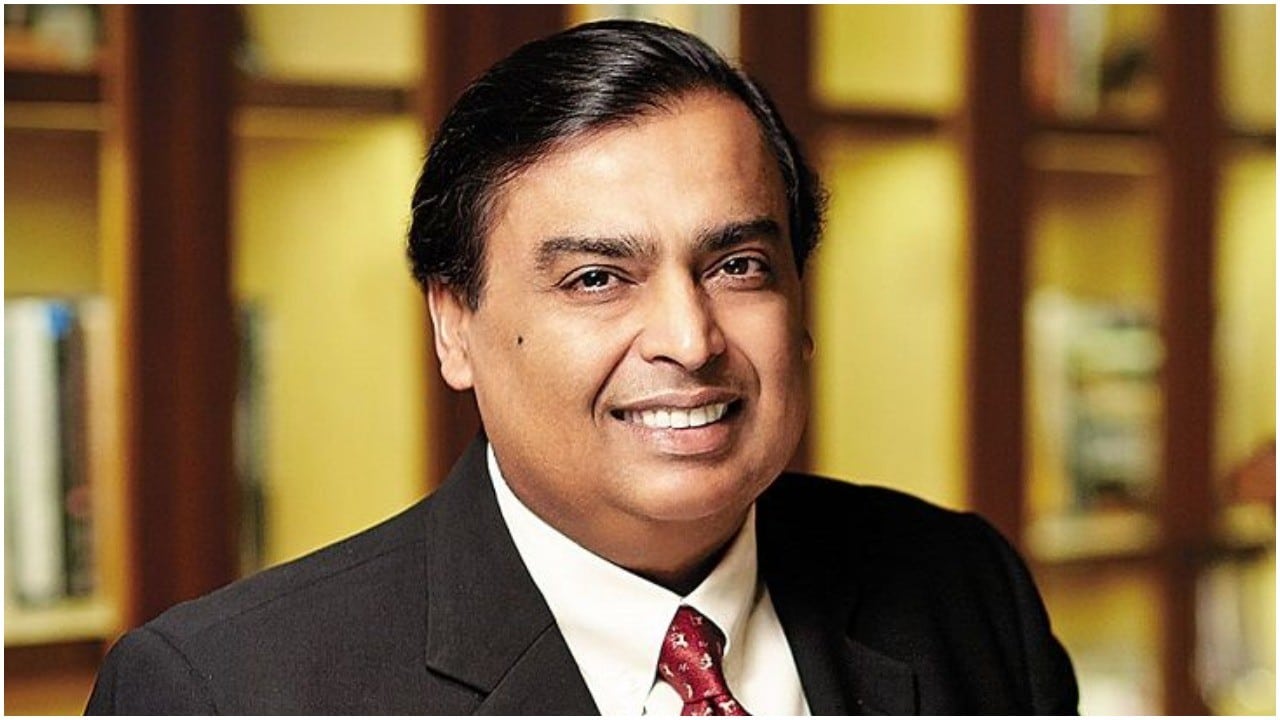

Bengaluru, NFAPost: Mukesh Ambani’s Reliance Industries Ltd on Saturday announced yet another disruption Indian retail business by acquiring Kishore Biyani’s Future Group for Rs 24,713.

Besides strengthening its retail play with its existing neworks, Reliance Retail is giving big challenge to global ecommerce players Amazon and Flipkart by strengthening its online presence also by Jio Mart.

The historical deal paves the way for a merger of five listed units of Future Group across grocery, apparel, supply chain and the consumer business into Future Enterprises Ltd (FEL), which currently manages the group’s retail back-end infrastructure.

“Reliance Retail Ventures Ltd (RRVL), subsidiary of Reliance Industries Ltd will acquire the retail and wholesale business and the logistics and warehousing business from the Future Group as going concerns on a slump sale basis for lumpsum aggregate consideration of Rs 24,713 crore,” the company said in a statement.

Expanded access

Reliance Retail will now have access to close to 1,800 stores across Future Group’s Big Bazaar, FBB, Easyday, Central, Foodhall formats, which are spread in over 420 cities in India.

The acquisition is happening at a time when Indian retail business is registering exponential growth and is expected to reach $1.3 trillion by 2025. This also happens when global ecommerce companies and internet companies are vying hard to get their due in this business via massive investment.

The above acquisition is being done as part of the Scheme in which Future Group is merging certain companies carrying on the aforesaid businesses into Future Enterprises Limited (FEL). As a part of the same Scheme the Retail and Wholesale Undertaking is being transferred to Reliance Retail and Fashion Lifestyle Limited (RRFLL), a wholly-owned subsidiary of RRVL.

Logistics and warehousing

Also the logistics and warehousing undertaking is being transferred to RRVL and RRFLL also proposes to invest Rs 1,200 crore in the preferential issue of equity shares of FEL to acquire 6.09 % of post-merger equity; and Rs 400 crore in a preferential issue of equity warrants which, upon conversion and payment of balance 75% of the issue price, will result in RRFLL acquiring further 7.05% of FEL.

Commenting on the acquisition, Reliance Retail Ventures Limited Direcotr Isha Ambani said with this transaction, we are pleased to provide a home to the renowned formats and brands of Future Group as well as preserve its business ecosystem, which have played an important role in the evolution of modern retail in India.

“We hope to continue the growth momentum of the retail industry with our unique model of active collaboration with

small merchants and kiranas as well as large consumer brands. We are committed to continue providing value to our consumers across the country,” said Reliance Retail Ventures Limited Direcotr Isha Ambani.

The acquisition of the retail, wholesale and supply chain business of the Future Group complements and makes a strong strategic fit into Reliance’s retail business. This will help Reliance retail to accelerate providing support to millions of small merchants in increasing their competitiveness and enhance their income during these challenging

times.

Retail franchise

Future Group Group CEO said Kishore Biyani said as a result of this reorganisation and transaction, Future Group will achieve a holistic solution to the challenges that have been caused by Covid and the macroeconomic environment.

“This transaction takes into account the interest of all its stakeholders including lenders, shareholders, creditors, suppliers and employees giving continuity to all its businesses,” said Future Group Group CEO said Kishore Biyani.

Future Group Group CEO said Kishore Biyani said he is pleased that Future Group’s strong retail franchise and brands, that the company created over time, are going in stronger hands and will continue to grow and delight Indian shoppers.

Future group was in debt trap that paved the way for the company to scout for probable suiters. According to Arvian Consulting report the company piled up its group level debt and an exposure of another Rs 11,970 crore to the promoter entities of the Future Group.

The deal got clearance earlier this week when Future Retail has paid $14 million (around ₹103 crore) as interest on its USD notes, according to a regulatory filing. The company has paid the interest amount of $14 million due on the 5.6% senior secured notes due 2025 (USD notes) after a grace period of 30 days, Future Retail said in the filing on Monday. The company on July 22 had informed the exchanges that it had missed the payment of interest on the USD notes on account of liquidity crunch.