Timely government and regulatory measures save the blushes in the current fiscal

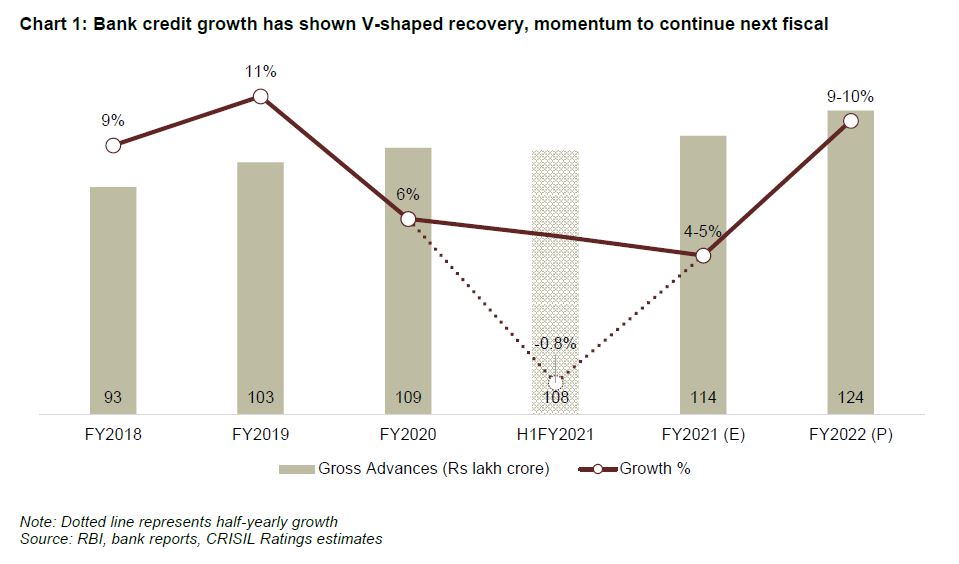

Bank credit is seen growing 400-500 basis points (bps) higher at 9-10% next fiscal (2021-22) as the Indian economy recovers, supported by budgetary stimulants and measures announced by the Reserve Bank of India (RBI), says a research paper by India’s leading credit rating agency CRISIL Ratings. CRISIL has already raised India’s GDP growth forecast for next fiscal to 11%, or 100 bps higher than what was estimated in December 2020.

In the current fiscal (2020-21), bank credit is seen rising 4-5% despite the sharpest contraction the Indian economy has seen since Independence. In June 2020, CRISIL Ratings had expected bank credit growth in this fiscal to be 0-1%.

Says Krishnan Sitaraman, Senior Director, CRISIL Ratings, “While bank credit growth had contracted 0.8% in the first half of this fiscal, it recovered sharply in the third quarter by growing 3% sequentially. In the fourth quarter, too, it should clock 3% sequential growth. Government measures, including the Rs 3 lakh crore emergency credit line guarantee scheme (ECLGS), have been supportive.”

In the first half of this fiscal, the Covid-19 pandemic forced both borrowers and lenders to tread cautiously, leading to contraction in bank credit. But a faster-than-expected uptick in economic activity since relaxation of lockdowns, and pent-up and festive season demand, helped thereafter.

In absolute terms, net credit increased by Rs 2.3 lakh crore in the first nine months of this fiscal.

Additionally, Rs 1.4 lakh crore was deployed by banks via the targeted long-term repo operation (TLTRO) and partial credit guarantee (PCG) scheme, which served as credit substitutes. Factoring this in, fiscal-to-date credit growth would be higher by 130 bps.

Growth rate will vary across sub-segments

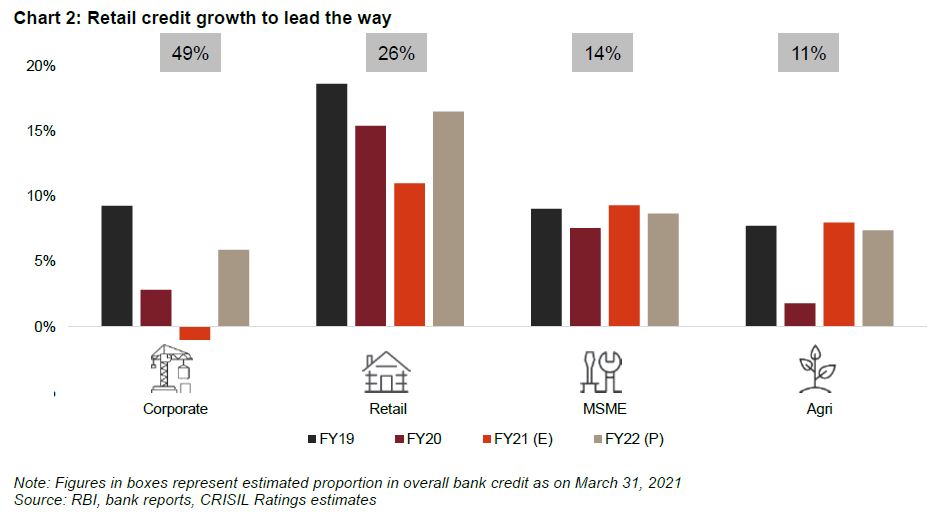

Corporate credit (49% of overall bank credit) growth is expected to contract this fiscal given that companies have put capex on the backburner. Sizeable incremental funding through the investment book – because of the availability of low-cost funds under TLTRO and PCG – has also applied downward pressure.

That should change next fiscal, when corporate credit is expected to grow 5-6% led by the government’s infrastructure push and a likely revival in demand. But the share of corporate loans in the overall credit pie would continue to shrink because of faster growth of other segments.

Retail lending, a major driver of bank credit in the past, is expected to slow down to 9-10% this fiscal before returning to the mid-teens growth of the past couple of years.

Says Subha Sri Narayanan, Director, CRISIL Ratings, “Banks are expected to benefit from lower competition as non-banks, grappling with multiple challenges, see tepid growth. With deposit growth outstripping credit growth so far, banks would use the surplus liquidity to wrench credit market share away from some of the largest catchments of non-banks such as mortgages and new vehicle finance. Even this fiscal, more than half of the incremental retail credit growth till date has been from mortgages.”

Lending to micro, small and medium enterprises (MSME) has been one of the fastest-growing areas for banks this fiscal, supported by ECLGS. The RBI’s decision to again exempt banks from the cash reserve ratio requirement for incremental credit to this segment – as was done last fiscal – should also increase the supply of credit to MSMEs. Overall growth in credit to MSMEs is expected to be 9-10% this fiscal and 8-9% next, given that the salutary effect of the ECLGS may not be available next fiscal.

Agriculture credit has also contributed, with rural India seeing lower impact of the pandemic and a good harvest. Credit growth here is foreseen at 6-7% in both, this fiscal and next. The monsoon, though, will be a monitorable.

Overall, sharp economic recovery, along with pick-up in private investment and capex demand, drive our expectation of buoyant credit growth next fiscal. A sub-normal monsoon and another surge in Covid-19 cases leading to localised or partial lockdowns pose downside risks.