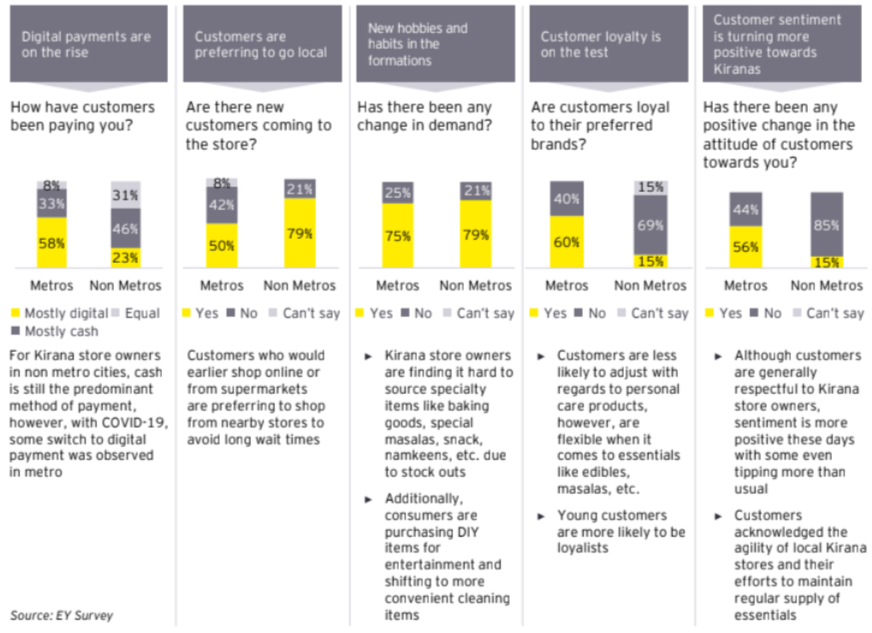

- 40% respondents stating they want to partner with online delivery and supply platforms

- 69% kiranas in the non-metros were able to sell alternative brands to their customer

Bengaluru, NFAPost: According to EY’s latest report ‘Sentiments of India – Pulse of the country, Kiranas’ there is a renewed trust in hyperlocal communities with the kirana store emerging as a hub that helped maintain the regular supply of essentials during the lockdown as cities struggle to get back to their normal rhythm.

The survey highlights that there has been a positive movement towards the adoption of technology with 40% respondents (i.e. kirana store owners) stating they want to partner with online delivery and supply platforms as they feel it can help them grow and tide over in these testing times.

Another key insight is that consumer loyalty to brands is now in question, providing a window for new brands to replace old loyalties. At least 69% kiranas in the non-metros were able to sell alternative brands to their customers.

Executive summary

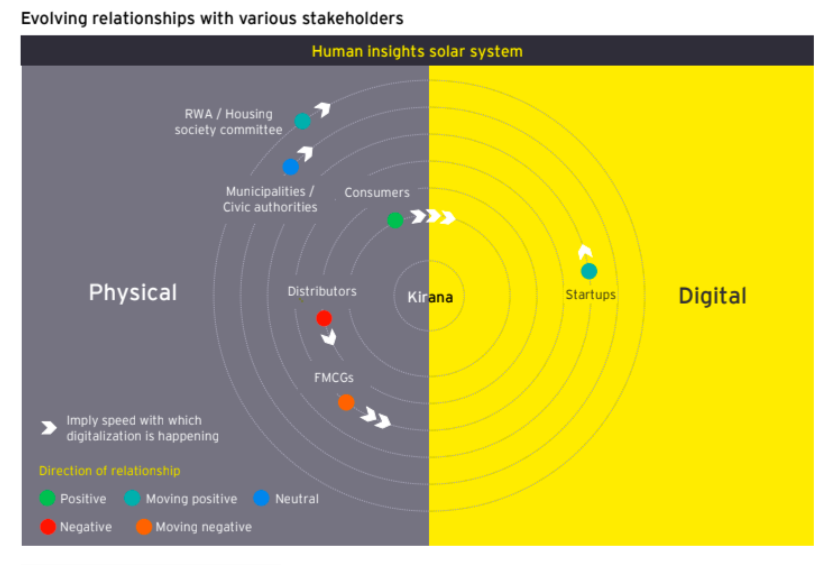

- Kirana stores have emerged as local saviours during this time of crisis. In the midst of the uncertainty, consumers have turned

to their local Kirana stores for their requirements. - The day to day life of a Kirana store owner has undergone a huge change to keep up with changing demands of the crisis. Kirana

stores now operate within a truncated window during the early hours of the morning. They are also forced to make multiple

journeys for stock purchases as their distributors have stopped delivery services. - Kirana store owners’ relationships with their various stakeholders have changed, with some strengthening and others weakening

- The lockdown has brought in a slew of changes in consumer’s behaviours, with new demands and increasing adaptability

- Innovation and digital adoptions have allowed Kiranas to cope, via digital payments, changing operating models and reduced

friction towards technology - Many FMCGs and Start-ups are bringing innovation to tackle supply chain, delivery, payment and credit issues of Kirana stores

- The way forward points to new partnerships and symbiotic relationships

The survey takes an in-depth look into the impact of the Covid-19 crisis on kirana stores. The insights were gathered through 27 qualitative interviews across 12 cities in India, 5 metros and 7 non-metros with participants who represent small and big kirana across a diverse socio-economic background.

The Covid-19 pandemic along with the certain restrictions that it imposed in the country has led to a sudden shift in consumer behavior which is reflected in the changing relationship that individual consumers and communities today have with the local kirana store.

EY India Customer Experience and Design Thinking Partner Shashank Shwet said amidst the Covid-19 pandemic, the kirana stores have emerged as local unsung heroes servicing the community at large.

“The kirana store owners have taken a lot of effort to keep up with the changing demands of the crisis and managing their day-to-day supplies. Moreover, the way that these kirana store owners have adopted to innovation and digital technologies, such as digital payments, changing operating models and reduced friction towards technology, to cope up with the pandemic is highly commendable,” said EY India Customer Experience and Design Thinking Partner Shashank Shwet.

EY India Customer Experience and Design Thinking Partner Shashank Shwet also said as kirana stores move from now to next and beyond of this crisis, the new level of growth for them will come from partnerships and symbiotic relationships.

The report covers both the impact that the pandemic has had on consumers and its pursuant impact on kirana stores as providers of essentials. Some of the key insights from the survey include:

- of respondents in metros feel that there has been a positive change in the attitude of consumers post the lockdown. FMCGs, large retailers and financial services companies should recognize that the kirana store is the new local touchpoint and their conduit into the daily life of a trusting consumers.

- With consumers now spending more time at home, we see an increasing demand for specialty food items and DIY items. 79% respondents in non-metros and 75% in metros stated that consumers are purchasing specialty food items and DIY items in unprecedented quantities to the extent that the kiranas are finding it hard to source such specialty food items like baking goods, instant foods, ready mixes, special masalas, namkeens, etc. due to stock-outs.

- The pandemic has led to a renewed trust in the local kirana store with a surge in new consumers visiting the local stores both in metros and non-metros. 79% of respondents in non-metros and 50% in metros state that there are new consumers coming to their store post the lockdown period. These are consumers who would earlier shop online or from supermarkets, are now preferring to buy from local kirana stores to avoid long queues and there is a semblance of trust and traceability. In fact, RWAs (Resident’s Welfare Associations) and societies have emerged as key players within the ecosystem who are enabling group buying and choosing vendors as a collective.

According to the survey, 20% of the kirana store owners across metros and non-metros have started leveraging online platforms to get a steady supply of goods and assistance in deliveries.

Kiranas have proven themselves to be both agile and resilient, being able to bear the brunt of an unforgiving pandemic. Lacking other means, they have created a simplified online journey using chat apps as a medium of taking orders, providing contactless delivery and then receiving payments through digital platforms.

On the downside, the kirana stores have experienced a break down in the regular supply chains and distribution channels. This has led to a growing acceptance of start-ups and partners which are endeavoring to enable the kirana stores with technology and services. However, the key issue that the kirana stores are facing is that the partnerships come at a high cost and not yet profitable.

EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

EY refers to the global organisation and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.