The GST revenues crossed ₹ 1 lakh fifth time in a row post-pandemic clearly indicating the economic recovery and the impact of various steps taken by ax administration to improve compliance, the finance ministry said.

“The GST revenues crossed ₹ 1 lakh fifth time in a row and crossed ₹ 1.1 lakh crore third time in a row post pandemic despite this being the revenue collection of the month of February. This is a clear indication of the economic recovery and the impact of various measures taken by tax administration to improve compliance,” the ministry said in a statement.

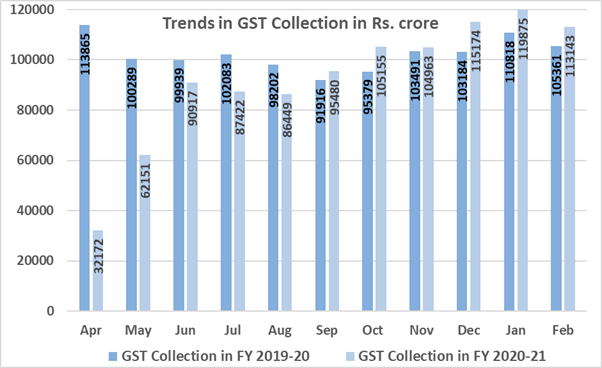

The gross GST revenue collected in the month of February 2021 is ₹ 1,13,143 crore.

“In line with the trend of recovery in the GST revenues over the past five months, the revenues for the month of February 2021 are 7 per cent higher than the GST revenues in the same month last year,” the finance ministry said in a statement.

During the month, revenues from import of goods was 15 per cent higher and the revenues from domestic transactions, including import of services, were 5 per cent higher than the revenues from these sources during the same month last year, it added.

Out of the Rs 1,13,143 crore GST collected, CGST is ₹ 21,092 crore, SGST is ₹ 27,273 crore, IGST is ₹ 55,253 crore, including ₹ 24,382 crore collected on import of goods.

Besides the cess is ₹ 9,525 crore including ₹ 660 crore collected on import of goods.

The government has settled ₹ 22,398 crore to CGST and ₹ 17,534 crore to SGST from IGST as regular settlement.

In addition, the Centre has also settled ₹ 48,000 crore as IGST ad-hoc settlement in the ratio of 50:50 between Centre and States/UTs.

The total revenue of Centre and the States after regular settlement and ad-hoc settlement in the month of February 2021 is ₹ 67,490 crore for CGST and ₹ 68,807 crore for the SGST.