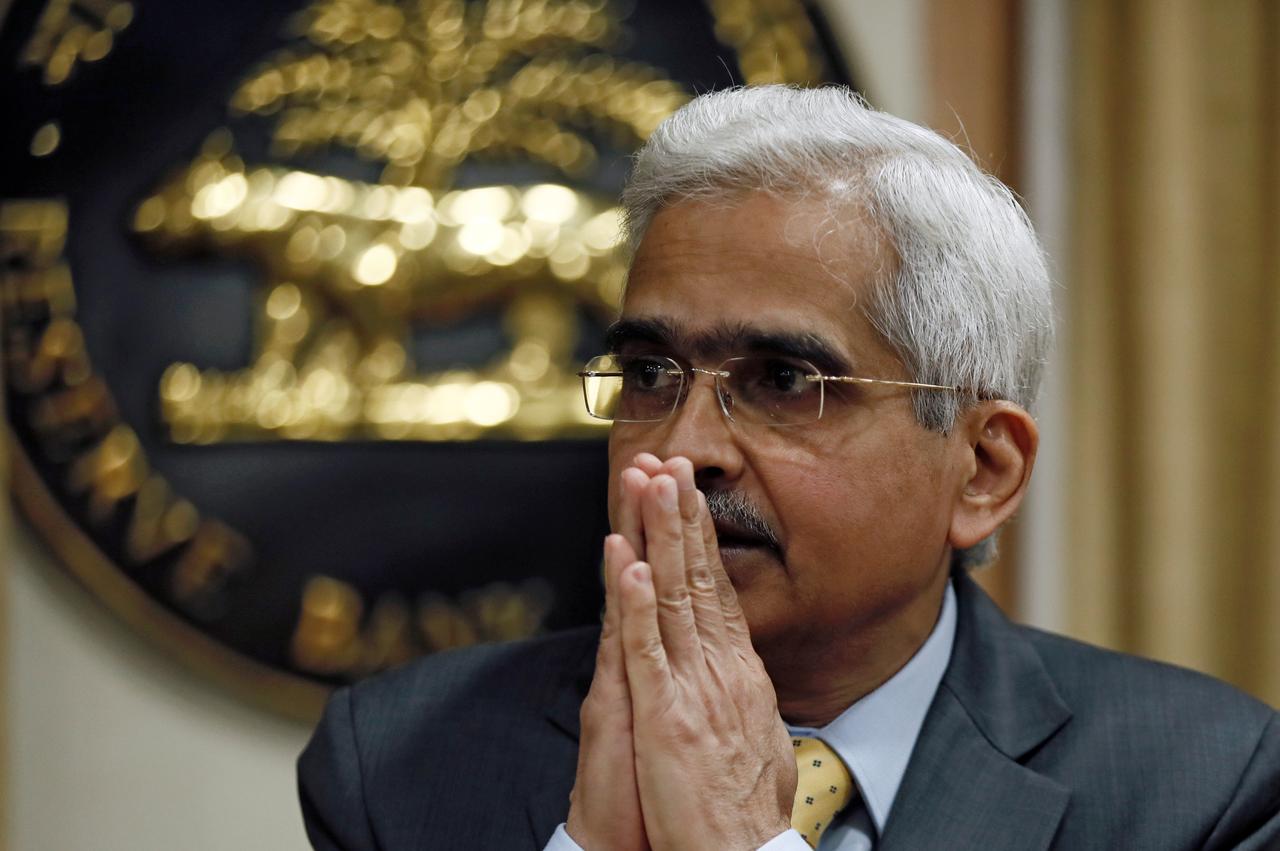

RBI Governor Shaktikanta Das said despite substantial impact of Covid pandemic in daily lives of the people, India’s financial system, including all the payment systems and financial markets, are functioning without any hindrance, uncertainty prevails over restoration of supply chains among other challenges.

“Despite the substantial impact of pandemic in our daily lives, the financial system of the country, including all the payment systems and financial markets, are functioning without any hindrance. The Indian economy has started showing signs of getting back to normalcy in response to the staggered easing of restrictions.

“It is, however, still uncertain when supply chains will be restored fully; how long will it take for demand conditions to normalise; and what kind of durable effects the pandemic will leave behind on our potential growth,” he said at the 7th SBI Banking & Economics Conclave organised by the State Bank of India.

Given the uncertainty regarding the evolution of the COVID curve, it was absolutely critical to anticipate the emerging economic risks and take pro-active monetary policy actions of sizable magnitude, using a comprehensive range of policy instruments to optimise policy traction, Das said.

The conventional and unconventional monetary policy and liquidity measures by the Reserve Bank have been aimed at restoring market confidence, alleviating liquidity stress, easing financial conditions, unfreezing credit markets and augmenting the flow of financial resources to those in need for productive purposes, he said.

“The broader objective was to mitigate risks to the growth outlook while preserving financial stability. The liquidity measures announced by the RBI since February 2020 aggregate to about ₹9.57 lakh crore (equivalent to about 4.7 per cent of 2019-20 nominal GDP),” he said

Targeted and comprehensive reform measures already announced by the government should help in supporting the country’s potential growth, Das said.

Possibly in a vastly different post-COVID global environment, reallocation of factors of productions within the economy and innovative ways of expanding economic activity could lead to some re-balancing and emergence of new growth drivers, he said.

“The policy measures, either, monetary, fiscal, regulatory and structural reforms, provide the enabling conditions for a speedier recovery in economy activity while minimising near-term disruptions,” he said.

The need of the hour is to restore confidence, preserve financial stability, revive growth and recover stronger, Das said.

“At the central bank, we strive to maintain the balance between preserving financial stability, maintaining banking system soundness and sustaining economic activity,” he said.

Post-containment of COVID-19, a very careful trajectory has to be followed in orderly unwinding of counter-cyclical regulatory measures and the financial sector should return to normal functioning without relying on the regulatory relaxations as the new norm, Das said.

“The Reserve Bank is making continuous assessment of the changing trajectory of financial stability risks and upgrading its own supervisory framework to ensure that financial stability is preserved. Banks and financial intermediaries have to be ever vigilant and substantially upgrade their capabilities with respect to governance, assurance functions and risk culture,” he said.

He said a recapitalization plan for PSBs and private banks has become necessary due to fears of higher non-performing assets and capital erosion of banks, due to lockdown and anticipated post-lockdown compression in economic growth.

“Going forward, there are certain stress points in the financial system, which would require constant regulatory and policy attention to mitigate the risks. The economic impact of the pandemic – due to lock-down and anticipated post lock-down compression in economic growth – may result in higher non-performing assets and capital erosion of banks. A recapitalisation plan for PSBs and private banks (PVBs) has, therefore, become necessary,” he said.

While the NBFC sector as a whole may still look resilient, the redemption pressure on NBFCs and mutual funds need close monitoring, Das said.

Mutual funds have emerged as major investors in market instruments issued by NBFCs, which is why the development of an adverse feedback loop and the associated systemic risk warrants timely and targeted policy interventions, he said.

Increasing share of bank lending to NBFCs and the continuing crunch in market-based financing faced by the NBFCs and Housing Finance Companies (HFCs) also need to be watched carefully, he added.

Das further said the supervisory approach of Reserve Bank is to further strengthen its focus on developing financial institutions’ ability to identify, measure, and mitigate the risks.

“The new supervisory approach will be two-pronged – first, strengthening the internal defenses of the supervised entities; and second, greater focus on identifying the early warning signals and initiate corrective action,” he said.

It is true that the pandemic poses a challenge of epic proportions, however, human grit will tremendously help India to come out of the present crisis, Das said.

Mahatma Gandhi had said, “…the future depends on what you do today.”

Das also said COVID-19 pandemic, perhaps, represents so far the biggest test of the robustness and resilience of Indian economic and financial system.

He said the RBI has taken a number of important historic measures to protect country’s financial system and support the real economy in the current crisis.