Apple Was Least Impacted Among Top-10 Vendors As Shipments Fell Just 20% Year-on-Year To Just Over 250,000 In Q2 2020: Canalys

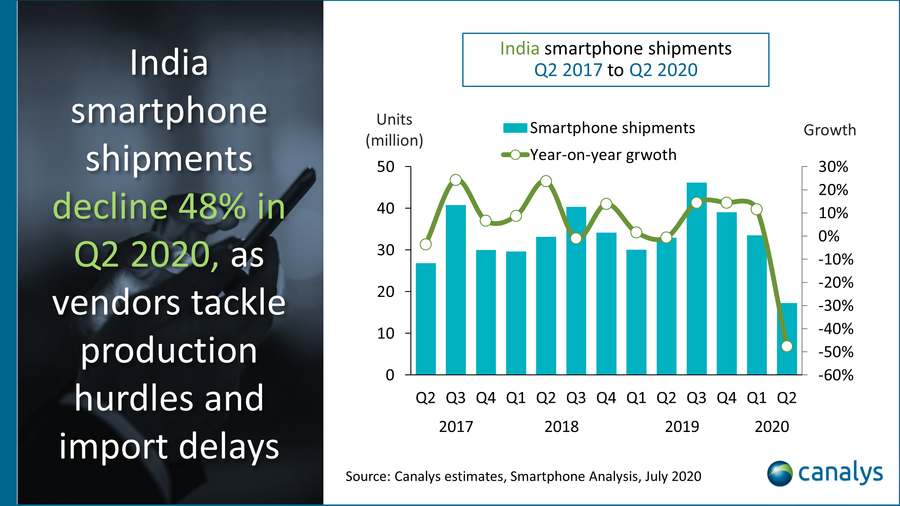

Bengaluru, NFAPost: Smartphone shipments in India fell a massive 48% in the April-June quarter to 17.3 million units due to nationwide shutdown until mid-May, states research and analysis firm Canalys.

The leading IT channels, mobility, intelligent vehicles and emerging tech research firm Canalys in its report states Smartphone shipments in India fell 48% in Q2 2020, to 17.3 million units as the country faced an unprecedented shutdown of its economy until Mid-May due to COVID-19.

?Smartphone shipments in India fell 48% in Q220, to 17.3m units

?Canalys estimates that over 96% of all smartphones sold in India in 2019 were manufactured/assembled locally.

?Vendors are driving the message of ‘Made in India’ to consumers

Smartphone vendors faced a catastrophic situation for the first time in their business history in India as they had to face both low supply due to a complete halt in production and diminished demand, as online and offline retailers were prohibited from selling smartphones.

As local production suffered through the early stages of Q2, vendors like Xiaomi and Oppo imported smartphones to meet pent-up demand.

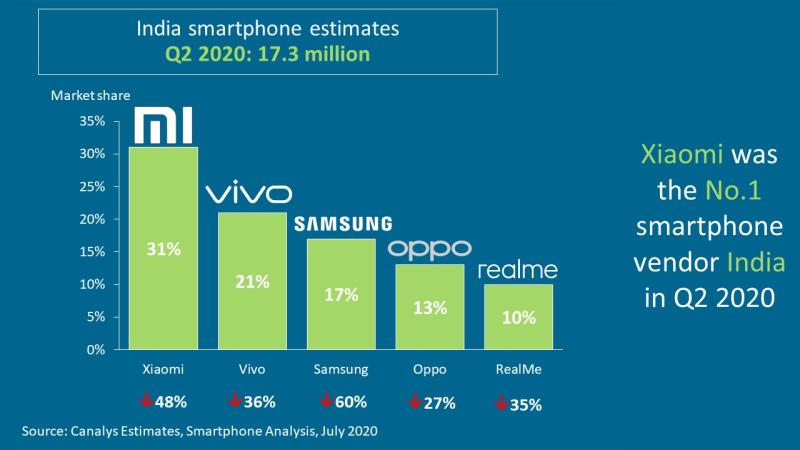

Xiaomi was the market leader in India, capturing 31% of overall market share, shipping 5.3 million smartphone units in the quarter. Vivo maintained the second position, shipping 3.7 million units, and grew its market share to 21.3% from 19.9% in Q1 2020.

Samsung was third, with 2.9 million smartphones shipped, and also saw exports impacted as its largest manufacturing plant outside of Vietnam shut down for most of Q2. Oppo edged out Realme to take the fourth position as it shipped 2.2 million units, compared to Realme’s 1.7 million.

As local production suffered through the early stages of Q2, vendors like Xiaomi and Oppo imported smartphones to meet pent-up demand.

Commenting on the development, Canalys Analyst Madhumita Chaudhary said it had been a rocky road to recovery for the smartphone market in India.

“While vendors witnessed a crest in sales as soon as markets opened, production facilities struggled with staffing shortages on top of new regulations around manufacturing, resulting in lower production output. The fluidity of the lockdown situation across India has had a deep-rooted effect on vendors’ go-to-market strategies,” said Canalys Analyst Madhumita Chaudhary.

Canalys Analyst Madhumita Chaudhary also pointed out that Xiaomi and Vivo have undertaken an O2O (offline-to-online) strategy to support their massive offline network. Online channels, too, while seeing a positive effect of the pandemic on market share, have seen sales decline considerably.”

Canalys Analyst Madhumita Chaudhary made it clear that it has been been a rocky road to recovery for the smartphone market in India.

“While vendors witnessed a crest in sales as soon as markets opened, production facilities struggled with staffing shortages on top of new regulations around manufacturing, resulting in lower production output. The fluidity of the lockdown situation across India has had a deep-rooted effect on vendors’ go-to-market strategies,” said Canalys Analyst Madhumita Chaudhary.

The Canalys states that India is also battling floods in parts of Eastern India, and a stand-off with China in the Northern borders.

Canalys Research Analyst Adwait Mardikar said luck is not on the side of the Chinese vendors as they are facing slide in their shipment because of global chaos created due to Covid-19 pandemic.

“There has been public anger directed towards China. The combinations of this and the recently announced ‘Aatmanirbhar’ (self-sufficient) initiatives by the government have pushed Chinese smartphone vendors into the eye of the public storm.” Canalys estimates that over 96% of all smartphones sold in India in 2019 were manufactured/assembled locally,” said Canalys Research Analyst Adwait Mardikar.

Canalys Research Analyst Adwait Mardikar said vendors are driving the message of ‘Made in India’ to consumers and are eager to position their brand as ‘India-first.’ Despite the sentiment, the effect on Xiaomi, Oppo, Vivo and Realme is likely to be minimal, as alternatives by Samsung, Nokia, or even Apple are hardly price-competitive.

| Indian smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q2 2020 | |||||

| Vendor | Q2 2020 shipments (million) | Q2 2020Market share | Q2 2019 shipments (million) | Q2 2019Market share | Annual growth |

| Xiaomi | 5.3 | 30.9% | 10.3 | 31.3% | – 48% |

| Vivo | 3.7 | 21.3% | 5.8 | 17.5% | – 36% |

| Samsung | 2.9 | 16.8% | 7.3 | 22.1% | – 60% |

| Oppo | 2.2 | 12.9% | 3.0 | 9.2% | – 27% |

| Realme | 1.7 | 10.0% | 2.7 | 8.1% | – 35% |

| Others | 1.4 | 8.1% | 3.9 | 11.8% | – 64% |

| Total | 17.3 | 100.0% | 33.0 | 100.0% | – 48% |

| Note: Xiaomi estimates include sub-brand POCO. Percentages may not add up to 100% due to rounding Source: Canalys Smartphone Analysis (sell-in shipments), July 2020 |

Impact on Apple

It is interesting to note that Apple is least impacted among the top 10 vendors as the company witnessed just 20% year year fall in its shipments to just over 2,50,000 in Q2.

The Canalys report states that the vendor has recently announced its plans to diversify its supply chain and is pushing its major partners Foxconn and Wistron to increase its investments in India.

“The transition to 5G is the next big opportunity, and Jio’s announcement of readiness to deploy 5G, as soon as spectrum is made available, has provided a ray of hope to most vendors who have been beaten by the current pandemic,” said Canalys Analyst Madhumita Chaudhary.