Ed-tech leader Byju’s has raised Rs 3,328 crore as part of its ongoing Series F round with a group of investors.

The new financing round has propelled its valuation over $13 billion and it is speculated that its valuations may shoot up to $14-$15 billion once the round is completed.

The latest fundraising was led by MC Global Edtech Investment Holdings LP and B Capital and others, participated, a regulatory filing said.

Other investors in the fundraiser include Tiga Investments, TCDS (India) LP, Arison Holdings, XN Exponent Holdings, Baron Emerging Markets Fund, and Baron Global Advantage Fund, which together picked up a 1.21% stake in Byju’s parent company.

This is the first investment in Byju’s this year. Last year, it had raised over $1 billion.

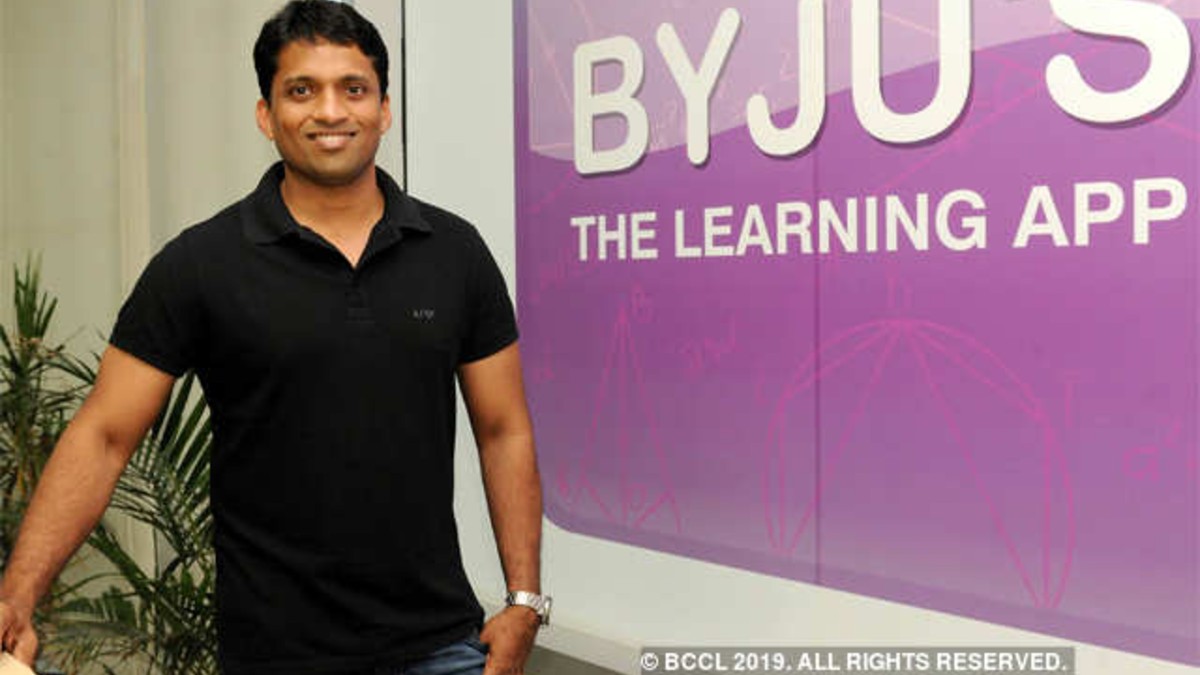

This funding has resulted in the fall of Founder-CEO Byju Raveendran and his family’s holding to 26.09%.

However, it is still far higher than the founder shareholding in many other companies.

The firm approved the allotment of 1,40,233 Series F compulsory convertible preference shares (CCPS) at a face value of Rs 10 and a premium of Rs 2,37,326 per share.

Apart from raising funds, Byju’s is on an acquisition spree.

It acquired a coding platform for kids WhiteHat Jr last year after shelling out $350 million.

The firm also acquired US-based Osmo for $120 million in 2019.

Byju’s is reportedly looking to acquire Aakash Educational Services for around $700-$800 million, in a 70-30 cash and stock deal.