficiaries.

The users of this seamless one-time payment mechanism will be able to redeem the voucher without a card, digital payments app or internet banking access, at the service provider

e-RUPI connects the sponsors of the services with the beneficiaries and service providers in a digital manner without any physical interface. It also ensures that the payment to the service provider is made only after the transaction is completed.

FIS APAC, Middle-east and Africa Chief Risk Officer Bharat Panchal said the new digital payment mode– e-RUPI– is basically a prepaid voucher that can be issued directly to citizens after verifying mobile number and identity.

“e-RUPI voucher will be delivered in the form of a QR code or SMS string-based e-voucher to the beneficiary’s mobile number,” said Bharat Panchal

FIS is a leading provider of technology solutions for merchants, banks and capital markets firms globally. Request you to please consider the same for your stories.

The beneficiary can redeem the voucher without a card, digital payments app or internet banking access, at the service provider. This would be very useful instrument for those who are not privy to use to the digital platform yet the government can extend monetary support in digital form directly to citizens in a “leak-proof manner” in the form of prepaid e-voucher powered by UPI.

It can also help to deliver services under schemes meant for providing drugs and nutritional support under Mother and Child welfare schemes, TB eradication programmes, drugs & diagnostics under schemes like Ayushman Bharat Pradhan Mantri Jan Arogya Yojana, fertilizer subsidies, etc. Further, the private sector can leverage these digital vouchers as part of its employee welfare and corporate social responsibility programs.

However, Bharat Panchal said some stronger controls may be required to monitor any possible frauds. “If real beneficiary starts encashing such vouchers in lieu of cash than it would be difficult to trace such pre-paid instruments once it start to move from one hand to other. Therefore, It would be very effective to match the beneficiary’s details at the time of redemption to make sure that the real beneficiary only is using it and not someone else,” said Bharat Panchal.

It has been developed by the National Payments Corporation of India on its UPI platform, in collaboration with the Department of Financial Services, Ministry of Health & Family Welfare and National Health Authority.