Pent-Up Smartphone Demand after April, May Lockdown Pushes the June 2020 Volumes to Pre-COVID Levels

Bengaluru, NFAPost: India’s smartphone shipments have declined by 51% YoY to just over 18 million units in Q2 2020, according to the latest research from Counterpoint’s Market Monitor service.

The nationwide lockdown imposed by the Indian government to combat COVID-19 resulted in zero shipments during April. However, the market is starting to return to normal. In June 2020, Indian smartphone shipments registered a mild decline of 0.3% YoY, thanks to the pent-up demand as well as a push from brands.

Due to concerns over potential COVID-19 infection, consumers prefer contactless purchasing and online channels. Smartphone brands are also recognizing this trend by pushing more inventory to online channels.

Commenting on the market dynamics, Prachir Singh, Senior Research Analyst at Counterpoint Research said, “The COVID-19 pandemic wiped-out almost 40 days of production as well as the sales of smartphones due to the nation-wide lockdown. During May, the government allowed shops to open and online channel deliveries for non-essential items. As a result, the market witnessed a surge in sales as the lockdown restrictions were slowly lifted. The quarter was thus marred by both demand and supply constraints which led OEMs to rethink their go-to-market strategies.

“On the supply side, the factories were shut down in April and started operating in May, which resulted in supply shortages for some manufacturers. Some brands maintained the supply of their products by importing fully assembled handsets. Additionally, the last week of the quarter saw components being held up at customs, which also impacted the supply chain.”

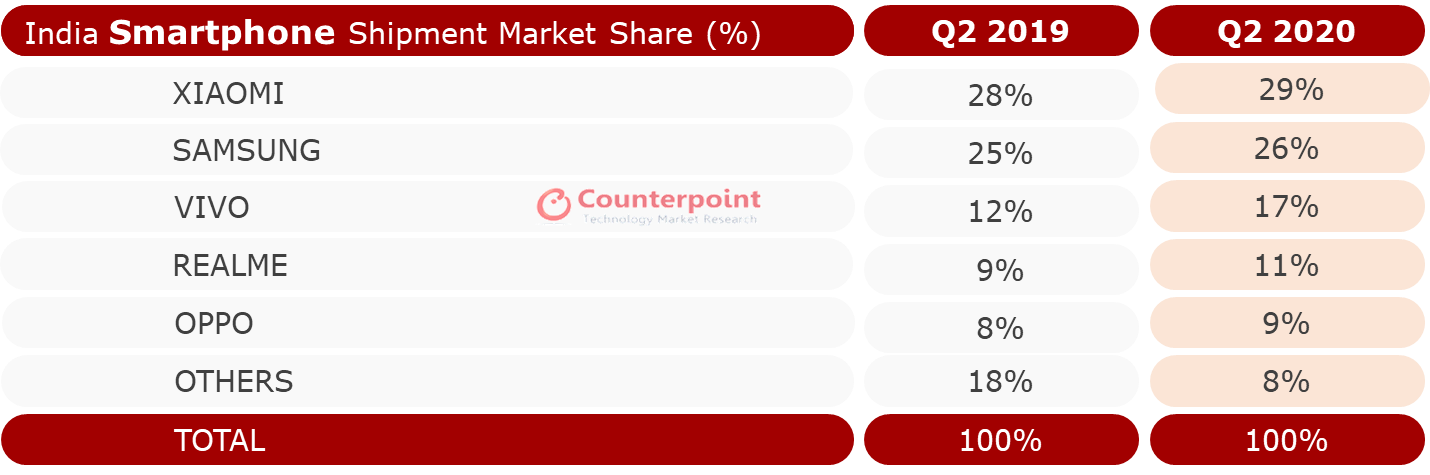

Exhibit 1: India Smartphone Market Share Q2 2020

Source: Counterpoint Research Market Monitor Q2 2020

Note: Xiaomi’s share includes Poco

Commenting on how the pandemic has been shaping the competitive landscape, Shilpi Jain, Research Analyst at Counterpoint Research, noted, “The contribution of Chinese brands fell to 72% in Q2 2020 from 81% in Q1 2020. This was mainly due to the mixture of stuttering supply for some major Chinese brands such as OPPO, vivo and realme, and growing anti-China sentiment that was compounded by stringent actions taken by the government to ban more than 50 apps of Chinese origin and delay the import of goods from China amid extra scrutiny. This all resulted from the India-China border dispute during June.”

“However, local manufacturing, R&D operations, attractive value-for-money offerings and strong channel entrenchment by Chinese brands leaves very few options for consumers to choose from. Additionally, in the era of globalization, it is difficult to label a product based on country of origin as components are being sourced from many different countries. This development has given a window of opportunity for brands like Samsung and local Indian brands such as Micromax and Lava, to recapture market share. Further, Jio-Google’s partnership to bring a highly affordable 4G Android smartphones could also gain ground, banking on the growing #VocalforLocal sentiment.”

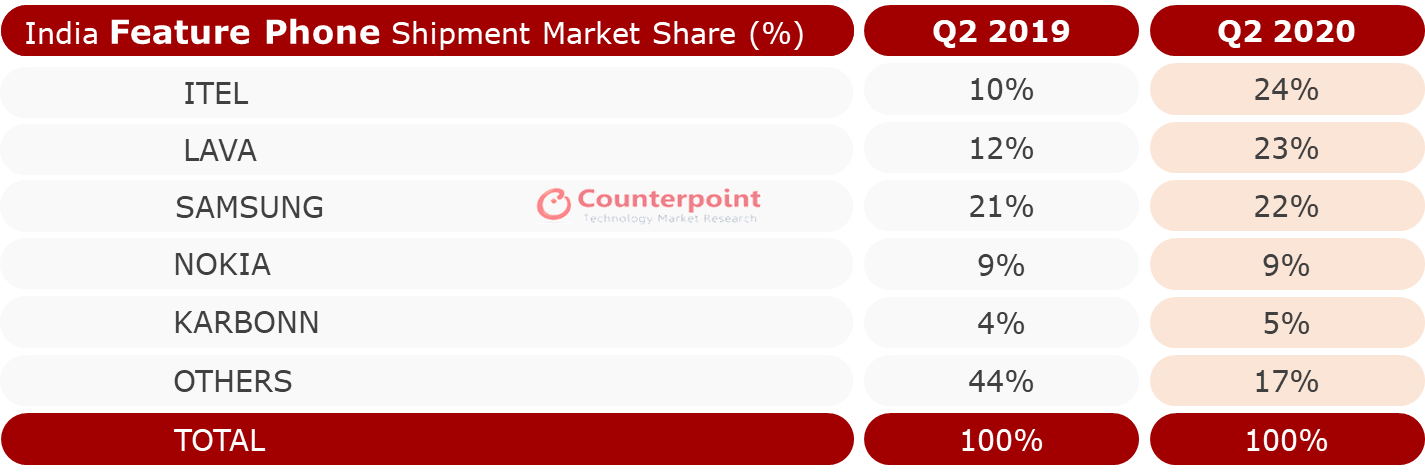

India is home to more than 350 million feature phone users and the feature phone market was the worst affected segment as it declined by a massive 68% YoY in Q2 2020 as consumers in this highly cost-sensitive segment tried to save money by reducing discretionary purchases. In the near-to-mid term, this could actually boost the used and refurbished mobile phone market.

Exhibit 2: India Feature Phone Market Share Q2 2020

Source: Counterpoint Research Market Monitor Q2 2020

Market Summary:

- Despite supply constraints and rising negative consumer sentiment towards China, Xiaomi continued to lead the Indian smartphone market in Q2 2020. Models like the Redmi 8A dual, Redmi Note 8 Pro, and Redmi Note 8 continue to attract consumers’ interest due to competitive pricing, strong value propositions, and good channel reach. During the quarter, the brand entered the ultra-premium segment (>INR 45000 ~ $597) with its flagship Mi10 5G device and continued to expand its IoT ecosystem portfolio with the launch of a smart vacuum cleaner and hearables. Good planning, customer focus, and timely actions to respond to the COVID-19 situation are some of the strategies that worked in its favor.

- Samsung recovered fastest as it reached 94% of pre-COVID levels becoming the second largest brand in Q2 2020. The brand closely followed Xiaomi, increasing its share to 26% in Q2 2020 from 16% during the last quarter. Revamping the M-series and launching it in offline channels together with new schemes like Samsung Care+ helped the brand to further to restore its position in the Indian market. Samsung also has a diversified supply chain compared to its competitors, which helped it to maintain a steady flow of components. It was the first brand to reach almost full manufacturing capacity by the end of June.

- vivo was also able to manage post lockdown demand well as it exited the quarter with 60% pre-COVID levels. Additionally, it also managed to ramp up its production output post lockdown. The launch of its flagship V19 and adding more smartphones like Y50, Y30 to its Y-series portfolio helped the brand to recover fast in June.

- realme maintained the fourth spot though its share declined to 11% as it faced manufacturing constraints due to the shut down of the factory for almost all of May. However, its newly launched Narzo series performed well in the budget segment and it will look forward to further capitalize on momentum in this segment.

- Although OPPO also struggled during the quarter due to supply constraints, it managed to gain mind share by entering the ultra-premium segment (>INR 45000 ~ $600) with the launch of its 5G flagship, Find X2 series and attractive hearables lineup. It also revamped its affordable A-series to broaden consumers appeal.

- OnePlus regained its top position in the premium market (>INR 30000 ~$398 ) with its newly launches OnePlus 8 series, which also comes with 5G.

- Apple remains the leading brand in the ultra-premium segment (>INR 45000 ~ $600) driven by iPhone 11 shipments, though it lost some share to OnePlus in Q2.

- During the quarter, OEMs like Xiaomi, vivo, Samsung, OPPO initiated the O2O channel strategy to cater to pent-up demand and support offline channel partners.

- Online channel share reached the highest ever level, accounting for almost 45% of sales, a second-quarter record. Consumers preferred contactless purchases and social distancing.

- Itel remains the market leader in the feature phone market reaching its highest ever share of 24% in the quarter.

- Huge opportunities lie ahead for India to become a manufacturing and export hub for handsets owing to the Indian government’s push. After the launch of the INR 41000 PLI scheme in April, OEMs are planning to set up production bases in India. For example, Lava, a homegrown brand is also planning to shift its handset production from China to India to leverage the PLI scheme. Apple is also planning to shift 20% smartphone production from China to India.