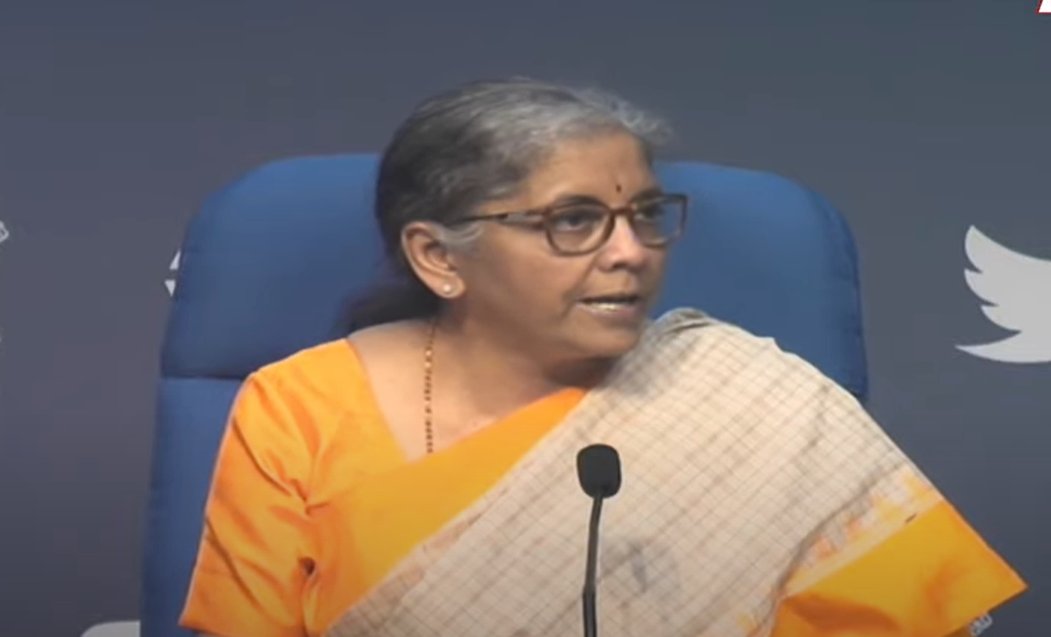

Bengaluru, NFAPost: Finance Minister Nirmala Sitharaman said the Indian economy is witnessing a strong recovery after a long and strict lockdown and announced a Rs 2.75 lakh crore Covid-19 stimulus package.

The government decision comes as a prelude to strategic decision to expand the PLI Scheme in ten sectors which includes white goods, auto, auto components and battery manufacturing wherein sops worth Rs 1.47 lakh crore would be given over the next five years, as per news source.Worth Rs 1.4 Lakh Crore.

The finance minister stimulus package includes a fresh fertiliser subsidy of Rs 65,000 crore, Rs 18,000 crore towards the Prime Minister’s Housing scheme and Rs 10,000 crore for Garib Kalyan Yojana among other to rejuvenate the economy. The move is expected to help rejuvenate economy which is moving towards its first annual contraction after 40 years.

Addressing a press conference to announce more stimulus measures to boost growth, she said macro-economic indicators are pointing towards recovery.

“COVID-19 active cases have declined from over 10 lakh to 4.89 lakh with case fatality rate (CFR) at 1.47%.The composite purchasing managers index (PMI) rose to 58.9% in October versus 54.6% in the previous month, registering strongest increase in output in close to nine years,” said Finance Minister Nirmala Sitharaman.

The government’s stimulus package announced till date alone accounted for 9% of GDP. Besides energy consumption growth trended higher in October at 12% year-on-year, Finance Minster also stated that Goods and Services Tax (GST) collections have grown 10% to over Rs 1.05 lakh crore.

“The NDA government led by the Hon’ble Prime Minister Modi has always focused on easing compliance for taxpayers. With Faceless Assessment, Faceless Appeal, Taxpayers’ Charter, Document Identification Number (DIN), etc. this government has ensured transparency in taxation,” said Nirmala Sitharaman.

Here are the highlights from FM Sitharaman’s announcement:

– ₹900 crore provided for Covid Suraksha Mission for research and development of the Indian Covid-19 vaccine to the Department of Biotechnology

– ₹3,000 crore will be given to EXIM Bank for promotion of project exports through Lines of Credit under IDEAS Scheme.

–An additional outlay of ₹10,000 crores will be provided for PM Garib Kalyan Rozgar Yojana in the current financial year, to boost rural employment.

– ₹65,000 crore to be provided for subsidised fertlisers. This will help 140 million farmers.

–For primary residential real estate sales, relief on the difference between circle rate & agreement value up to 20% vs 10% earlier.

-Income tax relief for developers and home buyers.

–Support for Construction & Infrastructure-Performance security on contract to be reduced to 3% instead of 5%. Earnest Money Deposit will not be required for tenders and will be replaced by Bid Security Declaration. Relaxations will be given till 31st December 2021.

-This extra budgetary resource being provided will help 12 Lakh houses to be grounded & 18 Lakh houses will get completed as a result.

– ₹18,000 crore will be provided over and above the budget estimate which was mentioned in the Budget 2020-21 under Pradhan Mantri Awas Yojana. particularly for the urban areas.

– ₹1.46 lakh crore boost for Aatmanirbhar Manufacturing Production-linked incentive for 10 champion sectors.

–Guaranteed credit support for 26 stressed sectors identified by the Kamath Committee. Original ECLGS had one year of moratorium and 4 years of repayment, the new scheme will have 1-year moratorium and 5 years of repayment.

–-The existing Emergency Credit Line Guarantee Scheme extended till 31st March 2021.

-If new employees of requisite number are recruited from October 1, 2020 to June 30, 2021, the establishments will be covered for the next two years

-Every EPFO registered organisations – if they take in new employees or those who had lost jobs b/1 March 1 & Sept 30 – these employees will get benefits.

–Establishments registering with EPFO after the commencement of Scheme to get subsidy for all new employees. Scheme to be in operation till 30 June 2021.

–Pradhan Mantri Rozgar Protsahan Yojana was implemented up to 31.03.2019. It had covered all sectors and is expected to run for 3 years. So even if someone joined the scheme on 31.03.2019, they would be covered under that existing scheme from then three years

–Atmanirbhar Bharat 3.0: Finance Minister announced new job scheme called Atma Nirbhar Rozgar Yojana to create jobs in the country. The new scheme will be effective from 1 October 2020

– ₹1,32,800 crores have gone as income tax refunds to 39.7 lakh taxpayers

–SBI Utsav cards being distributed, under the festival advance scheme announced on 12th Oct11 states sanctioned ₹3,621 crores as an interest-free loan towards capital expenditure

-Under the Emergency Credit Liquidity Guarantee Scheme, a total amount of ₹2.05 lakh crores has been sanctioned to 61 lakh borrowers, out of which ₹1.52 lakh crores has been disbursed

– ₹7,227 crores disbursed under the Special Liquidity Scheme for NBFCs/HFC

–Credit boost has been given to 2.5 crore farmers through Kisan Credit Cards, ₹1.4 lakh crores has been distributed to farmers.

– ₹25,000 crores has been disbursed to farmers from Additional Emergency Working Capital Funding through NABARD.

–The work has commenced on creating a portal for migrant workers.

–There has been very good progress on ‘One Nation-One Ration Card’ in 28 states covering 68.8 crore beneficiaries.

-About 157.44 lakh eligible farmers have received Kisan Credit Cards and sanctioned a limit of ₹1,43,262 crore in two phases.

-26.2 lakh loan applications were received under the PM SVANidhi scheme for street vendors.

-Bank credit growth is up 5.1%; markets are at a record high.