–White Labelled Loyalty Solutions for Banks and Merchants

– Campaign management capability for driving activation and redemptions

– Analytics platform built in to the Loyalty Platform

Bengaluru, NFAPost: National Payment Corporation of India (NPCI) said that it has launched its own business intelligence and analytics enabled omni-channel multi-branded loyalty platform – ‘nth Rewards’.

This unique loyalty rewards platform allows users to earn ‘nth’ (denoting infinite possibilities) points through various bank transactions and redeem them faster on various exciting products, E-Vouchers, donations, hotel and flight bookings.

With an objective to engage and retain bank customers, ‘nth Rewards’ offers easy earning and instant redemption of reward points on maximum purchasing options.

‘nth Rewards’ platform has a simple and smart dashboard for users where they can see their points accumulation, redemptions and also have access to all the offers and rewards.

Digital transaction

Customers can earn loyalty points on almost every transaction made digitally, especially while using the credit and debit cards. Rewarding customers for their loyalty helps organisations make long term engagement with their valued customers.

‘nth Rewards’ by NPCI is a step ahead to further induce the habit of digital payments among customers and at the same time provide a sense of personalisation to them by rewarding them in the right way.

‘nth Rewards’ works on four key pillars to provide an all new way of loyalty rewards to the customers.

- At the heart of “Nth Rewards” is the Loyalty Engine. This allows consumers to earn points from various transactions across all the digital transactions of the bank. The loyalty engine allows the banks or merchants to reward the behavior they would like to drive loyalty for and measure this regularly

- The Analytics & Business Intelligence provide real-time access to product portfolio and campaign performance. With the help of BI, the personalized dashboard on the platform offers actionable insights to banks through which they can identify the right audience to maximize returns on their marketing spends.

- The Offers & Rewards platform curate’s customer-specific offers that reaches them at the right time and right place with geo-tagged marketing. The customers with the Rewards Platform can utilize their earned points across categories like travelling, entertainment, gifts, recharge, etc.

- The Campaign manager enables real time communication to consumers through SMS and email. It offers a user-friendly omni-channel campaign module to banks which can be easily created, designed and implemented with ease.

Commenting on the new initiative, Equitas Bank President and Country Head Murali Vaidyanathan said banks need to engage with customers on a regular basis to build trust and understanding.

Customer satisfaction

“In an age of distraction, retaining a customer requires customer satisfaction and value added services that build loyalty towards the bank. A good loyalty program would help us target the right customer at the right time. It would increase the stickiness of the customers and induce transactions,” said Equitas Bank President and Country Head Murali Vaidyanathan.

He said all possible transactions are rewarded, placed in one account and can be redeemed at the same place – this defines convenience at its best.

“Therefore, I would like to place my appreciation and my sincere thanks to NPCI for coming up with this loyalty reward program – nth rewards. I am sure that this will go a long way in creating consumer stickiness, increase transactions and create an ideal platform for both, the consumer and the institution,” said Equitas Bank President and Country Head Murali Vaidyanathan.

TJSB Sahakari Bank General Manager Swapnil Jambhale said today consumers have more choice than they ever had before.

Loyalty programmes

“Therefore, it becomes crucial for the banks to have programs that interact with their consumers in a way that makes them feel values & special. Loyalty programs are crucial to build this relationship with the customers by providing the right kind of rewards. Rather than focusing on individual products, the platform should focus on the customer, making the user journey seamless,” said TJSB Sahakari Bank General Manager Swapnil Jambhale.

Congratulating NPCI on launching just such an omni-channel programme – nth rewards, TJSB Sahakari Bank General Manager Swapnil Jambhale said it is simplified commercial structure helps in defining products as well as provides incentives such as white labelling to deploy the program quickly and keep it cost effective.

NPCI Chief of Marketing Kunal Kalawatia said NPCI is are excited to launch ‘nth Rewards’ platform for Banks and Merchants.

Banks and merchants

“We believe our unique offering will provide banks and merchants to reward their consumers while paying digitally. Our focus at NPCI has always been on customers’ convenience, and with ‘nth Rewards’. We would like to recognize their loyalty and offer them a gamut of products and services to choose from,” said NPCI Chief of Marketing Kunal Kalawatia.

NPCI Chief of Marketing Kunal Kalawatia said the loyalty platform would also help banks and merchants to better understand consumer behaviour through which we can come up with more and more exciting deals and discounts well-suited for them.

The omni-channel platform aims to become a one stop shop for the bank which would help them retain and grow their customer base. The integration of nth Rewards with the bank system is seamless and secure with PCI-DSS compliance and developer friendly APIs, with an onboarding time of just 4 to 6 weeks.

Retail payment

This can help banks save cost as well as man-hours. The ready to use Platform can then be integrated in any existing website or app which reduces the go-to market time without changing the customer journey or experience.

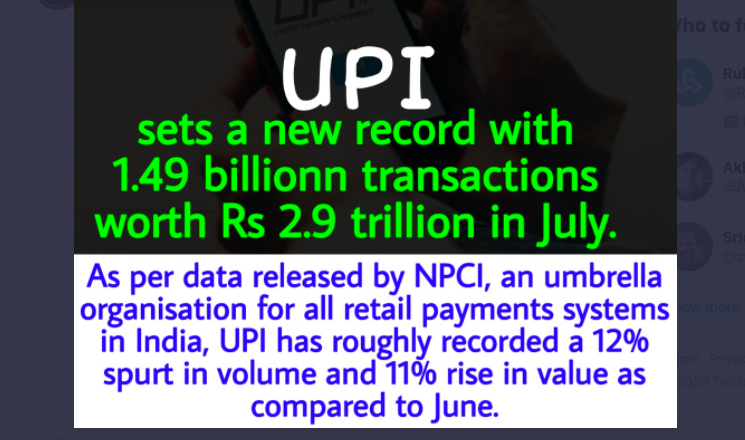

National Payments Corporation of India (NPCI) was incorporated in 2008 as an umbrella organization for operating retail payments and settlement systems in India. NPCI has created a robust payment and settlement infrastructure in the country.

It has changed the way payments are made in India through a bouquet of retail payment products such as RuPay card, Immediate Payment Service (IMPS), Unified Payments Interface (UPI), Bharat Interface for Money (BHIM), BHIM Aadhaar, National Electronic Toll Collection (NETC Fastag) and Bharat BillPay.

NPCI also launched UPI 2.0 to offer more secure and comprehensive services to consumers and merchants. NPCI is focused on bringing innovations in the retail payment systems through the use of technology and is relentlessly working to transform India into a digital economy. It is facilitating secure payments solutions with nationwide accessibility at minimal cost in furtherance of India’s aspiration to be a fully digital society.