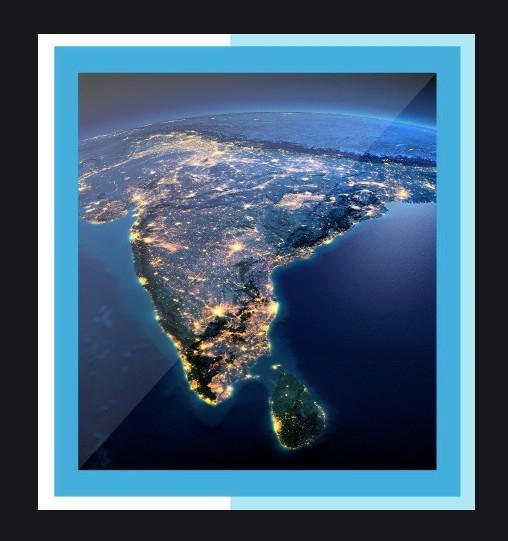

India’s second Covid-19 wave has seen daily cases surge to unprecedented levels, rising by a total of 2.4mn in the past week, pushing the cumulative caseload past 18mn. About 11.3% of the population has been vaccinated, of which ~2% have received both doses.

Coverage is set to widen from May as the rollout widens to all adults (18-44y), however, more time will be required to ramp up supply. Imported vaccines are due to arrive in May (Russia’s Sputnik V for a start), while the two domestic suppliers will ramp up supply to states and private health providers by mid-year.

Anecdotally, health practitioners suggest that material success in containing the second wave in the short-term hinges on prevention and movement restrictions, while hastened vaccination and immunity from this infection surge will help prevent a resurgence. Various third-party studies forecast that a peak in cases might be seen in second half of May.

Domestic financial markets have braved the Covid-19 headwind yet far.

In midst of the high infection rate, benchmark equity indices are off lows after an initial sell-off, owing to buoyant global markets, firmer earnings and lastly, recency bias from the strong pick-up in listed firms’ earnings in 2H20 vs a sharp correction in Mar-Apr20, when the economy reopened after the first wave.

Indian stocks nonetheless lag the MSCI EM ytd, with the path ahead likely to be choppy, dictated by the persistence of the pandemic caseload. Foreigners (own a little more than a fifth of NSE-listed companies) have turned cautious with $1.4bn outflows in April, after record inflows into equities in FY21.

On bonds, INR sovereign 10Y yield (generic) are down ~15-20bps vs March high, displaying a muted response to the infection surge. Despite a sizeable supply strain, the RBI’s assurance of bond purchases (e.g. introduction of G-SAP) and the perception that the government’s comfortable cash cushion allowed for part cancellation of bond sales in recent auctions, have capped moves.

The likelihood of a dovish-for-longer RBI is holding down the short-end, notwithstanding the threat of supply-driven price pressures. Lower rated corporate bonds, however, have shown strain given the onset of tougher business conditions. Besides being initially hurt by the Covid-19 surge, the rupee started April on a weak note on the back of a technical squeeze, passage of one-off support factors and the notion that the RBI had officially warmed up to quantitative easing.

But the currency has since trimmed losses to rank in the middle of the AXJ pack ytd (-1.3%/US$). Stabilisation in the US dollar and US rates have also provided a breather. Whilst financial markets have braved the Covid-19 relapse, underlying caution is likely to sustain as the path of the pandemic spread will dictate the severity and longevity of restrictions, which in turn will impact the growth trajectory (our note).

FX Daily: Trading places in May (Philip Wee)

USD index corrected lower in April after three months of appreciation. The record highs in major US stock indices on stellar US corporate earnings from a strong US economy were not accompanied by higher but lower US 10-year treasury yields. The Fed stepped up efforts to assure investors that the latest and coming US inflation readings above 2% were transitory.

Fed Chair Jerome Powell insisted at this week’s FOMC meeting that now was not the time to talk about tapering asset purchases. Investors also dialled back their excessive bearishness in the EUR in April, the largest component in the DXY. Germany upgraded its official GDP growth forecast for 2021 to 3.5% from 3.0% previously on prospects for a rebound in domestic spending in 2H21. ECB President Christine Lagarde predicted 70% of Eurozone’s population would be vaccinated with at least one dose by end-June and allow EU nations to reopen their economies.

USD has scope to stabilise in May and take back some of this month’s losses. Fed officials are likely to become more optimistic and less dovish into the next FOMC meeting in June. Expectations have emerged for the Fed to pave the ground for tapering asset purchases later this year. A signal at the Fed’s Jackson Hole Symposium in August has not been ruled out. St Louis Fed President James Bullard has flagged 75% vaccinations as a precondition for the Fed to consider tapering its asset purchases. After President Biden’s inauguration on 20 January, the share of Americans who received one dose of the vaccine has surged to 42.7% from 4.3%.

Fed Vice Chair Richard Clarida tipped that rising inflation expectations would bring forward Fed hikes. Corporate America has, during the earnings season, flagged the risks of price increases from higher raw materials and transport costs as well as supply chain disruptions, especially global chip shortages.

Consensus expects US headline and core CPI inflation to push above 3% YoY and 2% respectively in 2Q21, and real GDP growth to accelerate to 8.1% QoQ saar in 2Q21. Conversely, today’s expected 0.8% QoQ sa contraction in the Eurozone economy in 1Q21 is likely to be followed by a relatively slower recovery to 1.7% growth in 2Q21. It will probably be the ECB who will be pushing back tapering talk to temper a US-led rise in EU bond yields in the coming month.

Radhika Rao

Economist and Philip Wee, FX Strategist at DBS Group Research