New Delhi, NFAPost: Union Minister of Finance & Corporate Affairs Nirmala Sitharaman inaugurated Doorstep Banking Services by PSBs and participated in the awards ceremony to felicitate best performing banks on EASE Banking Reforms Index.

Secretary, Department of Financial Services Debasish Panda and Chairman IBA, Shri Rajnish Kumar, were also present at the virtual event.

As part of the EASE Reforms, Doorstep Banking Services is envisaged to provide the convenience of banking services to the customers at their doorstep through the universal touchpoints of Call Centre, Web Portal or Mobile App. Customers can also track their service request through these channels.

The services shall be rendered by the Doorstep Banking Agents deployed by the selected Service Providers at 100 centres across the country.

At present only non-financial services viz. Pick up of negotiable instruments (cheque / demand draft / pay order, etc.), Pick up new cheque book requisition slip, Pick up of 15G / 15H forms, Pick up of IT / GST challan, Issue request for standing instructions, Request for account statement, Delivery of non-personalised cheque book, demand draft, pay order, Delivery of term deposit receipt, acknowledgement, etc., Delivery of TDS / Form 16 certificate issuance, Delivery of pre-paid instrument / gift card are available to customers. Financial services shall be made available from October 2020.

The services can be availed by customers of Public Sector Banks at nominal charges. The services shall benefit all customers, particularly Senior Citizens and Divyangs who would find it at ease to avail these services.

Performance of PSB on EASE 2.0 Index

A common reform agenda for PSBs, EASE Agenda is aimed at institutionalizing clean and smart banking. It was launched in January 2018, and the subsequent edition of the program ― EASE 2.0 built on the foundation laid in EASE 1.0 and furthered the progress on reforms. Reform Action Points in EASE 2.0 aimed at making the reforms journey irreversible, strengthening processes and systems, and driving outcomes.

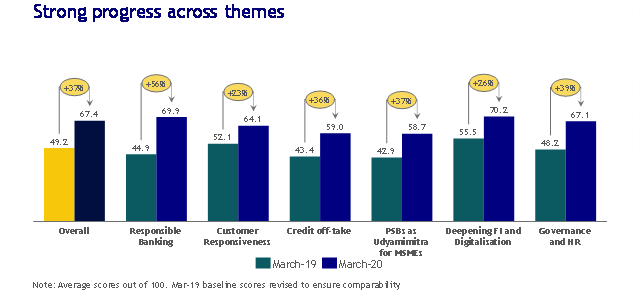

PSBs have shown a healthy trajectory in their performance over fourquarters since the launch of EASE 2.0 Reforms Agenda. The overall score of PSBs increased by 37% between March-2019 and March-2020, with the average EASE index score improving from 49.2 to 67.4 out of 100.

Significant progress is seen across six themes of the Reforms Agenda, with the highest improvement seen in the themes of responsible Banking’, ‘Governance and HR’, ‘PSBs as Udyamimitra for MSMEs’, and ‘Credit off-take’.

PSBs have adopted tech-enabled, smart banking in all areas, setting up retail and MSME Loan Management Systems for reduced loan turnaround time andPSBloansin59minutes.comandTReDS for digital lending.

PSBs have instituted real-time visibility to retail and MSME customers on the status of their loans. Most branch-based services are now accessible from home and mobile, including in local languages.

EASE Reforms Index has equipped Boards and leadership for effective governance, instituted risk appetite frameworks, created technology- and data-driven risk assessment and prudential underwriting and pricing systems, introduced Early Warning Signals (EWS) systems and specialised monitoring for time-bound action in respect of stress, put in place focussed recovery arrangements, and established outcome-centric HR systems.

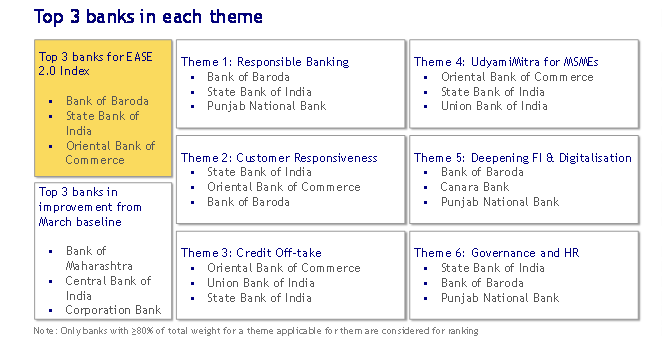

Bank of Baroda, State Bank of India, and erstwhile Oriental Bank of Commerce were felicitated for being the top three (in that order) in the ‘Top Performing Banks’ category according to the EASE 2.0 Index Results.

Bank of Maharashtra, Central Bank of India &erstwhile Corporation Bank were awarded in the ‘Top Improvers’ category basis EASE 2.0 Index. Punjab National Bank, Union Bank of India, and Canara Bank were also recognized for outstanding performance in select themes.

Major Reform achievements between March 2018 to March 2020

- Most PSB customers now have access to 35+ services such as IMPS, NEFT, RTGS, intra-bank transfer, account statement, cheque book request on mobile/ Internet banking and23 services such as chequebook issuance, cheque status, issuance of form 16A, block/activate debit card on the call centre. The availability of services has nearly doubled over the last 24 months.

- Nearly 4cractive customers on mobile and internet banking with 140% increase in financial transactions through mobile and internet banking channels and almost 50% of financial transactionsthrough digital channels.

- Call centers now offer services in 13regional languagessuch as Telugu, Marathi, Kannada, Tamil, Malayalam, Gujarati, Bengali, Odia.

- Complaint redressal average turnaround time reduced from the average of approximately 9 days to 5 days

- 23 branch-equivalent services such as account opening, cash deposit, cash withdrawal, fund transfer made available by PSBs through Bank Mitras

- PSBs have issued RuPay credit cards to nearly 23 crore basic savings account customers

- Significant improvement in customer outreach through dedicated marketing force and external partnerships. The number of dedicated marketing employees has increased from 8,920 to 18,053.

- Sourcing of retail and MSME loans through the dedicated salesforce and marketing tie-ups has increased nearly five times from 1.5 lakhs to 8.3 lakh loans

- Turnaround time (weighted average) for retail loans reduced by 67% from the average of nearly 30 daysto nearly 10 days

- Cross-sell of non-banking financial products has made available bouquet of financial products to the customer

- For prudential lending, PSBs are now systematically keeping watch on adherence to risk-based pricing, and cases with deviation have reduced from 59% to 20%, and have put in place data-driven risk-scoring for appraisal of high-value loans that factors in group-entities.

- Most PSBs have deployed IT-based EWS systems leveraging third-party data, which have enabled early, time-bound action in stressed accounts. Monitoring has also been strengthened by deploying Agencies for Specialised Monitoring, and proactively monitoring listed entities based on published financials. Slippage into NPA has reduced from 3.90 lakh crore in 12-months ending March-18 to 1.45 lakh crorein 11-months ending February-20.

- PSBs have adopted digital platforms such as online OTS, e-Bक्रय, e-DRT for expedited recovery. 88% of one-time settlement (OTS) cases are now tracked through dedicated IT systems.

- PSBs have adopted new ways of credit, such as PSBloansin59minutes.com and Trade Receivables Discounting System (TReDS) for digital lending for MSMEs and retail. 73% of all PSB inland bills are now discounted through online TReDS.

- The Government has introduced several governance reforms. The governance reforms include arm’s length selection of top bank management through Banks Board Bureau, introduction of non-executive chairpersons, broader talent pool for such selections, empowered bank Boards, strengthening of the Board committees system, enhancing the effectiveness of non-official directors, and leadership development and succession planning for the top two levels below the Board. In larger PSBs, Executive Director strength has been increased, and Boards are empowered to introduce CGM level for increased business.

Like in the previous year, progress made by PSBs was tracked quarterly through a published EASE Reforms Index leading up to the annual review.

In addition to the inclusion of the EASE Reforms Index in the evaluation of Whole Time Directors of PSBs, it has now been made part of the annual appraisal of PSB leadership up to two levels below the Whole Time Directors.

The Index measures the performance of each PSB on 120+objective metrics across six themes. It provides all PSBs a comparative evaluation showing where banks stand vis-à-vis benchmarks and peers on the Reforms Agenda.

The Index follows a fully transparent scoring methodology, which enables banks to identify precisely their strengths as well as areas for improvement. The goal is to continue driving change by spurring healthy competition among PSBs and by encouraging them to learn from each other.

PSBs supports during COVID-19

PSBs have massively stepped up to support the nation during the COVID-19 crisis. From different modes of staffing to remote working, 80,000+ bank branches were operational during COVID-19.

Additionally, there has been 90% uptime of self-service machines during the COVID times andaroundthree times increase in Aadhaar Enabled Payment System (AEPS) transactions through micro ATMs, and enhanced doorstep banking support by 75,000+Bank Mitras.

To further support the customers in these times, the banks have drastically increased the number of services being offered at the call centers, from 11 in March-19 to 23 as of June-20 in 13 regional languages.

Banking for Aspiring India

A comprehensive agenda for smart, tech-enabled banking has been adopted for FY2020-21, under which PSBs have initiated eShishu Mudra for straight-through processing of loans to micro-enterprises and digital personal loan for customers. PSBs have started providing customer-need driven credit offers through analytics and partnerships with FinTechs and e-commerce companies.

Many PSBs have already started taking steps in line with the reform priorities. Progress of PSBs will continue to be tracked on metrics linked to Reform Action Points, and their progress will be published through a quarterly index.

EASE Reforms journey

Following the completion of recognition of legacy stress as NPA, PSBs have returned to profitability with sound financial health and institutionalised systems to prevent the recurrence of past weaknesses. The improved financial health of PSBs reflects in many parameters—

- Gross NPAs reduced from ₹8.96 lakh crore in March-2018 to ₹6.78 lakh crore in March-2020;

- A sharp decline in fraud occurrence from 0.65% of advances during FY10-FY14 to 0.06% in FY19-20; due to fraud prevention reforms and proactive checking of legacy NPA

- Record recovery of ₹2.27 lakh crore in FY19-FY20 driven by newly setup dedicated stressed account management verticals in PSBs;

- Asset quality has improved significantly, with the net NPA ratio reducing from 7.97% in March 2018 to 3.75% in March 2020

- Number of PSBs under PCA down to three;

- CRAR 197 bps above the regulatory minimum; and

- The highest provision coverage ratio of 80.9% in eight years.