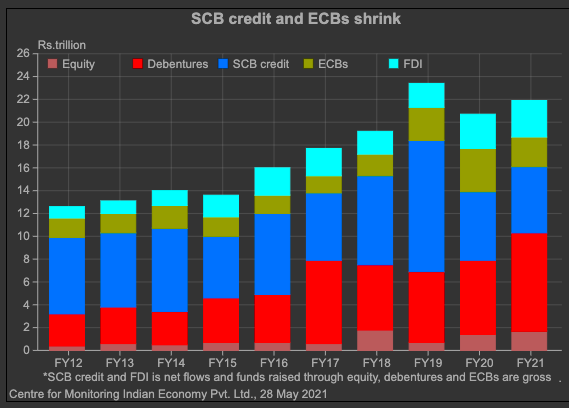

Long-term fund mobilisation by non-banking enterprises in India through five major sources equity, debentures, bank credit, ECBs and FDI increased by 5.8% to Rs.21.9 trillion in 2020-21 from Rs.20.7 trillion in 2019-20. This was also the second-largest annual fundraising by them.

Non-banking enterprises increased their thrust on the primary capital market for meeting long-term fund requirements. They mobilised Rs.10.3 trillion through primary market in 2020-21, according to the information compiled by CMIE’s Prowess database. This is the highest fund mobilisation by non-banking enterprises in a single year. Funds raised in 2020-21 were 30.2% higher than the Rs.7.9 trillion raised in 2019-20.

Equity issuances during 2020-21 amounted to Rs.1.7 trillion, 23.7% higher than their year-ago level of Rs.1.4 trillion. The growth, however, was dominated by a single equity issue of Rs.531 billion by Reliance Industries. This is the largest rights issue India has ever seen. Had it not been for this issue of Reliance, equity fund raising during 2020-21 would have been 14.3% lower than in 2019-20.

Bulk of the funds mobilisation through primary capital market in 2020-21 happened through debt instruments. Issuances of debentures peaked at Rs.8.6 trillion during the year. These were 31.6% higher than debentures issued in 2019-20, of the order of Rs.6.5 trillion.

Debt securities

The government wanted large companies to borrow funds from the primary market and ease pressure on banks, which traditionally have been the single largest source of borrowings for them. For this, the Securities and Exchange Board of India (SEBI) had brought a circular in November 2018 that large corporates should raise at least 25% of incremental borrowings through debt securities. This long pending wish of the government seems to have materialised in 2020-21.

Large companies reduced their exposure to scheduled commercial bank (SCB) credit by Rs.196 billion during 2020-21, as per the data released by the Reserve Bank of India’s (RBI). Enterprises of all sizes collectively borrowed Rs.485 billion from SCBs. These were a steep 75.6% lower than Rs.2 trillion borrowed from SCBs in 2019-20.

This data is of net fresh credit availed by enterprises from SCBs after adjusting for repayments of their borrowings from them during the year. Hence, this data is not directly comparable to the data of funds raised by enterprises through primary capital market, which does not account for redemptions of old debentures. Nonetheless, the two data sets together clearly indicate the shift of enterprises towards direct debt fundraising through the debt market.

Interest cost

Hesitance of SCBs to issue long-term loans, abundance of systemic liquidity and a substantial fall in interest costs during 2020-21 made enterprises choose the debenture route for fundraising. The marginal cost of fund-based lending rate (MCLR), the minimum interest rate below which financial institutions cannot lend except in certain cases, fell by 85 basis points to 6.55-7.05% in 2020-21. Corporate bond yields, on the other hand, softened in the range of 100 to 200 basis points. Average yield on 5-year AAA rated corporate bond was at 6.1%, which was considerably lower than the MCLR, making bonds the preferred option for fund raising at least for large companies with sound balance sheets.

Enterprises cut their exposure to external commercial borrowings (ECBs) in 2020-21, according to the data released by the RBI. They mobilised Rs.2.6 trillion through ECBs in 2020-21, which was 30.2% lower than preceding year’s ECB fund raising of Rs.3.8 trillion. These are fresh funds raised through the external borrowings route during the year on a gross basis. The balance of payments data, which measures net inflows of ECBs, that is the fresh inflows after adjusting for repayments of existing ECBs, shows that exposure of Indian enterprises’ balance sheets to ECBs declined by Rs.2.2 trillion during the first three quarters of 2020-21.

Net foreign direct investment (FDI) inflows to India increased by 4.7% to Rs.3.2 trillion in 2020-21 from Rs.3 trillion in 2019-20. FDI inflows increased amid the Covid-19 pandemic because of two reasons firstly record fund raising of around Rs.1.5 trillion by Reliance through sale of its stake in the Jio platform and secondly 4.5% depreciation of Indian rupee against US dollar.

Capital market

Unlike non-banking enterprises, SCBs reported a drop in funds raised through the primary capital market in 2020-21. SCBs mobilised Rs.1.2 trillion in 2020-21 as compared to Rs.1.6 trillion in 2019-20. This implies a decline of 25.6%. Fund mobilisation through issuance of fresh equity by banks declined by 42.1 per cent to Rs.739.8 billion from Rs.1.3 trillion in 2019-20. Large issuances among these were Yes Bank and ICICI Bank’s equity issue of Rs.150 billion each, Axis Bank’s equity issue of Rs.100 billion and Kotak Mahindra Bank’s equity issue of Rs.74.4 million. Their fund raising through debentures at Rs.483.8 billion was small, but higher than last years’ Rs.367 billion.

Despite lower fund raising through primary market, banks were flush with funds in 2020-21 owing to record deposit mobilisation of Rs.15.4 trillion. This was 55.6% higher than the deposits mobilised during 2019-20. This data reflects net deposit mobilisation, that is amount mobilised through fresh deposits after providing for maturity of old deposits during the year.

SCBs utilised only 37.7% of the money mobilised through deposits for lending purposes in 2020-21. Fresh credit advances by them adjusted for repayments of loans declined by 3.4% to Rs.5.8 trillion from Rs.6 trillion in 2019-20. They invested bulk of their deposit money in government papers.

Commercial papers

Short-term funds raised by both, banks and enterprises through various sources fell during 2020-21. Funds raised through commercial papers (CPs) declined by 20.7% to Rs.17.4 trillion, while those raised through certificates of deposits shrunk by 66.3% to Rs.1.3 trillion. Export credit during April-December 2020 at Rs.2.1 trillion was flat compared to its corresponding year-ago level.

The prime reason behind reduced short-term fund requirement of enterprises was bumper cash profits they made amid the pandemic. Ample cash generation through regular business activity is likely to have reduced their reliance on external funds. Banks’ short-term fund requirement was also met through cheap fund easily available under the LAF window and also in the call money market.

The trend observed in 2020-21 is likely to continue in 2021-22. We expect the RBI to continue its accommodative policy stance to support growth. Ample liquidity in the system and consequent low-interest rates are likely to help enterprises meet their fund requirement through the primary capital market easily. Banks would end up utilising a bulk of their deposit money to purchase fresh papers issued by the government as part of its exceptionally high borrowings programme of Rs.12.05 trillion for 2021-22.

(The story is based on CMIE report)