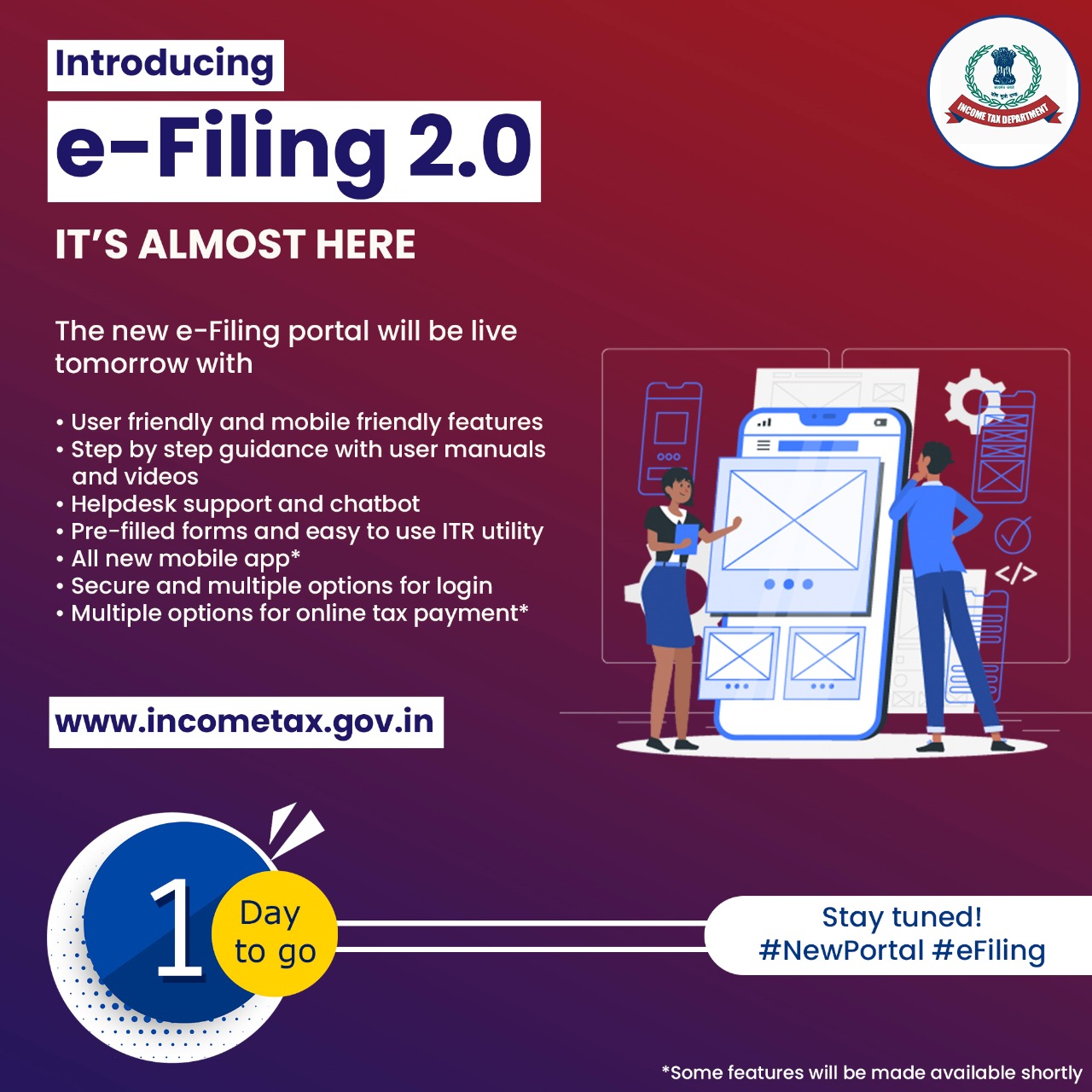

The new Income Tax Returns (ITRs) e-filing website will be launched today with new features to make the process effortless.

“The new e-filing portal is aimed at providing taxpayer convenience and a modern, seamless experience to taxpayers,” the Central Board of Direct Taxes (CBDT) said in a statement.

The new portal — www.incometax.gov.in — will be integrated with the immediate processing of ITRs to issue quick refunds to taxpayers.

The CBDT, which comes under the Ministry of Finance, also said that a mobile app of the portal will be released after the launch of the portal.

Features of the new ITR e-filing portal

- All interactions and uploads or pending actions will be displayed on a single dashboard for follow-up action by taxpayers.

- Free of cost ITR preparation software available with interactive questions to help taxpayers for ITRs 1, 4 (online and offline) and ITR 2 (offline) to begin with; Facility for preparation of ITRs 3, 5, 6, 7 will be made available shortly.

- Taxpayers will be able to update their profile with details of income including salary, house property, business/profession which will be used in pre-filling their ITR. Detailed enablement of pre-filling with salary income, interest, dividend, and capital gains will be available after TDS and SFT statements are uploaded (due date is June 30th, 2021)

- New call center to respond to taxpayer queries. Detailed FAQs, user manuals, videos, and chatbot/live agent will be provided.

- Functionalities for filing Income Tax Forms, add tax professionals, submit responses to notices in faceless scrutiny or appeals would be available.

In a tweet, the Income Tax Department said the new portal will be available shortly.

We are as excited about the new portal as our users!

We are at the final stages in the roll-out of the new portal and it will be available shortly. We appreciate your patience as we work towards making it operational soon.#NewPortal

— Income Tax India (@IncomeTaxIndia) June 7, 2021