Bank has deployed Mobile ATMs in 19 cities

Mobile ATMs to cover over 50 locations

Customers can conduct over 15 transactions in a Mobile ATM

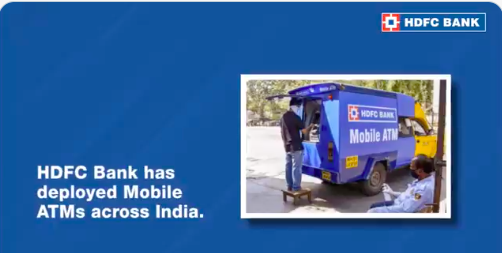

Mumbai, NFAPost: In view of rising Covid-19 cases and restrictions imposed in various parts of the country, HDFC Bank announced the availability of Mobile Automated Teller Machines (ATMs) across India to assist customers during the lockdown.

HDFC Bank Group Head – Liability Products, Third Party Products and Non-Resident Business S Sampathkumar said the bank hopes its mobile ATM will provide great support for people who want to avail basic financial services without having to venture far from their neighborhood.

“During this difficult time, we want to do our part to help everyone #Stay Home and #Stay Safe as we stand together to curb the spread of COVID19. This service will also be of great help to all the healthcare workers, and other essential service providers who have been working tirelessly to combat the pandemic,” said S Sampathkumar

At restricted / sealed areas, the Mobile ATMs will eliminate the need for general public to move out of their locality to withdraw cash. During the lockdown last year, HDFC Bank successfully deployed mobile ATMs in over 50 cities and facilitated lakhs of customers in availing cash to meet their exigencies.

Customers can conduct over 15 types of transactions using the Mobile ATM, which will be operational at each location for a specific period. The Mobile ATM will cover 3-4 stops in a day.

All necessary precautions in terms of maintaining social distancing while queuing for the ATM and sanitization are being taken to ensure safety of staff and customers.

|

List of cities |

|

|

Mumbai |

Salem |

|

Pune |

Dehradun |

|

Chennai |

Lucknow |

|

Hosur |

Ludhiana |

|

Trichy |

Chandigarh |

|

Hyderabad |

Cuttack |

|

Ahmedabad |

Bhubaneshwar |

|

Delhi |

Vijaywada |

|

Trivandrum |

Coimbatore |

|

Allahabad |

|

Serial No |

Type of services offered on ATMs |

|

1 |

Cash withdrawal |

|

2 |

Balance enquiry |

|

3 |

Request for mini-statements |

|

4 |

Changing ATM PIN |

|

5 |

Generating ATM PIN through Green PIN |

|

6 |

Making Credit Card payments |

|

7 |

Instant Loans to Customers |

|

8 |

Ordering Cheque book / account statement |

|

9 |

Prepaid mobile recharge |

|

10 |

Transferring funds between accounts linked to the same ATM / Debit Card |

|

11 |

Paying Utility bills |

|

12 |

Enquiring about cheque status |

|

13 |

Requesting for IPIN (Netbanking PIN) |

|

14 |

Registering for Mobile Banking |

|

15 |

Updating the Mobile Number |

|

16 |

Card-less Cash Withdrawal |