Chennai, NFAPost: India Ratings and Research (Ind-Ra) believes the impact of COVID-19 and the associated policy response is likely to result in an additional Rs 1.67 lakh crore of debt from the top 500 debt-heavy private sector borrowers turning delinquent between FY21-FY22.

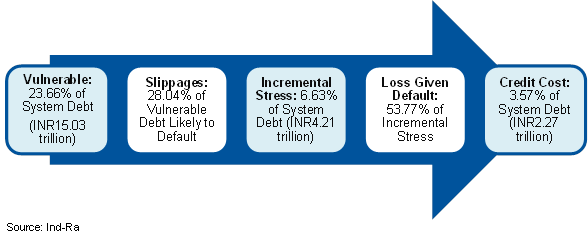

This is over and above the Rs 2.54 lakh crore anticipated prior to the onset of pandemic, taking the cumulative quantum to Rs 4.21 lakh crore. This constitutes 6.63% of the total debt (previous estimate: 4%). Given that 11.57% of the outstanding debt is already stressed, the proportion of stressed debt is likely to increase to 18.21% of the outstanding quantum. Ind-Ra expects the corresponding credit cost to be 3.57% of the total debt.

Ind-Ra has analysed in detail the degree of vulnerability of the top 500 debt-heavy private sector issuers, after assessing the mix between productive and non-productive assets (i.e. asset quality) held by each issuer along with their refinancing risks. The report buckets issuers in five categories of vulnerability – low, moderate, high, extreme and stressed. Based on these buckets, the agency has arrived at the estimates of debt at risk and expected credit costs.

Further Downside Risks: The agency believes that in a scenario wherein funding markets continue to exhibit heightened risk aversion, corporate stress could increase further by Rs 1.68 lakh crore, resulting in Rs 5.89 lakh crore of the corporate debt (9.27% of the total debt) becoming stressed in FY21-FY22. The resultant credit cost could be higher at 4.82% of the outstanding book. Consequently, 20.84% of the outstanding debt could be under stress in the agency’s stress case scenario.

Although further revisions in the FY21 GDP growth epectations by itself may not lead to a change in Ind-Ra’s stress estimates, the risk of a significantly prolonged recovery in the economic activity through FY22 and a larger-than-anticipated dent on demand could even result in stresses surpassing the agency’s stress-case estimates.

The progression of the pandemic, the policy response and its impact on economic growth, the actual buildup of stress could result in higher default rates and credit costs – in line with the peak levels experienced in the last decade.

Credit Growth to Fall 15%; Refinancing Requirements to Remain Elevated: The tepid corporate capex coupled with muted revenue is likely to restrict credit growth in FY21. However, refinancing pressures will persist and securing timely funding could continue to prove challenging. Ind-Ra expects the Rs 4.81 lakh crore fresh credit demand by the top 500 debt-heavy private sector corporates to emanate from a mix of receivable financing and a further drawdown of unutilised bank limits to shore up liquidity, meet cash flow shortfalls and to fund various isolated pockets of capex spending – largely restricted to maintenance capex.

Bipolarisation to Intensify: An additional downside risk emanates from the fact that the impact beyond the top 500 debt-heavy private sector corporates could be more severe depending on the access to liquidity, and could even be disproportionately higher. Ind-Ra, for instance, has detailed its views on the severity of this impact on the small and medium enterprises in its FY21 Mid and Emerging Corporate Outlook published on May 12, 2020.

In particular, as economic uncertainties continue to linger, lenders despite adequate liquidity are most likely to deploy their capital at the upper end of the credit curve with a shorter tenure. Lenders may turn even more selective – weakening the resource mobilisation ability of lower rated issuers in the investment grade, including those rated in the ‘A’ and ‘BBB’ categories. Consequently, these issuers are at the greatest risk of facing rating transitions in FY21, although the rating sensitivities for various higher rated corporates could also be tested, Ind-Ra said.