India’s FY22 Budget is to be presented on 1st February. This budget holds utmost significance in the aftermath of Covid-19 pandemic which stymied economic development while having negative consequences for health, income inequality, job prospects, and overall sentiment.

The upcoming budget is expected to be growth supportive at the forefront at a time when India’s FY21 annual real GDP contraction is expected at 7.7% – lowest growth yet in India’s history. Sectors like rural and urban infrastructure, housing, agriculture, domestic manufacturing, hospitality, tourism and aviation are likely to be the key focus areas along with a strong thrust on – MSMEs, start-ups and education. Heath and R&D related spending is expected to see a boost to align India with its global peers and to adapt to ongoing changes in global health conditions. That said, India’s fiscal position remains vulnerable with revenue receipts stretched and economic growth hampered. Despite which we expect a strong fiscal push led by assumptions around divestment of public sector undertakings, increase in revenue from excise and customs duty and revenue flow from 5G spectrum auction – the timing of which still remains uncertain. In our view FY21 is likely to clock fiscal deficit at 7.5% vis-à-vis the budget estimate of 3.5%. Likewise, we expect fiscal deficit to come in at 5.2% in FY22. Our assumption of nominal GDP growth for FY22 is 13.5% after a contraction of 4.2% in FY21.

Total Receipts

Tax Revenue

· The direct tax receipts are likely to undershoot government’s budget estimates by at least INR 4 tn. The corporate tax and income tax revenue are expected to see a shortfall of ~INR 2 tn shortfall each due to low corporate profitability and earnings amidst nationwide lockdown in Q1 FY21, phased ‘unlock’, business closures, retrenchments, and salary cuts. This is notably the highest shortfall seen in direct tax account.

· Revenue on account of indirect tax is expected to perform relatively better, with revenue shortfall of ~INR 1.6 tn as against budget estimate of INR 10.9 tn. The indirect tax revenue is supported due to excise duty collections and pick-up in GST collections post ‘unlock’. Excise duty collection is likely to have garnered ~INR 3.6 tn, which is more than the budget estimate by INR 950 bn.

After adjusting for states share, net tax revenue is likely to see a shortfall of more than INR 4 tn.

In FY22, we expect the recovery in economic activities to manifest itself through improved tax revenue receipts. Income tax and corporate tax are likely to recover towards INR 5-6 tn level, from an expected average of INR 4.5 tn in FY21. Though corporate profitability is expected to improve in FY22, business closures and impact on services sector is likely to affect the revenue flow at least till the activities attain their pre-pandemic levels. Similarly, income tax revenues are expected to show improvement in FY22 however they are unlikely to be higher than FY20 levels (INR 6.4 tn) because of still fragile economic growth recovery. In case the budget increases the threshold for income tax exemption – Rs 2.5 L p.a. at present – to enhance net disposable income, revenue gains will be further capped.

Non-Tax Revenue

Non-tax revenue is likely to undershoot FY21 budget estimates by ~Rs 1.1 tn, by coming in at INR 2.7 tn.

· The transfer of dividend from the RBI to government is at Rs 571.3 bn as against last year dividend transfer of INR 1230 bn (excl. excess provisions). Dividends from the PSU’s are likely to miss the budget estimates on account of low earnings. On dividends and profits, we expect the government to garner ~INR 1.1 tn as against budget estimates of INR 1.6 tn.

· On telecom revenue, we are optimistically expecting an inflow of Rs 1.5 tn. Revenue on this account remains uncertain as the telecom spectrum auctions are to be held in March with 5G spectrum auctions pushed for FY22.

In FY22, non-tax revenue is likely to increase to INR 3.4 tn, assuming higher dividend payout from PSEs and 5G spectrum auction. We are pricing in INR 2 tn of revenue on account of telecom spectrum auction, licensing fees etc. However, revenue expectation on this account remains uncertain with no clear timeline in sight.

Non-Debt Capital Receipts

Non-debt capital receipts are likely to see major shortfall as disinvestments have remained muted, as of date. While the pipeline of projects for disinvestment remains strong, it is unlikely for the government to reach the budget estimate of Rs 2.1 tn. Divestment of Air India and BPCL are likely to be pushed to FY22.

· We expect the revenue shortfall of more than 1/3rd on account of non-debt capital receipts. It is likely to come in around Rs 850 bn out of which Rs 700 bn is expected from disinvestments. As of date, total disinvestments have clocked Rs 161 bn.

In FY22, we expect a sharp pick-up in non-debt capital receipts to Rs 2.7 tn on account of strong disinvestment pipeline, government’s focus on asset monetization and privatization. Similar to FY20 budget expectations, we expect the government to remain ambitious on its disinvestment target and have accordingly priced in INR 2.5 tn as revenue from disinvestments.

To sum up, we expect total receipts to post a shortfall of ~Rs 6-7 tn in FY21, with the decline led by sharp contraction in tax revenue account and disinvestments missing the target. For next fiscal, we expect revenues to pick-up largely on account of disinvestments, possible 5G telecom auction and recovery in tax revenue collection.

Total Expenditure

We expect total expenditure to come in line with budget estimates at around INR 30.5 tn in FY21. Up till November, revenue expenditure has clocked 63.5% of the budgeted spending and capital expenditure is at 58.5% of budgeted expenditure.

· Capex spending by government, which has been trailing, has increased in Q3 FY21. We expect this pace to continue in Q4 FY21 such that the government manages to achieve its capex target of INR 4.1 tn for FY21.

· On revenue expenditure account, the government is likely to see some savings from oil subsidy rollout due to low oil prices and tepid economic activity in H1 FY21. The savings will be more than offset by increase in food and fertilizer subsidy that were a part of various fiscal stimulus measures. Overall, we expect the revenue expenditure to be only marginally higher than budget estimates in FY21.

In FY22, we expect the pace of capital spending to resume. As such, we see capital expenditure touching INR 6 tn in FY22, an increase by almost INR 2 tn from FY21 budget and our expectations. This is on the back of government’s likely fiscal push to housing, real estate and infrastructure sectors with a) multiplier effects on income and employment channels, and b) forward and backward linkages with key MSME industries and growth oriented sectors like steel, cement, coal and power. Revenue expenditure is expected to increase by INR 1 tn to ~INR 27 tn from FY21 budget estimate with the delta arising from higher healthcare expenditure. We expect the increase in healthcare expenditure to come around 0.4-0.5% of GDP.

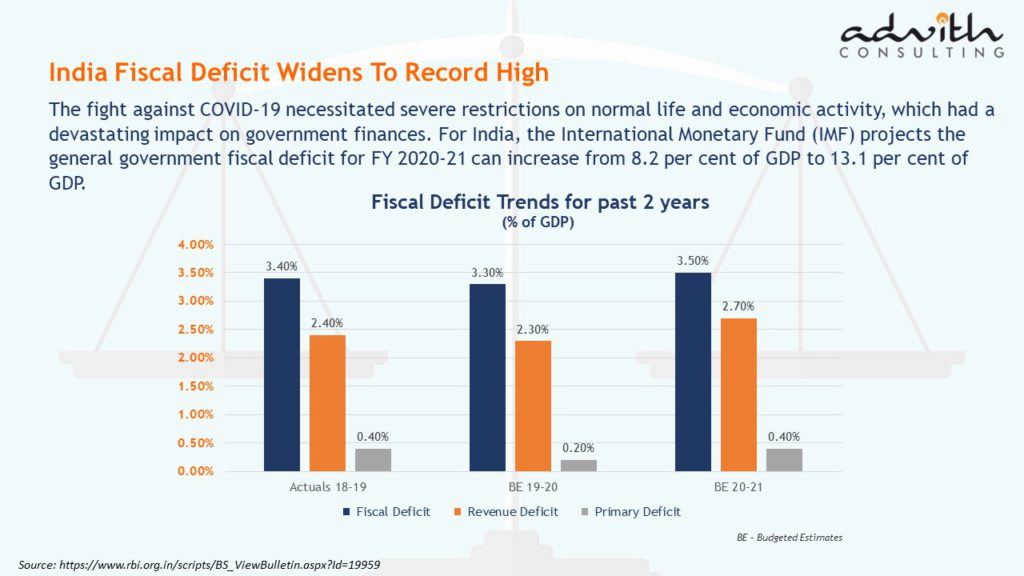

Fiscal Deficit

On net basis, we expect FY21 fiscal deficit at INR 14.5 tn or 7.5% of GDP, assuming nominal GDP growth of -4.2% in FY21. On the back of expected economic recovery in FY22, we view FY22 fiscal deficit at INR 11.5 tn or 5.2% of GDP (nominal GDP: 13.5%).

With state fiscal deficits likely at 4.5% of GDP in FY21 and 4.0% of GDP in FY22, we expect center and state fiscal deficit at 12.0% of GDP in FY21 and 9.2% of GDP in FY22.

Market Borrowing

We expect the government to stick to its FY21 gross market borrowing target of INR 13.1 tn (INR 10.3 tn has been done so far). For FY22, we expect 70% of fiscal deficit or INR 8.1 tn to be funded by market borrowings. With redemptions at INR 2.7 tn, the gross market borrowing is expected at INR 10.8 tn.

Bond Market Overview

We maintain our 10Y g-sec yield view at 5.75-6.00% for Q4 FY21. For FY22, we expect the yields to trade in the range of 6.00-6.25%.