The central government’s fiscal response to the second wave of Covid-19 so far has been timid. While it has not announced any fiscal stimulus to arrest the derailment of the economy from its nascent recovery path, it has also refrained from spending its expenditure budgeted for 2021-22 on a pro-rata basis. The government went slow on expenditure despite making robust tax collections in April 2021.

In April 2021, the government spent Rs.2.27 trillion, which was only 6.5% of its annual budgeted expenditure of Rs.34.8 trillion. Ideally in a situation when the country is witnessing lockdowns, a slowdown in business activity and huge job losses, its government would be expected to increase its expenditure or at least front-load the expenditure it has budgeted for the fiscal year. But the central government did none. It spent even lesser than what it should have spent in April 2021 from the annual budgeted target on a pro-rata basis, which works out to Rs.2.9 trillion.

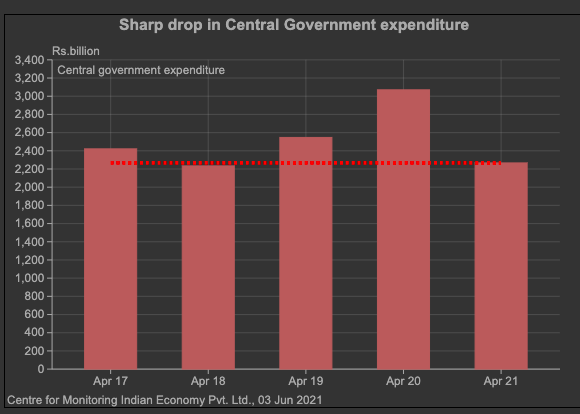

The government’s spending in April 2021 was 26.2% lower than the Rs.3.07 trillion it had spent in the year-ago month. April 2020 was an extraordinary month in terms of government expenditure. A year-on-year fall in government expenditure in April 2021, therefore, is not alarming. But, the magnitude of the fall in the midst of the second wave is disconcerting. This is particularly so when we compare government expenditure in April 2021 at Rs.2.27 trillion the average expenditure of Rs.2.4 trillion incurred in April of 2017, 2018 and 2019.

Revenue expenditure of the government declined y-o-y by 35.6% to nearly Rs.1.8 trillion in April 2021. It was 12.3% lower than the average revenue expenditure in April of 2017, 2018 and 2019. Capital expenditure, on the other hand, shot up by 66.5% to Rs.471 billion in April 2021, after falling by 7.5% in April 2020. It was 33.4 per cent higher than the April average of 2017, 2018 and 2019. The bulk of the capital expenditure in April 2021 was incurred by the ministry of road transport & highways and the ministry of railways.

Among revenue expenditure, interest outgo, which is non-productive spending, increased by 11.1% to Rs.297 billion in April 2021. The rise came on top of 36.5% increase recorded in April 2020. Expenditure on subsidies, on the other hand, declined by 15.2% to Rs.374 billion in 2020-21, after contracting by an even steeper 36.1% in April 2019.

Revenue expenditure by the ministry of agriculture & farmers’ welfare slumped by 79.9% to Rs.51.8 billion in April 2021. But when compared to the average of April 2017, 2018 and 2019, it was higher by 12.7%. Last year, the Centre had transferred Rs.177.9 billion to farmers under the PM-Kisan Samman Nidhi (PM-KISAN) since it announced the nationwide lockdown up till April 21, 2021. This year, the PM-KISAN funds were released a little late, in May, which explains the steep y-o-y fall in expenditure by the ministry of agriculture & farmers’ welfare in April 2021.

The ministry of rural development, which runs the Centre’s flagship employment guarantee scheme MGNREGS, provided 341 billion person days of employment in April 2021, which was 140.8% higher than in April 2020 and 47.8% higher than the average of April 2017, 2018 and 2019. Yet, revenue expenditure by the ministry of rural development in April 2021 at Rs.43.7 billion was a sharp 88.5% lower than in April 2020 and 77% lower than the April average of the preceding three years.

This is because the ministry under-provided for MGNREGS expenses during the month. As per the data released by the ministry on its MGNREGA website, only Rs.34 billion were made available to the scheme in April 2021 as against a requirement of Rs.81.5 billion, leaving a deficit of Rs.47.5 billion. The deficit means that payments to labour and for raw material were delayed.

Revenue expenditure by the ministry of health & family welfare declined y-o-y by 54.3% to Rs.59 billion in April 2021. It was, however, 88.3% higher than the average expenditure reported by the ministry for the month of April of 2017, 2018 and 2019.

The Centre’s transfers of funds to state governments and UTs have been rising progressively for the past few years. From an average of Rs.57.1 billion in the April of 2017, 2018 and 2019, these increased to Rs.215.6 billion in April 2020 and further to Rs.290 billion in April 2020. The increase in April 2021 is not surprising as the Centre has given the responsibility of Covid-19 vaccinations to the states and has provided for support of Rs.350 billion for the same in the Union Budget 2021-22.

Transfers by the revenue department under the ministry of finance had surged from an average of Rs.1.3 billion in April 2017, 2018 and 2019 to Rs.154 billion in April 2020 as the Centre cleared GST compensation dues of states for November 2019-February 2020 worth Rs.141 billion in April 2020. But, this year in April, expenditure by the revenue department dropped to Rs.893 million.

The government did not have any financing constraints. It went slow on expenditure in April 2021 despite making robust gross tax collections of Rs.1.7 trillion. These were the highest tax collections made by the Centre in the month of April ever. The April 2021 gross tax collections were two-and-a-half times the collections made in April 2020 and 66.8 per cent higher than the average tax collections made in April of 2017, 2018 and 2019.

Despite making record tax collections, the government reduced states’ share in Central taxes. Its devolution of tax revenue to the states at Rs.391.8 billion in April 2021 was 14.9% lower than last year and 23.4% lower than the preceding three years’ average for April. Transfer of taxes from the Centre is a major source of revenue for state governments. Lower devolution of taxes by the Centre in April 2021 could have affected the ability of the state governments to spend.

Non-tax revenues in April 2021 at Rs.168.1 billion were also 191.2% higher than in April 2020 and 4% higher than the April average of 2017, 2018 and 2019. Non-debt capital receipts in April 2021 were quite anaemic at Rs.3.7 billion in absence of any progress on the disinvestment front.

The government utilised its record revenues in April 2021 to reduce its fiscal deficit to Rs.787 billion. This is the lowest deficit it has reported in the month of April since 2012-13.