Combined electric vehicle sales in the US, China and Europe to outstrip all other engine sales by 2033

By 2045, non-EV sales will shrink to less than 1% of overall sales

Europe is expected to lead EV sales volumes until 2031, with China taking the lead from 2032 to 2050

New Delhi, NFAPost: Electric vehicle (EV) sales in the US, China and Europe will outstrip all other engines five years sooner than previously expected, according to new EY research and analysis.

The figures come as EY launches the EY Mobility Lens Forecaster, an artificial intelligence (AI) powered forecast modeling tool that provides an outlook for the supply and demand of mobility products and services through 2050.

The latest predictions show that by 2028 EV sales in Europe will surpass those of other powertrains, a trend that will be repeated in China by 2033 and in the US by 2036.

The analysis also shows that by 2045, non-EV sales will shrink to less than 1% of overall sales. In terms of EV sales volumes, Europe is expected to lead the way until 2031, with China taking the lead from 2032 to 2050.

EY Global Advanced Manufacturing & Mobility Leader Randall Miller says amix of changing consumer attitudes, ambitious climate-focused regulations and technology evolution is about to change the landscape of vehicle buying forever.

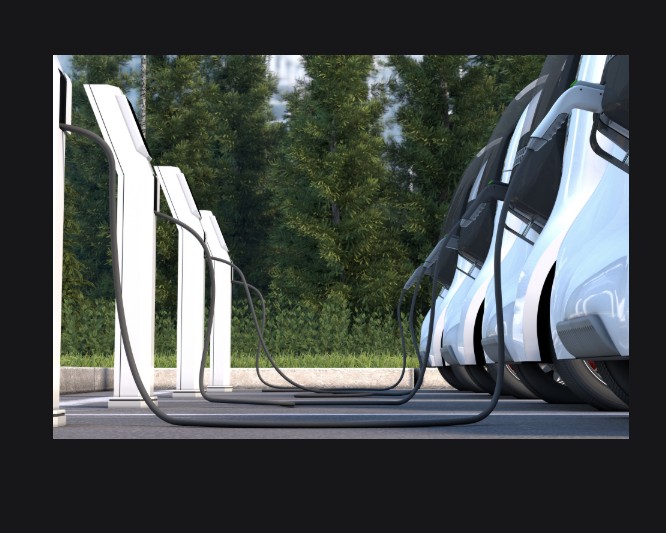

“While the automotive industry has begun to more fully embrace the move toward electrification, the impact of this seismic shift is arriving sooner than many expected. This new outlook also has implications for governments and energy industries in terms of infrastructure and electricity generation and storage, and forward-looking organizations are already using this data to help ensure a smooth transition to this new EV-dominated market, which will be here much sooner than expected,” said Randall Miller.

A new market

As the global auto industry continues to recover from the issues it’s facing due to the Covid-19 pandemic, it will be met by a new group of car buyers. Many people who had rejected ownership in lieu of ridesharing and public transport have reassessed in the shadow of the COVID-19 pandemic, according to EY analysis.

The EY Mobility Consumer Index published in November showed that almost one-third of non-car owners planned to buy a car in the next six months (19% plan to buy new, 12% used cars), and about half of those are millennials. Among both current car owners and non-car owners, 30% said they’d prefer a non-ICE (internal combustion engine) vehicle for their next purchase.

In terms of regulatory support, the new US administration’s announcements include continuity of EV buying incentives and the development of charging infrastructure. In Europe, incentives to purchase EVs are part of COVID-19-related relief measures in France, Germany, Spain, Italy and Austria.

The UK has announced that it will ban the sale of ICE vehicles starting from 2030. China also continues support for EVs through regulatory measures, wide product range and increasing customer demand. From the supply perspective, automakers globally have also begun to set their own twilight dates for gasoline-and diesel-powered vehicles, in favor of EVs.

A better way to forecast

EY automotive analysts and data scientists built the EY Mobility Lens Forecaster on a neural network model that uses AI to analyze several variables that influence demand and supply for mobility. These include variables that reflect consumer behavior, regulatory trends, technology evolution (vehicle and ecosystem) and manufacturers’ announced strategies.

The model is updated regularly with new market inputs to keep up with the ever-changing reality, including disruptions and available technology. As its predictions are matched up against actual outcomes, the model adjusts its calculations and learns from any mistakes for future predictions, essentially becoming smarter and more accurate over time.

Given its adaptation capability, the EY Mobility Lens Forecaster can also generate forecasts for possible future scenarios to help inform business or government planning decisions, sitting at the center of the EY cross-sector eMobility offering and linking up with solutions such as EY UtilityWave, which uses data from across an existing energy network to better inform future decisions.

For example, a breakthrough in autonomous vehicle technology could shake up the landscape, creating opportunities for fleet operators and cutting into owner-operator sales. Similarly, policy intervention from governments can accelerate the tipping point for the powertrain mix in favor of EVs.

Integrated mobility

Future travelers may adopt an integrated urban mobility model where users make little or no distinction between public and private transport, driving the ownership mix toward shared rather than privately owned vehicles. These factors – and more – can be accounted for using the EY Mobility Lens Forecaster.

EY is already using the data from the EY Mobility Lens Forecaster to help business and government clients. EY teams have helped a leading energy company to come up with a plan for their charging infrastructure roll-out based on expected EV penetration from the model and is also working with a major city council in the UK to develop it as a leading EV city and to support its deployment strategy for EV charging infrastructure.

Randall Miller says the EY Mobility Lens Forecaster is a game-changer, using AI to analyse changing market inputs to give a clear view of the future of the mobility market in terms of powertrain, autonomy level or owner status.

“We believe it will become an essential tool to help clients in both the public and private sector to simulate potential future scenarios and develop a strategic viewpoint on the future of the mobility landscape,” said Randall Miller.